Do you need a personal loan? Today we are comparing two alternative options from a traditional lender.

In this LendingTree Vs Lending Club article, we will help you with getting a personal loan by comparing loan interest rates, the online process, lender benefits, loan fees, support options, and more.

What is LendingTree?

LendingTree was founded in 1996 by Doug Lebda. LendingTree brings consumers and lenders together. LendingTree is not a typical lender. Instead of dishing out loans themselves, LendingTree will connect you with other lenders. Over $6 billion have been borrowed using the LendingTree platform. With LendingTree you can get loans for debt consolidation, credit card refinance, home improvement, home buying, major purchases, car financing, business, vacation, and more.

What is Lending Club?

Lending Club is a peer-to-peer lender. Peer lenders such as Lending Club and Prosper allow you to borrow from individuals and investors. Working with P2P lenders is a good way to get a loan if you have bad credit. Lending Club allows you to borrow personal and business loans, auto refinancing, and more.

Reputation comparison

Better Business Bureau

To get a good grade on the BBB platform you must build trust, advertise honestly, tell the truth, be transparent, honor promises, be responsive, safeguard privacy, and embody integrity.

Both companies received good grades from Better Business Bureau.

LendingClub

LendingClub Corporation has had BBB accreditation since 1/1/2008. LendingClub currently has an “A-” BBB rating.

LendingTree has over 6000 Trustpilot customer reviews. The company received an Excellent 5 out of 5 stars and an awesome 9.3 out of 10 TrustScore.

LendingTree

Similar to LendingClub, LendingTree also received an “A-” BBB rating.

Personal loan rates comparison

No loan rate is ever the same. Your loan rate is going to be dependent on several factors. Your loan rate is going to be dependent on your credit score, the term option that you select, the rate type that you choose, and more.

LendingClub rates

LendingClub is well-known for their affordable loan rates, which can range from 6.16% – 35.89% APR.

LendingTree rates

Personal loan rates with LendingTree are dependent on the lender that you end up going with. Your loan rates will range anywhere from 6% to 36%.

Fees comparison

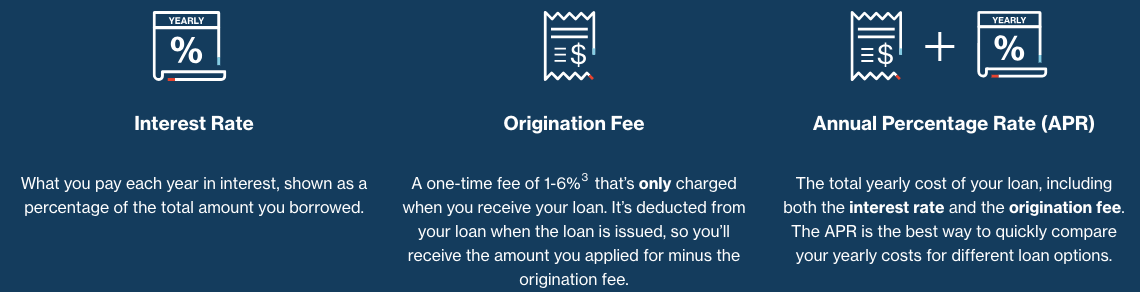

Lending Club fees

With Lending Club, you will not have to worry about any prepayment penalties for paying your loan off on time.

However, there are origination fees that range from 1% – 6%. Your origination fee will be taken out of your loan.

Lending Club has a 15-day grace period. If your bill is not paid in this time period, you will be charged the greater amount between $15 or 5% of your unpaid loan bill.

LendingTree fees

It’s hard to determine fees without knowing the lenders in your area that you will be matched with.

Features comparison

Lending Club benefits

- Low debt-to-income ratio.

- All Lending Club loans are unsecured.

- Low minimum borrow amount compared to other lenders such as SoFi.

- Easier to get approved.

- Financial Advisors

- Soft credit check

LendingTree benefits

- Free credit score

- Works with a large number of lenders.

- Those who qualify may be able to get a lump sum of cash in 24 hours after approval.

- Low minimum borrow amount

- Soft credit check

- Unsecured loan

How does LendingTree work?

As mentioned in the beginning, LendingTree will connect you with other lenders. The LendingTree loan process is simple and fun. All that you must do is add basic information such as the amount you want to borrow, your address, etc. In minutes you will be able to get multiple loan offers from several lenders.

