The average student loan debt is well over $30,000. It was reported that Americans owe over 1 trillion in student loan debt. Are you drowning in debt? Today, we will be comparing CommonBond vs SoFi to help you to find the right student loan refinancing option for you.

Although the statistics are crazy, you could lower your rates today and get more perks than you are currently getting. In this article, we will compare interest rates, features that these lenders offer, the lender’s reputation, and more.

What is CommonBond?

CommonBond was founded in 2012 by David Klein, Michael Taormina, and Jessup Shean. CommonBond is a marketplace lender that refinances graduate and undergraduate student loans for university graduates. CommonBond also gives out loans. Along with graduate and undergraduate student loans, CommonBond also offers MBA loans. CommonBond has funded over $2 billion in student loans.

What is SoFi?

SoFi is a popular online lender that is headquartered in San Francisco, CA. SoFi was founded in 2011 and has topped CommonBond with over $30 billion in funded loans. Currently, the company has over 500,000 members. Unlike CommonBond, SoFi also offers personal loans, mortgage refinancing, and more.

Student loan refinance companies

When a company offers student loan refinancing that means that they will give you a new loan at a new interest rate. If you are struggling to handle your current payments, then this is a great option. You will be able to refinance both federal and private student loans.

Better Business Bureau comparison

Let’s use BBB to give us a glimpse on how CommonBond and SoFi handle the complaints of their loyal customers. BBB will allow you to know if the lender of choice can be trusted or not. BBB looks at everything when they rate loan servicing companies. They look at if any complaints have been filed, they look at the age of resolved complaints, they look at the time the lender has been in business, and more.

CommonBond received an “A-” rating from BBB which means they scored from 90 to 93.99 out of 100 points.

SoFi received an “A+” rating from BBB which means they scored from 97 to 100.

Student loan refinance rates comparison

Variable rates

Explained – Variable rates are not stable compared to fixed rates. Variable rates are usually more affordable than fixed rates, but they have the ability to go up and down in price due to the trend in the market.

CommonBond

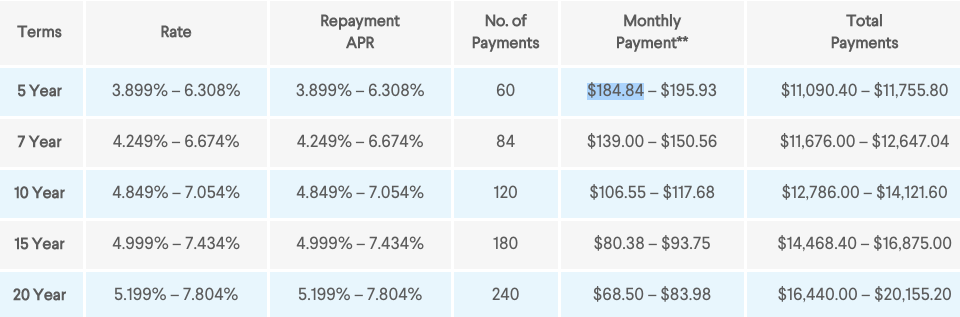

CommonBond has variable rates that range from 2.72% to 7.40% with autopay.

- A 5-year term has a rate of 2.72% to 6.11%.

- A 7-year term ranges from 3.96% to 6.40%.

- A 10-year term ranges from 4.46% to 6.65%.

- A 15-year term ranges from 4.84% to 6.93%.

- A 20-year term ranges from 5.09% to 7.40%.

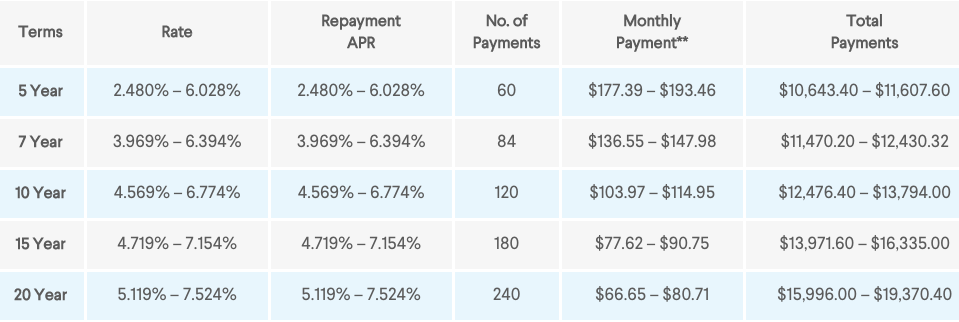

SoFi

SoFi has variable rates that can be as low as 2.480% and as high as 7.804% with autopay. You may be able to get a more affordable variable rate with SoFi, but if you select a longer term option you may pay slightly more.

