Whether you need a personal loan or student loan refinancing, choosing the right lender is crucial. In this article, we will compare SoFi vs LendingClub to help you to find the best lender for your current situation.

A few loan elements that we will compare include: the APR of each lender, loan amounts, credit score requirements, fees, and more.

What is LendingClub?

LendingClub was founded in 2006 and it offers peer-to-peer lending services. The company is not like a traditional lender. Instead, LendingClub connects borrowers to investors. In 2012, LendingClub surpassed $500 million in personal loans. In 2017, the company was reported to have over 4.6 billion in total assets.

What is SoFi?

SoFi was founded in 2011 and similar to LendingClub it is considered a nontraditional lender. SoFi is an online lender that allows their customers to have a sense of community unlike your local bank. Unlike your typical bank, SoFi is rich in membership benefits to help their customers.

What is a personal loan?

A personal loan is money that is borrowed for a specific purpose. Personal loans can either be secured or unsecured and they will help you to fund a large expense. You can get a personal loan for your wedding, refinancing your credit cards, your home improvement projects, cover a vehicle purchase, and more.

Better Business Bureau comparison

BBB helps to determine the trustworthiness of a company and how well the company handles customer complaints. Both lenders are rated well by BBB. Better Business Bureau takes into consideration 15 factors including: type of business, time in business, failure to address complaint pattern, and more.

LendingClub

LendingClub has had BBB accreditation since 01/01/2008. The company currently has an “A-” rating in the BBB rating system overview. This means that on a 100-point scale LendingClub scored 90 – 93.99 points. LendingClub Corporation received a BBB composite score of 3.62 out of 5 stars.

SoFi

SoFi received the highest BBB grade possible which was an “A+” rating in the BBB rating system overview. This means that SoFi received 97 – 100 points on a 100-point scale.

Personal Loan rates comparison

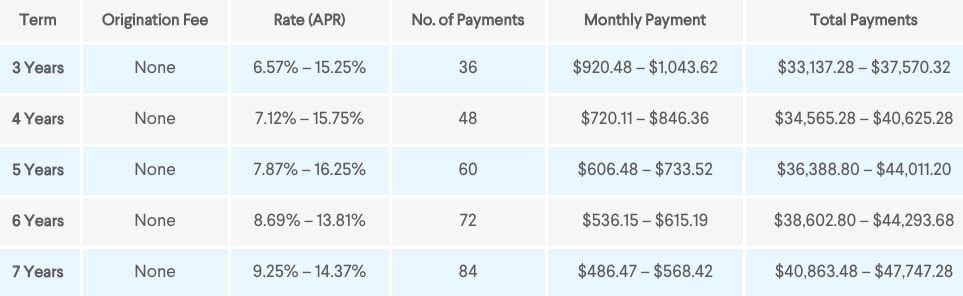

SoFi

SoFi offers interest rates ranging from 6.57% to 16.25% depending on your loan term. To get the most accurate rate I encourage you to get rates today. There are no prepayment fees.

LendingClub

LendingClub rates range from 6.16% – 35.89% APR. With LendingClub you will not have to worry about prepayment fees if you pay off your loan before your loan term.

How much can I borrow from each lender?

SoFi – $5000 – $100,000

SoFi offers loans ranging from $5000 to $100,000.

SoFi is a great personal loan option if you need larger loans over $40,000.

LendingClub – $1,000 – $40,000.

As I said in my review of Prosper vs SoFi, peer-to-peer lenders usually have a smaller minimum loan amount. LendingClub offers loan amounts ranging from $1,000 to $40,000.

LendingClub is great if you need small loans under $5000. However, if you need a loan under $40,000 you will have to look elsewhere.

Lender fees comparison

LendingClub

LendingClub has origination fees that range from 1% – 6%. This is the amount that the borrower pays to process the loan application and agreement. Your origination fee is based on a number of factors such as your credit score. The fee amount is taken out of your loan.

For example, if you qualify for a $5000 loan with a 3% origination fee, then you will pay $150 in fees. Instead of receiving $5000 you will receive $4850.

If you were to qualify for a $40,000 loan with a 3% origination fee, then you will have to pay $1200 in fees. Instead of receiving $40,000 you will receive 38,000.

LendingClub also has late fees if you pay your bill more than 15 days late. Your late fees can cost you $15 or 5% of your unpaid bill. The greater of the two is the one that you will have to pay.

SoFi

One of the best things about SoFi that there are no extra fees whatsoever. There are no prepayment fees, no origination fees, and no late fees.

Benefits and features

SoFi features

- Member discount – 0.125% rate discount when you take out another loan.