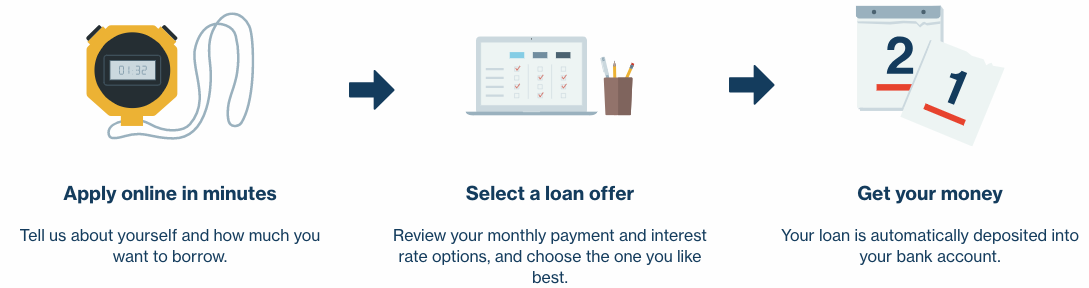

How does Lending Club work?

If you are interested in borrowing using LendingClub.com you will have to fill out the loan application. LendingClub uses innovative technology that calculates your information to assign the proper interest rates. Your loan will be deposited within one week of approval.

How much can I borrow?

LendingTree personal loan amounts range from $1000 to $35,000.

LendingClub personal loans allows you to borrow $1000 to $40,000.

The borrow amounts are great. Many lenders won’t let you borrow anything under $5000 so it’s awesome that both companies will be able to handle your small loan needs.

Credit score requirements

To use Lending Club, you must have a minimum credit score of 600. Lending Club likes for their borrowers to have at least 3 years of credit history. The average borrower on Lending Club has a credit score that is around 700.

With LendingTree you will need a minimum credit score of 640. Although this is achievable, Lending Club better accommodates those with less than desirable credit.

Funding time

The awesome thing with LendingTree is that you may be able to get your personal loan funded in 24 hours.

With Lending Club you will be receive your loan within 1 to 7 days of being approved.

Both lenders have fast funding times, but there may be a chance that you receive a loan faster with LendingTree.

Loan term options

LendingTree has several loan term options that range from 1 to 5 years.

With Lending Club, you can get a loan term for either 3 or 5 years.

Mobile apps

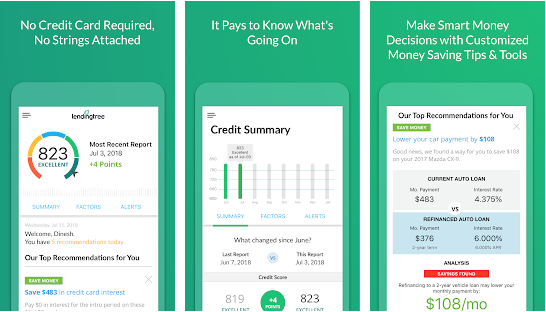

The most popular LendingTree app is Credit Score by LendingTree. This free app allows you to see your credit score and all the different possibilities that you have using LendingTree.com.

LendingTree also offers the LendingTree Loan Calculator.

Lending Club does not offer a helpful app for borrowers. However, they do offer a helpful app for investors called Lending Club Invest. This app allows you to easily access your investment account.

Support comparison

Lending Club

Lending Club offers a truckload of information to help you to get started and to also learn more about different loan terms. Their Resource Center will help you to determine what is the best option for you, learn if you have a debt problem, and more. Lending Club also offers a helpful blog. If you need any more advice you will love the fact that Lending Club offers an awesome blog.

You can contact their support team from Monday to Friday from 6am to 5pm PT and Saturday from 8am to 5pm PT.

LendingTree

The LendingTree Customer Care team can be contacted from Monday – Thursday 8am – 9pm EST, Friday 8am – 8pm EST, and Saturday10am – 7pm EST. You may also submit a ticket with your question or answer.

Which is the better lender to go with?

If you want a more traditional option, then Lending Club is the better option. LendingTree does offer perks, but it’s more of a comparison site. Lending Club is easy to use, you will be able to borrow more, there is a low credit score requirement, and there is a low debt-to-income ratio. Another benefit with LendingTree is that your interest rates are more straightforward. The best time to get rates is now. I strongly recommend that you get rates today, which can be done in under 2 minutes.