SoFi is a highly respected lender that provides personal loans that are higher and better supported than most other lenders.

You’ll need to have great credit, employment history, and good financial decision making to be approved by SoFi. They work hard to make sure they choose borrowers who be able to repay, and they provide a lot of support to help those to succeed, both in life and in repaying the loan.

What is a SoFi loan?

SoFi offers loans for student loan refinancing, medical, mortgage, and a range of other personal loans, as well as offering life insurance and investment opportunities. They tend to target people who have good credit and excellent employment histories.

SoFi prides itself on an easy loan experience, with no fees of any kind, not even late fees. Sofi personal loans are unsecured, so you don’t have to provide collateral for the loan. You can choose between fixed or variable rate loans.

SoFi is a direct lender, so your money will come directly from them, not from a third-party lender.

Benefits of getting a personal loan

A personal loan can be used for whatever you need cash now for. You can use it to make a big purchase that you can enjoy while you pay it off, rather than saving up for it. You can consolidate credit card debt to achieve a lower interest rate and save money in the end, as well as making your payments easier using one platform.

Reputation

SoFi has an A+ rating on Better Business Bureau. SoFi is well-known for handling the complaints of their customers well which is the reason for their fantastic BBB rating. SoFi aims to do more for borrowers than just providing the loan. Dinners and networking events are provided for members only, and there is a career and financial advice forum online where borrowers can compare notes and get ideas. For all of these reasons, Sofi is generally respected by those who borrow from them.

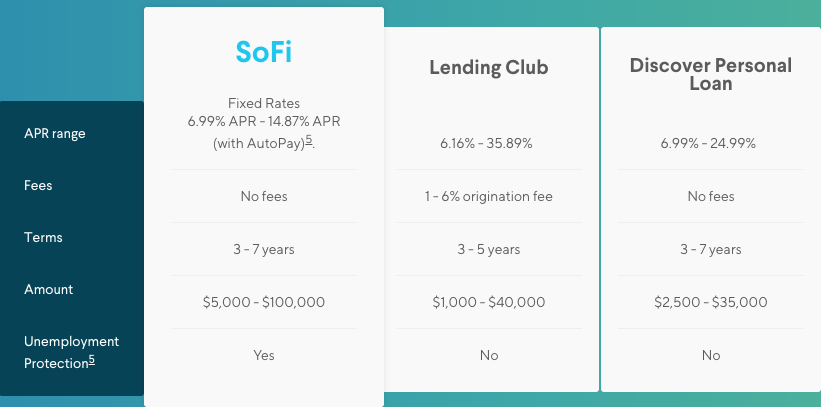

SoFi personal loan rates

SoFi offers rates from 5.81% to 14.87%, depending on credit score and income. There are not too many companies that can can compete with SoFi’s low unsecured personal loan rates. What I love about SoFi is that their lows are very low and their high rates are not high compared to other prominent lenders in the industry. By clicking on the link below you will receive $100 with SoFi.

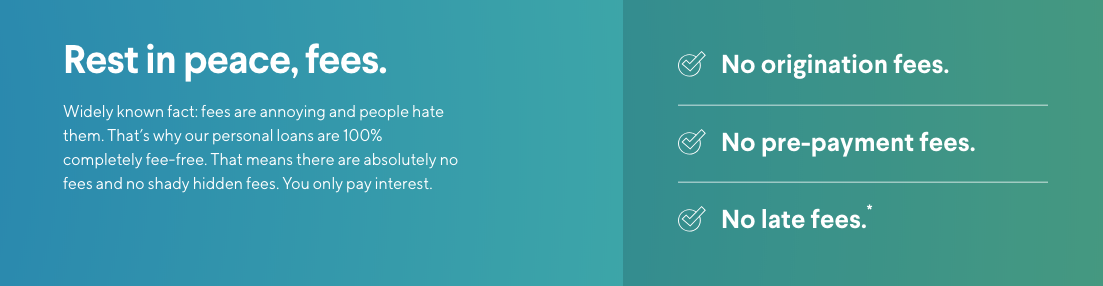

Fees review

Loan fees can get really expensive and annoying. One thing that is common between SoFi and yourself is that, SoFi hates fees, just like you do. You will not pay an origination fee, a balance transfer fee, or a prepayment penalty. Incredibly, you don’t even pay late fees with SoFi.

How does SoFi Work?