- Unemployment Protection Program – If you were ever to lose your job, then SoFi will suspend your monthly SoFi loan payments and help you to look for a job.

- Career coaching – $999 Value

- No fees

- Short credit history

- Good for debt consolidation

- Start SoFi here and get a $100 bonus.

LendingClub features

- Low minimum credit score compared to other lenders.

- Low debt-to-income ratio.

- You can be both a borrower and a lender

- You will be able to take out small loans

- Good for debt consolidation

Loan process options

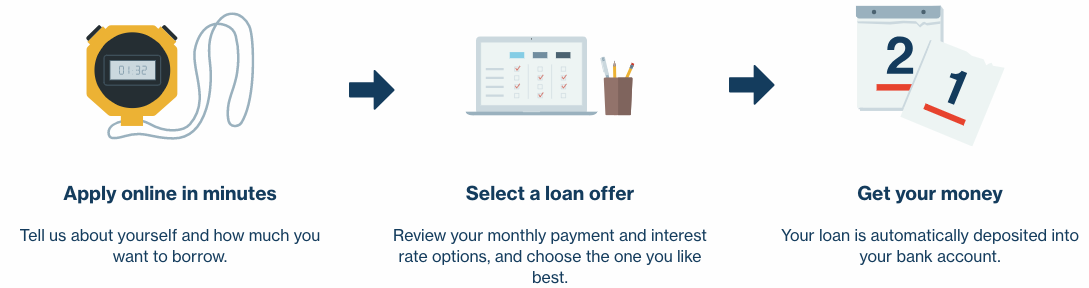

LendingClub

With LendingClub all that you have to do is add details about yourself and let them know how much that you want to borrow. Then you will select your loan.

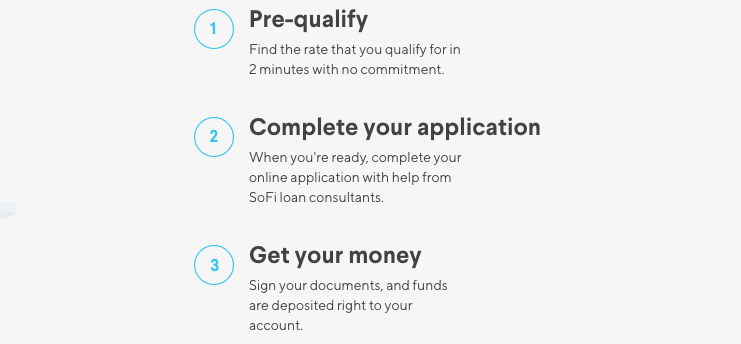

SoFi

SoFi offers an easy online application. You will be able to complete your application in a couple short minutes.

Credit score requirement / credit history

LendingClub

To qualify for LendingClub personal loan you will need a minimum credit score of 600. Anything from 580 to 619 is considered poor credit. LendingClub is going to be more lenient when it comes to getting approved for a loan. The average borrower on LendingClub.com has a credit score of around 700.

Those who qualify for LendingClub should have a minimum credit history of 3 years.

Start a loan with LendingClub today!

SoFi

SoFi is geared to those with a good credit. To qualify for a SoFi personal loan you will need a minimum credit score of 650. Anything from 650 to 699 is considered fair to good. Most SoFi borrowers have a credit score above 700.

Those who apply for SoFi do not need to have a long credit history.

Funding time comparison

Both lenders will fund your approved loan within 1 to 7 days.

Loan term options

SoFi offers loan terms ranging from 3 to 7 years. The longer your loan rates the cheaper your monthly rates. – Click here to get rates with SoFi.

LendingClub offers loan terms ranging from 3 or 5 years. – Click here to get rates with LendingClub.

Support comparison

LendingClub

LendingClub offers a Resource Center to help you to learn personal finance concepts. LendingClub also has a help area with helpful articles to help customers learn about the LendingClub loan process.

Customer support is available:

Monday – Friday: 6am – 5pm PT

Saturday: 8am – 5pm PT

SoFi

SoFi offers various forms of support such as a frequently asked questions page, a resource center, a blog, career coaching, community events, and more. Phone support is available:

Monday – Thursday 4:00 AM – 9:00 PM PT

Friday – Sunday 4:00 AM – 5:00 PM PT

Which is the best personal loan lender?

LendingClub and SoFi are unique in their own way. LendingClub has a lower minimum credit requirement and you will be able to take out smaller loans. However, SoFi gives you more features than LendingClub such as their membership discount. SoFi is better when it comes to fees. Also, SoFi is not like other lenders where you will need a long credit history. Choose the loan that best fits your needs. Both lenders have a fast loan process. I encourage you to get rates.