Finding the right company to fund your personal loan can be a daunting task if you don’t know where to look. In this article, we will compare LendingPoint Vs Lending Club to help you to choose the best lending option.

Both companies are well-known and accommodate those who don’t have the most desirable credit score.

What is LendingPoint?

LendingPoint is a direct lender that was founded in 2014. The company is based in Georgia and they are a loan option for those with average or bad credit. Today LendingPoint has issued over 70,000 loans which has come up to around $500,000 million in loans. With LendingPoint you will be able to get personal loans for debt consolidation, home improvement, credit card refinancing, vacation, medical or dental, funeral expenses, major purchases, and more.

What is Lending Club?

Lending Club is one of the most popular peer to peer lenders in the United States. Lending Club makes it clear that they are not a bank. What Lending Club does is connect borrowers and investors. Instead of borrowing from a bank you will be borrowing from individuals, which is a great way of getting lower personal loan rates.

Reputation comparison

LendingPoint

LendingPoint received BBB accreditation on 12/12/2014. In the BBB rating system overview, LendingPoint received an “A+” rating. This is the best grade that you can receive from BBB. A+ grades mean that a company has excellent business practices. They are transparent, trustworthy, etc.

LendingPoint has 900+ Trustpilot reviews. LendingPilot received a TrustScore 9.6 out of 10, which reveals that they are trustworthy and have a great reputation among their customers.

LendingPoint has been featured on Yahoo! Finance, Reuters, American Banker, Credit Union Times, and more.

Lending Club

Lending Club is the larger more popular option of the two online lenders. Lending Club received an “A-” Better Business Bureau rating. This is the third highest grade that you can receive from BBB. This means that Lending Club has received a 90 – 93.99% score out of 100%. Lending Club is recognized as one of the top lending and investing platforms by The Economist, Credit Karma, The New York Times, Inc, and more.

Personal loan rates comparison

LendingPoint

LendingPoint is one of the most expensive lending platforms. We have to remember that LendingClub accommodates those with poor credit. With LendingPoint you will have loan rates that range from 15.49%–35.99%.

LendingClub

With a P2P lender you will be able to get better rates than if you were to go with a traditional lender. With that said, LendingClub is pretty affordable compared to LendingPoint. With LendingClub you will be able to get rates as low as 6.16% APR. Their rates can range anywhere from 6.16%–35.89% APR.

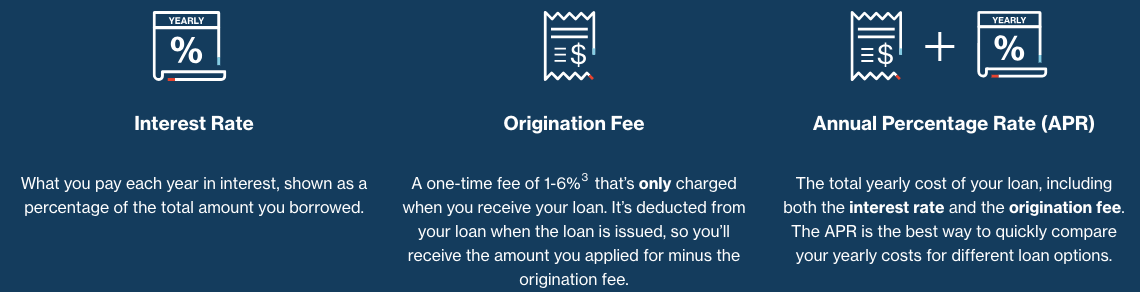

Loan fees

Both lending options do not have any prepayment penalty fees. This is the fee that you pay when you finish paying off your loan before your loan term ends. Although both lenders do not have prepayment penalty fees, they do have origination fees and late fees. Origination fees are fees that the lender will charge you to process your loan application. This fee is not taken out of pocket. It will be taken out of your loan. Late fees are fees that you pay when you are late on your loan payment. Usually lenders have grace periods.

LendingPoint

Origination fees – LendingPoint loan origination fees range from 0% to 6%.

Prepayment penalty fees – LendingPoint has a $30 late fee, but you will have a 15-day grace period.

LendingClub

Origination fees – Those who borrow using the LendingClub platform will have to pay a 1% – 6% origination fee.

Prepayment penalty fees – With Lending Club your late fee will be the greater out of $15 or 5% of your unpaid loan bill. There is a 15-day grace period.

Comparing the features and benefits of each lender

LendingPoint benefits

- Next Day Deposit

- Twice monthly payments

- Low minimum individual annual income requirement

- Option for those with bad credit scores.

- Soft credit check

- Flexible repayments

LendingClub benefits

- Get connected with investors for lower interest rates.

- Get your loan in as little as a few days

- Multiple loan offers

- Low minimum borrow requirement

- Soft credit check

- Low debt-to-income ratio.

