In this article, we will be helping borrowers by comparing two giants in the peer-to-peer lending industry.

This Lending Club vs Prosper article will examine all the important factors that you should look for in a lender. We will check out interest rates, lending platform benefits, lender fees, average funding times, and more.

What is Lending Club?

Lending Club is a well-known peer-to-peer lending company that was founded in 2006. Since Lending Club was founded, the company has had over $38 billion borrowed. Lending Club has over 2.5 million customers. Lending Club allows you to receive personal loans, business loans, auto refinancing, and patient solutions. Lending Club also allows you to invest.

What is Prosper?

Prosper Marketplace, Inc. is a San Francisco, California-based peer-to-peer lender that was founded in 2005. The company has funded over $7 billion in loans and has over 450 employees. Prosper allows for personal loans, debt consolidation, and more.

Peer to peer loans

Peer-to-peer lending is not like a traditional bank loan. With P2P you will be able to borrow from individuals and investors. With good credit you may be able to receive a very low rate. Services such as Prosper and Lending Club will match you with lenders, which makes the entire loan process quick and easy. There are many benefits of choosing a P2P lender such as low costs, they are easier to get approved for if you don’t have the best credit, and they are easy to use.

Better Business Bureau comparison

BBB builds trust between consumers and lenders. BBB has various rating elements that they use to rate businesses. A few of their rating elements include a business’s complaint history, time in business, type of business, transparent business practices, advertising issues, and more.

LendingClub is a BBB accredited business that currently has an “A-” rating in the BBB rating system.

Prosper is a Better Business Bureau accredited business. The company currently has an “A+” rating in the BBB rating system.

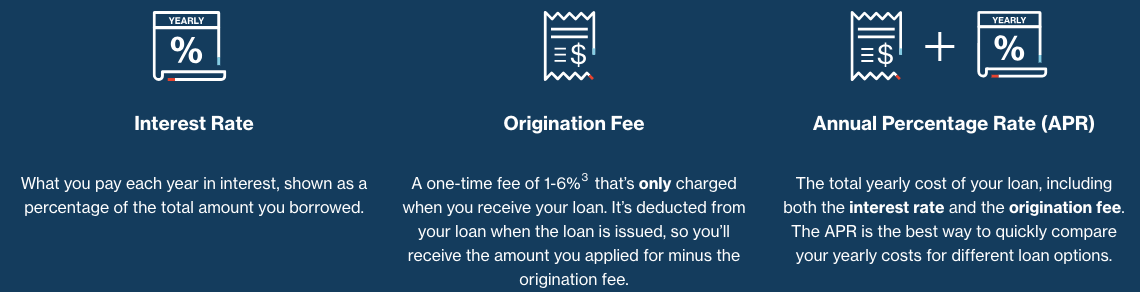

Personal loan interest rate comparison

LendingClub

LendingClub has loan rates that range from 6.16%–35.89% APR.

Prosper

Prosper loan rates range from 6.95% to 35.99% APR.

Bottom

Both rates are competitive, but LendingClub is slightly more affordable than Prosper. Your personal loan rate is going be dependent on if you have good or excellent credit, the amount that you want to borrow, etc.

Lender fees comparison

LendingClub fees

Prepayment penalties – LendingClub allows you to partially or fully pay off your loan at any time without having to worry about a prepayment penalty.

Origination fee – Lenders will usually charge a fee to cover the cost of processing the loan. The origination fee is taken out of your loan. LendingClub borrowers have to pay a 1% – 6% origination fee.

Late fees – LendingClub has late fees if your monthly loan bill is over 15 days late. Your late fee is going to be the greater amount between $15 or 5% of your unpaid loan bill.

Prosper fees

Prepayment penalties – Similar to Lending Club with Prosper you will not have to worry about any fees if you pay your loan before your loan term is over.

Origination fee – Prosper’s origination fee has the potential to be slightly lower. Prosper has origination fees that range from 2.4% – 5%.

Late fees – Once again, similar to LendingClub is the borrower is more than 15 days late with paying their bill, then they will be hit with a late fee. The late fee with Prosper is either going to be 5% of your unpaid bill or $15, whichever is greater is the amount that you will have to pay.