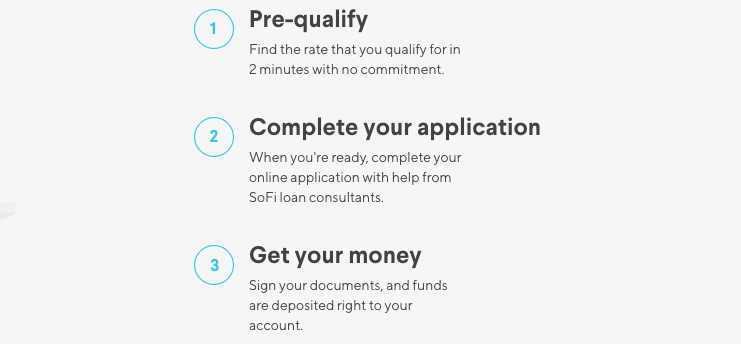

SoFi has a simple application process which can be completed entirely online. You will need a driver’s license, an active checking account, be a resident or citizen of the US. You will also need your pay stubs and proof of income.

Pre-approval is instant, so you’ll know as soon as you provide the information what kind of loan you qualify for.

Once you are approved, you will complete a customized multiple-choice questionnaire to verify your information and clarify details.

SoFi member benefits and features

SoFi offers great benefits to their members, making them much more than a lender in the lives of their members. If you need to take out an additional loan from SoFi, you will receive a .125% discount. SoFi seems to genuinely want you to succeed and pay off your loan. They offer career services like resume parsing, one-on-one career coaching, and personalized strength assessment. If you lose your job, SoFi will pause payments while they help you find a new one. SoFi also gives you options for participating with other members at dinners, educational events, and exclusive experiences across the country.

SoFi minimum credit score

The lowest credit score SoFi will consider is 680. They take other things into account like the stability of your job and the amount of your paycheck left after expenses to decide your rate, so don’t feel deterred from applying if your score is on the lower scale of what is acceptable to SoFi.

Funding time

Funding times can build anticipation. If we’re honest with ourselves we want our money now and we shouldn’t have to apologize for desiring it as fast as possible. With SoFi, you will fall in love with their extremely fast funding times. You will generally know if you are approved by SoFi within an hour. After approval, you will receive your funds within seven business days.

Qualifications

To be considered for a personal loan from SoFi, you must be employed or have consistent income from somewhere else. It is preferable if your paycheck exceeds your monthly expenses considerably. You must be at least 18, unless you live in a state that requires a higher age to take out a personal loan. If you don’t meet requirements, SoFi allows you to use a cosigner.

How much can I borrow from SoFi?

To get a personal loan with SoFi you must borrow at least $5000. With SoFi borrowers will be able to get a loan anywhere from $5000 and $100,000.

Loan term options

Personal loan terms range from 36 to 84 months. If you lose employment or income, SoFi will freeze payments so you have time to find a new job, but you will continue to accrue interest. This could extend your payment time.

Mobile app

SoFi has a wonderful mobile app lets you keep track of your loans, apply for a new account, invest saved money, and participate in many aspects of the SoFi community. Complaints about the mobile app in the playstore are individually addressed by a SoFi representative, showing a commitment to quality in the app.

Availability

SoFi personal loans are available nationwide, with the exception of MS. Some restrictions on age of eligibility and minimum loan are dependent on your state of residence.

Comparison to other online lenders

SoFi is the highest rated online lender. SoFi offers some of the highest loan amounts in the business, up to 100,000, compared to $40,000 by Prosper and Lending Club. SoFi gets you funds faster than Lending Club as well. While rates at SoFi only go as high as 14.87% fixed, other lenders like Lending Club go as high as 35.89%. Sofi offers many more services to their members than competing lenders, like networking and community events. They have a fee-free service that sets them apart from most other lenders, who charge fees. Their eligibility requirements are among some of the strictest. In general, if you can quality for a SoFi loan, it is likely to offer you some of the best terms you’ll find.

Customer support

SoFi offers awesome support and communication. All complaints are responded to promptly, and SoFi offers many more services to their borrower community than you could expect from another lender. You can get career coaching, network with other borrowers, and if you lose your job, SoFi will freeze payments so you have a chance to get back on your feet. This kind of support really makes you feel like SoFi cares if you are able to pay back your loan, and that they are doing what they can to help.

Prior to being approved, you may find support less quality. SoFi representatives will be unlikely to tell you how long it will take to process your loan once you are pre-approved.

Bottom line

SoFi is an excellent personal loan choice for those with good credit, good employment, and good established habits of paying back loans and making good financial decisions. More people take a SoFi loan because of a deliberate decision to make a large investment than use it to consolidate credit card debt, due to the high credit required. SoFi offers awesome benefits to their members, seeming to truly take care of their clients and give them the best chance to pay off the loan.