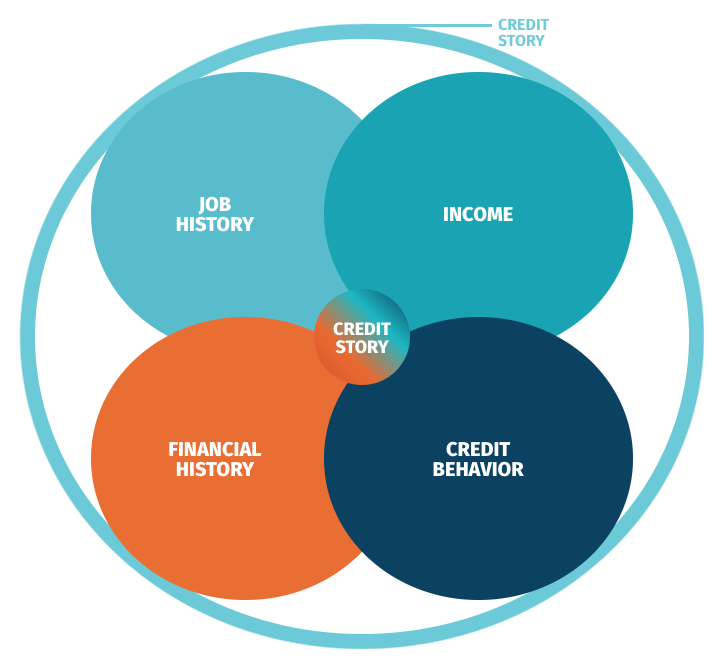

Credit score requirements

To qualify for a personal loan with LendingPoint there is a 600 minimum credit score requirement. You should also be making at least 20K a year before you apply. LendingPoint wants their borrowers to have a responsible banking and financial track record.

To qualify for a personal loan with LendingClub you should have a credit score of at least 600. Most LendingClub borrowers have a credit score that is around 700. You should have a credit history of at least 3 years.

Funding time

One of the best things about LendingPoint is that LendingPoint has next day deposits.

With LendingClub you will be able to get your loan within 1 to 7 days.

Loan terms options

LendingPoint has 2 and 4-year loan options for you to choose from. You can pay your loan bill every week, every 28 days, or every month. LendingPoint has AutoPay options.

Lending Club has 3 and 5-year loan repayment options.

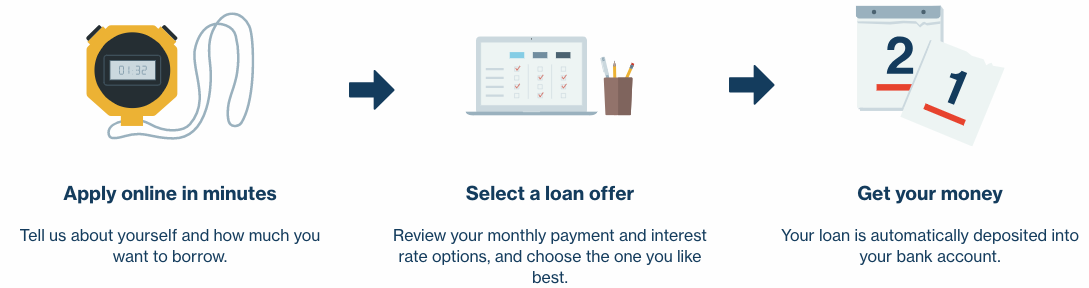

The loan application process

Applying for a loan with both lenders is simple. Both lending platforms have a similar approach. Determine how much that you need, determine the reason you need to take out a loan, and add basic information about yourself. You will be able to get rates in two minutes.

How much can you borrow?

LendingPoint might not be the best option if you need a personal loan that is over $25,000. With LendingPoint you will be able to borrow anywhere from $2000 to $25,000.

LendingClub allows you to borrow under $2000. This is great if you want a small personal loan. LendingClub allows you to borrow $1000 to $40,000 if you have larger loan needs.

Availability

LendingPoint is available in 40 states. If it is not available in your state, then you will have to look elsewhere.

LendingClub is available in all states.

Support comparison

LendingClub.com is filled with support options for borrowers and investors. They have a plethora of sections to help you to succeed as a borrower. You can check out their Overview, Resource Center, Rates & Fees, Reviews, Debt Consolidation, Credit Card Payoff page, etc. You can contact phone support from Monday to Friday from 6am to 5pm PT and Saturday from 8am to 5pm PT.

LendingPoint.com has a blog to help their borrowers. You can also contact their support team by phone and email.

Which lender is the better choice?

I believe the winner in this comparison is easy. Lending Club is the better lending choice. Lending Club offers better lending features, cheaper interest rates, a lower minimum borrow amount, and a higher amount that you can borrow. Lending Club is the more popular option and it easily beats out LendingPoint. I encourage you to take advantage of the low market rates. Get your rates today.