Features comparison

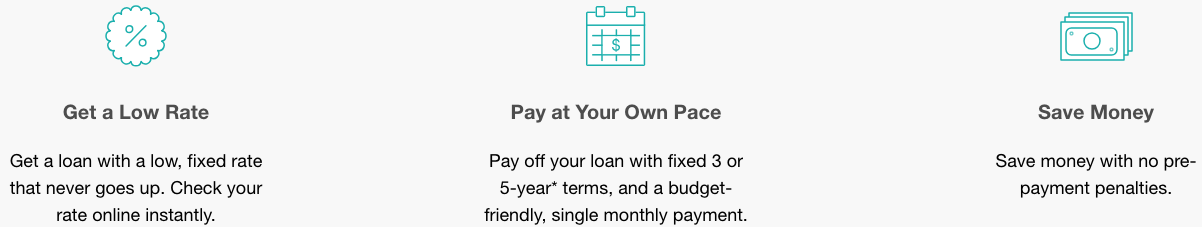

Lending Club benefits

- Low minimum borrow amount

- No prepayment penalties

- Low, fixed interest rates

- Low debt-to-income ratio.

- Soft credit check

- Multiple loan term options

- Debt Consolidation

- Investing options

Prosper benefits

- Fast funding times

- Live loan center

- Debt Consolidation

- Soft credit check

- Investing options

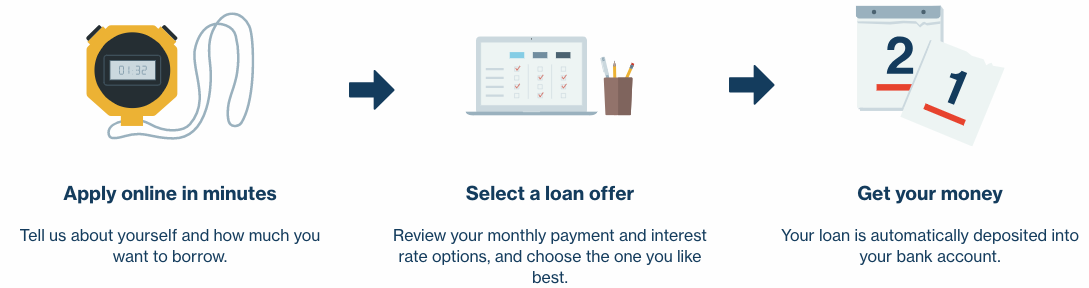

The Loan process comparison

Lending Club

Lending Club is easy to apply for. Getting rates will take a couple of minutes. All that you will need to do is add basic information about yourself such as your name, date of birth, and place of employment. Then, you will select a loan offer that best fits you.

Prosper

Getting a loan with Prosper is just as easy. First, select your loan amount and then answer a few questions that you would expect from a lender. You will then choose your desired rates and term.

Credit score requirement

Lending Club

Lending Club requires that all borrowers have a 600 minimum credit score. You should have a minimum credit history of 3 years.

Prosper

Prosper requires that all borrowers have a minimum credit score of 640. Prosper borrowers should have a minimum credit history of two years.

How much can I borrow for a personal loan?

One thing that is awesome about P2P lenders is that there is going to be a smaller minimum requirement. For example, CommonBond requires that you borrow a minimum of $5000. If you need a loan for only $4000, then you are going to be out of luck.

Prosper

With Prosper you can get a loan ranging from $2,000 – $40,000.

LendingClub

LendingClub does slightly better in this category because they allow you to get a loan ranging from $1000 – $40,000. If you need a smaller loan, then you will appreciate the lower loan minimum requirement.

Loan terms options

Both Prosper and Lending Club have 3 or 5-year loan term options for you to choose from.

Funding time

Prosper

One of the benefits of Prosper is that they will usually fund your loans faster than other lending platforms. You may be able to be funded in as little as one business day. Approved Prosper loans have an average funding time of around 1 to 3 business days.

Get a loan with Prosper Today!

LendingClub

LendingClub has a relatively speedy funding process as well. Approved loans will be funded within 1 to 7 days.

Get a loan with LendingClub today!

Support comparison

Prosper.com offers a large help center where you can get helpful information on borrowing, payments, fees, Autopay, pre-approval, verification, and more. Borrower phone services are available from Monday – Friday:

8am – 9pm (ET)

5am – 6pm (PT)

6am – 7pm (MT)

7am – 8pm (CT)

LendingClub offers a resource center, education center, financial advisors, and more.

The LendingClub.com phone support team is available from Monday to Friday from 6am to 5pm PT and Saturday from 8am to 5pm PT.

Which P2P lender is better?

This was a difficult battle. There are things that I love about each lender. I love that Lending Club has a lower minimum credit score requirement to accommodate people with fair credit. I love Proper’s faster funding times and with Prosper you know the company that you are working with. I recommend that you get rates today which can be done in minutes.