Let’s compare Prosper Vs Upstart, which are reputable personal loan companies that rely on peer lending instead of financial institutions, but which is better for your needs? Upstart has historically been the choice of students on their way to becoming young professionals, since it considers aspects like education and job history as well as credit score when determining rates.

Prosper can offer slightly better rates, so for those with good credit, Prosper may provide a better loan for you. If you are interested in a loan on the lower or higher end of the personal loan spectrum, Upstart may be a better option. Upstart offers slightly better communication electronically via chat, but charges more for check payments.

What is Prosper?

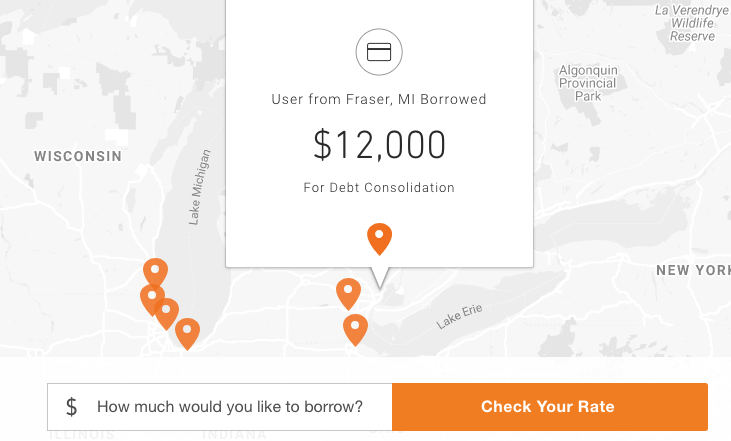

Prosper is a lending company that offers personal loans at relatively low rates. The company has processed over $12 billion in loans. The loans offered by Prosper are unsecured, so you don’t have to put up collateral that could be taken from you if you don’t make payments. Every loan is funded by many people across America, so no individual lender bears the brunt of the loan. Prosper is used primarily by established citizens for life events like marriage, having or adopting a child, etc.

What is Upstart?

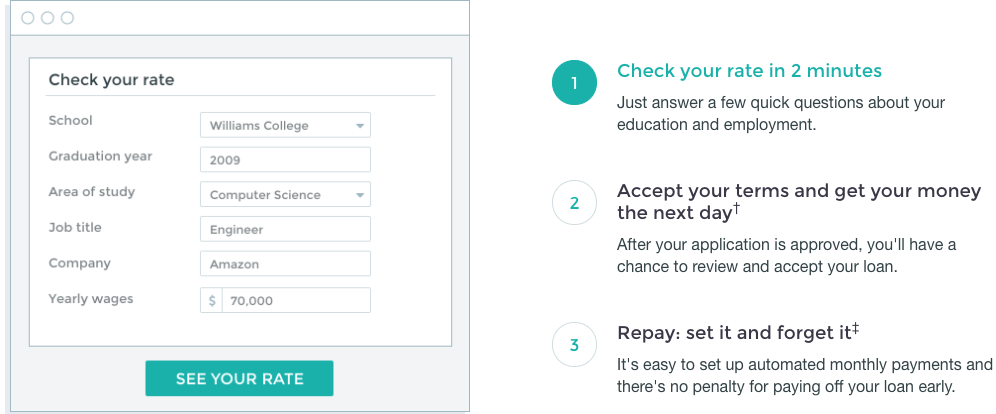

Upstart is another online lender with unsecured loans that began by students exchanging a percentage of their income over the course of a decade in exchange for mentorship and capital from investors. The similarity of this system to a sort of indentured servitude made a change necessary, and in 2014 Upstart began offering fixed term lending like Prosper. They have retained their primarily young adult target audience. Upstart considers factors like education and job history, and may offer better rates for those without much of a credit history.

Reputation comparison

Upstart is younger than Prosper by about five years, so it has had less time to establish itself as a trusted brand. Trustpilot gave Upstart a rating of 9.2 out of 10, with 90% of users finding its services to be excellent. Prosper had 49 reviews on Trustpilot and received a score of 7.3 out of 10 and an excellent rating. Prosper has been recognized by NBC, NPR, Wall Street Journal, Reuters, and more as being one of the top P2P lenders.

Prosper and Upstart both received an A+ from the Better Business Bureau. Upstart has a reputation for being easy to communicate with, especially with younger applicants.