Fixed rates

Explained – Fixed rates are your standard rates. They are more stable. With fixed rates you know what you will be paying every month.

CommonBond

CommonBond has fixed rates that range from 3.20% to 7.25% depending on your loan term.

SoFi

SoFi has fixed student loan refinancing interest rates that range from 3.899% and as high as 7.804%.

Hybrid rates

CommonBond also offers hybrid rates. Hybrid rates are basically a combo of fixed and variable rates. For example, if you had a 10-year loan then 5 years would be with fixed rates and the other 5 years would be with variable rates.

Loan fees comparison

As I said while showing the differences between SoFi and Earnest, with refinance loans you will not have to worry about any fees. With both lenders you will not have to worry about any origination fees for processing your loan. Nor will you have to worry about prepayment fees. When it comes to late fees, CommonBond has a 10-day grace period while SoFi has a 15-day grace period. CommonBond has a higher late fee. Their late fee is 5% of the unpaid bill. SoFi has a 4% late fee of the bill that is due or $5, whichever is lower.

Features discounts

SoFi features

- Over 200+ events – Events will be free for all SoFi members. You will also be able to bring a guest.

- Member Discount – Get a 0.125% rate discount when you add an additional loan.

- Unemployment protection – If you were to ever lose your job, then SoFi will temporarily pause your loan payments to help you to get back on your feet. The great thing about SoFi is that they will also help you to get a job.

- Exclusive career coaching – This is a $999 value that is available to all SoFi members.

- Multiple loan options to choose from.

- SoFi Money

- Direct Student Loan Consolidation

- No origination fees

- Student loan calculator

CommonBond features

- Up to 24 months of forbearance.

- Hybrid Rates

- No origination fees

- Social Promise – CommonBond partners with Pencils of Promise to fund the education of children.

- Student loan refinancing calculator

- Federal consolidation

- Evaluation Tool

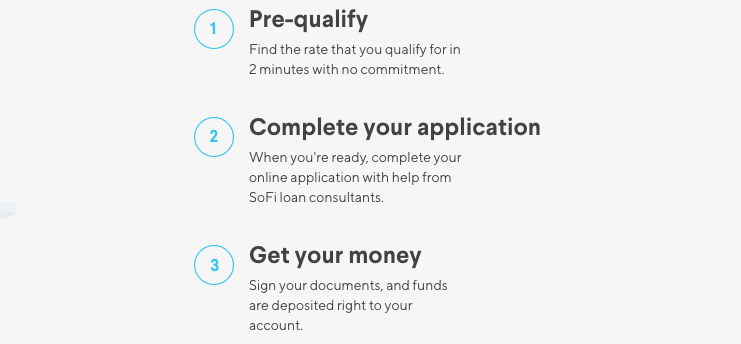

The loan process

Both platforms are easy to use. There are more benefits with going with an online lender besides cheaper rates. One of the benefits of going with an online lender is that you will be able get through the loan application process effortlessly.

SoFi is slightly easier to navigate through, but with both platforms you will be able to finish your loan application in minutes.

How much can I borrow?

CommonBond.co allows you to borrow anywhere from $5,000 to $500,000.

SoFi.com allows you to borrow anywhere from $5000 to as much as your loan requires.

Credit score requirement comparison

CommonBond

CommonBond has a minimum credit score requirement of 660. However, most of the people who use CommonBond have an average credit score that is well over 700.

The credit score requirement for SoFi is slightly lower. SoFi requires you to have at least a 650-credit score. However, most of the people who use SoFi have a credit score above 700.

Funding time comparison

SoFi usually gets your money to you faster than other lenders. SoFi has a funding time of 1 to 7 days after approval.

CommonBond has a funding time of up to 10 days after approval.

Loan term options

The lower your loan term the lower your APR will be.

CommonBond offers 5, 7, 10, 15, and 20-year terms.

SoFi offers 5, 7, 10, 15, and 20-year terms as well.

Support comparison

The CommonBond U.S. based customer phone and live chat support team is available from Monday–Friday, 9AM–6PM EST. CommonBond also offers a FAQ page where you can get common general questions, undergraduate loan questions, graduate loan questions, refinancing loan questions, and more.

SoFi has a phone support team that is available from Monday – Thursday 4:00 AM – 9:00 PM PT and Friday – Sunday 4:00 AM – 5:00 PM PT. SoFi also offers a detailed FAQ page that allows you to know about personal loans, refinancing, member services, wealth management, mobile apps, and more.

Which lender is better?

Both lenders are awesome choices and they both provide competitive loan rates. SoFi will give you more membership benefits, it has a better reputation, faster funding time, and it will be easier for you to get approved with them. CommonBond might give you slightly cheaper rates depending on your loan term. I recommend SoFi because of the added perks, but it all depends on what you are looking for. I encourage you to get rates today.