LendingTree is a matchmaking company that helps borrowers find lenders offering the best loans with the best rates, while minimizing the legwork.

In this LendingTree personal loan review, we will take a look at the LendingTree reputation, loan rates, funding time, minimum credit score, and more.

Advantages of getting a personal loan

There are many good reasons to take out a personal loan. Since you don’t have to put up collateral to qualify for a personal loan, it can be a safer and more obtainable option for many borrowers, despite the higher interest rates than you expect to see with secured loans.

Perhaps you have been hit by a large unforeseen cost, such as a medical cost or major home repair. A personal loan can let you take care of the payment and have more time to pay it off than would be possible with your credit card.

If you have racked up a lot of debt due to credit card use or student loans, a personal loan can consolidate the debt, allowing you to make a single monthly payment that is easier to handle than many credit card accounts or loans. You may also be able to qualify for a better rate than you are currently getting, saving you money overall.

Perhaps everything is going well in your life, and you would like to make a big purchase or expenditure like a boat, pool, or wedding. A personal loan can let you enjoy the purchase or event now, then pay it off while continuing to enjoy it, rather than having to save up for it.

What is LendingTree?

When the founder of LendingTree, Doug Lebda, wanted to buy his first home, he found the process of obtaining a mortgage by shopping at multiple banks exhausting and challenging, even for an accountant like him. He thought it must be extremely difficult for the average prospective homeowner with a full-time job and no financial experience.

LendingTree was Lebda’s answer to this challenging process, letting people shop for a mortgage, personal loan, student, loan, or other kind of loan choice between multiple loans for which they qualified, without the legwork. Not only does this save the borrower time, but it also causes banks and lenders to compete for the borrower’s business, which may get you a better deal.

How does LendingTree Work?

LendingTree prides itself on taking the frustration and legwork out of shopping for a personal loan. The application process is extremely simple and easy for anyone, no matter your financial history or credit score. Just complete as much information as you can, and LendingTree will match you to five banks for whom you prequalify. Lenders may run reports that can affect your credit score in order to pre-approve you. You will find out which five lenders you prequalify for very quickly. Once you choose a company, you will begin their application process, taking it out of the hands of LendingTree.

Reputation

An A- rating on Better Business Bureau, due to a failure to respond to a few complaints, combined with a five-star rating and 82% excellent score on Trustpilot, leaves LendingTree with a relatively good but not stellar reputation.

Keep in mind that many borrowers will tend to judge LendingTree based on the experience they have with the lender that they are matched with, although this experience does not necessarily reflect at all on LendingTree as matchmaker.

Once you are matched with a loan provider, carefully consider their reputation, as well as their policies, before you make up your mind. LendingTree does not guarantee the experience you have with a matched lender.

LendingTree personal loan rates

You can get some of the best rates in the business by giving LendingTree your stellar credit score, financial history, and income to expenditure ratio and letting lenders fight over your highly desirable business.

Rates as low as 6% can even beat a credit card or mortgage for some highly qualified candidates.

For those who are not so well qualified, rates can go pretty high. You may receive a rate as high as 36% if your credit score isn’t great, or you don’t have a responsible financial history or if your income is mostly taken up by expenses. Keep in mind that you can apply with a cosigner through LendingTree so that you can be matched to banks that offer more reasonable rates with a cosigner.

Fees review

LendingTree is completely free for borrowers to use. You won’t be asked for any money, or even your payment information, until you have been matched with lenders, chosen one, and been qualified. LendingTree warns borrowers never to pay anything or give payment information until the process has been completed. LendingTree is free to borrowers because lenders pay for the privilege of being matched to borrowers.

LendingTree member benefits and features

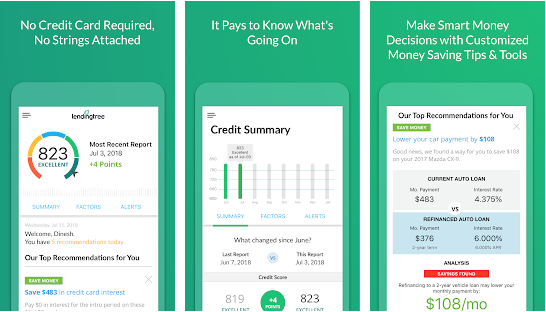

The experience of being a part of LendingTree will only last for a very short period. Just fill out the information, get matched, and your relationship with LendingTree is over. The features offered are straightforward: the opportunity to be matched with five lenders who are competing for your business. What I love about LendingTree as well is that you will be given a free credit score.

LendingTree minimum credit score

You can apply through LendingTree with any credit score, even one that is very low or nonexistent. You will certainly be matched with some of the highest rates with a very low score, but these rates may still be better than existing credit card debt, or may be worth it to you in the face of unavoidable medical or home expenses. Typically, you need a score of at least 640 to be matched with decent loans. If your score is very bad, consider trying to find a cosigner to make you more attractive to lenders.

Funding time

LendingTree will provide you with a list of lenders with loans you prequalify for. The time from matching to funding depends on how quickly you get through the lender’s application process, and how quickly they provide funds once the process is complete. Typical wait times are from 24 hours to seven days, although your wait time may be shorter or longer.

Qualifications

LendingTree will match you with companies that offer loans you qualify for, so just put accurate information and you can find a loan no matter your qualifications. You can use LendingTree services nationwide. Your debt to income ratio must be 45% or below to be considered for a loan through one of LendingTree’s lenders.

How much can I borrow with LendingTree?

Lenders working with LendingTree provide loans from $1000 to $35,000. Remember that if you need more you can take out more than one loan at a time.

Loan term options

Loan term and repayment options vary by company. When comparing the companies that LendingTree matches you with, remember to not only think about rates, but also decide if you can pay off loan amounts within the specified time and if the options in repayment are attractive to you.

Mobile app

The LendingTree app lets you see your own credit score, completely for free. It also shows you what open accounts you have so that you can see how these accounts might be affecting your score. You can also use the app to find a loan and see what your options are.

Availability

LendingTree is available nationwide and will only match you with lenders who serve in your area.

Comparison to other online lenders

LendingTree will pull your credit and may affect your credit score, so if you think you qualify for a loan from one of the top lender like SoFi, it may be worthwhile to apply directly with the best lenders you think you qualify with instead of using LendingTree. If, on the other hand, you are unsure what loans you will qualify for, and want to save yourself the legwork, LendingTree can be a great option for you.

Customer support

LendingTree is a huge company that deals with thousands and thousands of short term relationships with customers every day, and their customer support is what you might expect with that model. If you have a problem during your application process with LendingTree, it is likely you will be on your own, although there is a complaint process you can wade through if it is very important to you.

Bottom line

LendingTree is a great option for matching borrowers to several lenders that offer competitive loans to those with mid-level or low credit scores and mediocre financial histories. If you need money now and don’t know what kind of loan you are likely to qualify for, LendingTree is a great place to start.