Personal loan rates comparison

Both companies offer rates depending on your situation. Keep in mind that while Prosper offers the lowest rates, Upstart looks at more than your credit history to determine your rate, so a loan from Upstart may be lower for you if you don’t have much of a credit history.

Prosper rates

APR rates from Prosper are between 6.96 to 35.99%. Your rate will depend on which of seven tiers you land on. These rates are wider on both the lower and higher side than Upstart’s rates. Rate assignment depends primarily on credit score and income. The low end of this spectrum is one of the lower rates that you are likely to find in a personal loan.

Upstart rates

Upstart offers interest rates from 8.85 to 29.99%. Since Upstart is targeted towards young applicants, it looks at more than credit history to determine the rate it will offer. Education and job history also go into the formula, so rates may be much better for well-educated applicants without much credit than with Prosper. If you are on the highest end of the rate spectrum, you will at least not be hit with a rate as high as those offered by Prosper.

Loan fees comparison

Upstart charges between 1% and 8% on what you borrow to open a loan, while Prosper fees are kept a little lower, at from 1% to 5% of the borrowed amount. This is called the origination fee. This can make a big difference if you are taking out a significant amount or intend to borrow and pay back multiple times.

The digitally focused Upstart charges a whopping $10 fee for a paper check, while with Prosper paying with a check will only cost you $5. Both companies charge 5% or $15 for past due payments, whichever is greater.

Comparing the features and benefits of each lender

Upstart benfits

- Lower than average credit score requirement.

- Co-signer option

- Soft credit check

- Simple and fast loan application process

- State-of-the-art machine learning techniques

- Get a loan with Upstart.

Prosper benefits

- Fast funding times

- Live loan center

- Soft credit check

- Auto Invest tool

- Get a loan with Prosper.

Credit score requirements

Your credit score is the single most important aspect that will be judged to determine your rate. To even be considered for a personal loan you must have a minimum credit score. To get a personal loan through Prosper you must have a credit score of 640, while Upstart requires a slightly lower rate of 620. This is probably to account for the lower credit scores of college students, who haven’t yet had the opportunity to build much credit.

Qualifications

Make certain that you can even qualify for a personal loan from either company before researching further. Both Prosper and Upstart require that you be an American citizen or permanent US resident over 18. Upstart will also allow lending to those with a long term visa, so if you are in the US on a visa Upstart is your only option between these companies. Both companies require you to have a valid bank account and steady source of income. Upstart may be more understanding to students still looking for work. Incidentally, Upstart doesn’t offer loans in Virginia.

Funding time

If you are looking for a loan, there’s a good chance that you need the money sooner rather than later. Both companies get you money fast.

Upstart may take a few days to verify and underwrite your loan, but once you accept the contract you could see funding the next business day.

Prosper will provide you with a loan contract within seven days of qualifying, and funds will arrive shortly thereafter.

The loan application process comparison

Upstart’s online application is easy, taking only a few minutes to complete. Prosper’s online loan application is easy as well, but it slightly more time-consuming.

Loan terms options

Prosper offers a wide range of term options to cover whatever might come up in your life. You can qualify for a loan for weddings, military, baby and adoptions, bridge, or engagement rings, among other things.

Get a personal loan with Prosper.

Upstart offers a range of loan term options as well, although their terms are more focused on younger applicants and business start up. You can get a loan to pay your students loans, relocate or travel, pay medical bills, or start a business.

Get a personal loan with Upstart.

Both Prosper and Upstart have 3 or 5-year loan term options.

How much can you borrow with each lender?

Upstart allows personal loans from as low as $1000 to up to $50,000, providing a greater range of loan options that Prosper, which allows loans from $2000 to $40,000. If you are looking for a loan on the lower or higher range, Upstart provides better options.

Availability

Both companies offer services nationwide with the exception of Virginia, to which Upstart does not offer loans.

Support comparison

Upstart provides great support via live chat, phone, or email. You will have to limit your inquiries to normal business hours. Prosper operates within normal business hours as well, but doesn’t have a chat feature, only email or toll free calls.

Bottom line

Prosper and Upstart are both great peer to peer lending companies that can get you the money you need now. Prosper offers better rates but less of a range in loan amounts. Their application process can be a little more time consuming, and credit score and reliable income will be the primary determinants of loan approval and interest percentage. Upstart will consider a student’s job experience and education as well, so it can be better for those without significant credit histories. I recommend that you get rates today.