This Best Egg vs Prosper comparison is a review of two well-known and popular personal unsecured loan companies, meaning you don’t have to put up collateral that could be taken from you if you don’t make payments. Every loan is funded by many people across America, so no individual lender bears the brunt of the loan.

Best Egg offers lower rates than Prosper, and has fewer qualifications and a faster process, but depending on your circumstances Prosper may provide a better rate. Prosper is available nationwide, while Best Egg is limited in where they provide loans.

Best Egg is more likely to be used for debt consolidation than other uses, unlike Prosper, which is largely used for home improvement, medical, etc.

What is Prosper?

Prosper is a lending company that offers personal loans at fairly low rates. Prosper is used primarily by established citizens for life events like marriage, having or adopting a child, etc. Loan amounts for the average loan recipient are a little higher than Best Eggs, but Best Egg can provide higher loans to well qualified borrowers. Prosper’s application process takes a little longer and there are more qualifications that you must meet, but if you rank well with Prosper, their rates could beat Best Egg’s rates.

What is Best Egg?

To get the best rates with Best Egg, you will need a high annual income and a credit score of at least 700. Loans are taken out primarily for debt consolidation, but they may also be taken out for home improvement, business, vacations, etc. Best Egg has a very easy and fast application process and fewer restrictions on qualifying than Prosper, and their rate may be lower for you.

Reputation comparison

Trustpilot gave Best Egg a five-star rating, with 89% of users finding its services to be excellent. Prosper had 49 reviews on Trustpilot and received a score of 7.3 out of 10 and an excellent rating from 65% of those who used it. Prosper and Best Egg both received an A+ from the Better Business Bureau.

Personal loan rates comparison

Both companies offer variable rates depending on your situation. Prosper rates tend to be higher than those of Best Egg, unless you qualify well.

Prosper rates

APR rates from Prosper are between 6.96% to 35.99%. Your rate will depend on which of seven tiers you land on. Rate assignment depends primarily on credit score and income. These rates are slightly higher than those you will find with Best Egg, but your particular rate may end up being higher on Best Egg than on Prosper, depending on your individual circumstances.

Best Egg rates

Best Egg keeps rates lower overall, from 5.99% to 29.99%. The low end of this spectrum is one of the lower rates that you are likely to find in a personal loan. Rates are based almost entirely on income and credit score.

Loan fees comparison

Best Egg takes from .99% to 5.99% to open a loan, while Prosper origination fees are kept a little lower, at from 1% to 5% of the borrowed amount. This can make a big difference if you are taking out a significant amount or intend to borrow and pay back multiple times.

For those not enrolled in automatic payments with Best Egg there is a $7 processing fee. If payment is late or returned there is a $15 fee. For those who want to pay with a check, keep in mind that Prosper will charge you $5. Prosper charge 5% or $15 for past due payments, whichever is greater, while Best Egg charges a flat $15 fee for being three days or more late.

Comparing the features and benefits of each lender

Prosper benefits

- Intuitive Tools – You will be given tools to make getting a loan easier.

- Low fees

- Investment options – Prosper allows you to diversify your portfolio beyond stocks and bonds.

- Your funding times with Prosper will be faster than most lenders.

- Soft credit check

Best Egg benefits

- Fair rates – Best Egg loans are available at a lower cost.

- You can get loans in as little as 1 day.

- Fast loan process – With Best Egg you will be able to check your rates in minutes.

- Soft credit check

- Friendly Service – Awesome knowledgeable customer service team

Credit score requirements

Your credit score is the single most important aspect that will be judged to determine your rate. To even be considered for a personal loan you must have a minimum credit score. To get a personal loan through Prosper or Best Egg you must have a credit score of 640.

Qualifications

Make certain that you can qualify for a loan before getting attached to the idea of applying for a loan from either company. Both Prosper and Best Egg require that you be an American citizen or permanent US resident over 18, and that you can verify a source of income. For residents of Nebraska or Alabama applying for Best Egg loans you must be 19. Loans are not offered by Best Egg in VT, WV, or IA.

Funding time

If you are looking for a loan, there’s a good chance that you need the money sooner rather than later. Both companies get you money fast. Best Egg can have you approved and funds transferred within as little as 24 hours, so if speed is an important consideration for you, Best Egg may be a better bet. Prosper is similar to SoFi when it comes to funding time. Prosper will provide you with a loan contract within seven days of qualifying, and funds will arrive shortly thereafter.

Loan terms options

Prosper offers a wide range of term options to cover whatever might come up in your life. You can qualify for a loan for weddings, military, baby and adoptions, bridge, or engagement rings, among other things.

Best Egg offers loans covering the same sorts of things as Prosper, like live events, medical, etc. but it is more often used for debt consolidation or to pay off credit cards. Best Egg and Prosper loans come in three or five-year plans, but there are no prepayment penalties, so you can pay off your loan as quickly as you want.

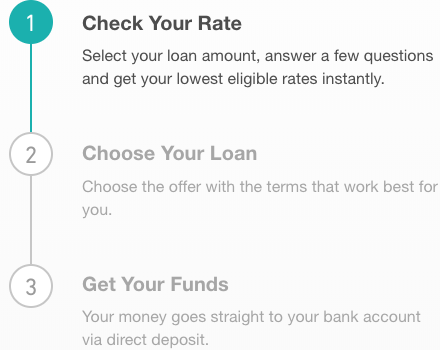

The loan application process comparison

Best Egg has a rapid and easy application process. Just go to their website and fill out the questionnaire. It should only take a couple of minutes if you have your information available. Prosper’s loan application is fast as well. In a couple minutes you will be able to receive personalized loan rates.

Prosper requires you have three open trades on your credit report, and under seven credit inquiries in the past six months or bankruptcies within 12 months. For Prosper your debt-to-income ratio must be less than 50%.

How much can you borrow with each lender?

Best Egg provides loans from $2000 to $35,000 while Prosper allows loans from $2000 to $40,000. If you are looking for a loan on higher range, prosper potentially provides $5000 more. For qualified borrowers, Best Egg offers additional loan amounts up to $50,000.

Availability

Prosper offers services nationwide, while Best Egg doesn’t serve people in VT, WV, or IA. For residents of Nebraska or Alabama applying for Best Egg loans you must be 19.

Support comparison

Prosper and Best Egg both operate within normal business hours and provide email or toll-free calls, as well as social media.

Bottom line

Prosper and Best Egg are both great peer to peer lending companies that can get you the money you need now. Best Egg provides better rates on average than Prosper, but if you qualify well with Prosper your rates may be better. Best Egg has fewer qualifications, basing its rate decisions almost entirely on credit score and income, while Prosper looks at more aspects of your life to make a decision.

Prosper is more often used for life events like marriage, illness, or vacation, while Best Egg is better known for paying off credit cards and for debt consolidation, but both companies can be used for a variety of loan reasons.