Are you looking for an online lender that meets your needs? In this article, we will compare LendKey vs SoFi.

Both companies are major players in the online lending world. We will differentiate reputation, loan rates, features, and more to help you making a comfortable choice for your student loans.

What is LendKey?

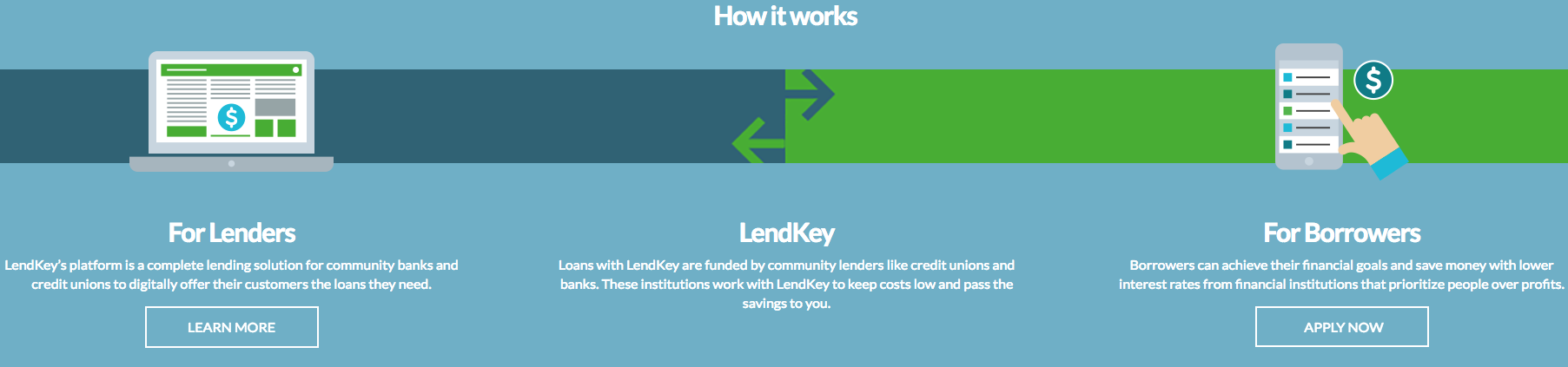

Fynanz was founded in 2009 by Vince Passione and Michael Stallmeyer. In 2013, the company changed their name to LendKey. LendKey.com is an online lending platform that allows you to get private student loans, student loan refinancing, and home improvement loans from credit unions and community banks. This will result in low-rate loans. LendKey partners with a plethora of non-profit credit unions and banks such as Everence, McGraw-Hill Federal Credit Union, Black Hills Federal Credit Union, WSFS Bank, Generations Bank, and more. Currently, the company has serviced over $1.5 billion loans and has over 68,000 customers.

What is SoFi?

SoFi might be the most popular online lending platform in the nation. SoFi was founded in 2011 and today the company has funded over $30 billion in loans and has over 500,000 members. SoFi specializes in student loan refinancing, but they also offer medical resident refinancing, mortgages

mortgage refinancing, personal loans, parent PLUS refinancing, and more.

Comparing the reputation of both lenders.

BBB

I love BBB because they give you an idea of how each lender interacts with their customers. Better Business Bureau will help us to know if we should trust a lender or not. The LendKey and SoFi BBB rating is based on several factors including complaints received from the public, the length of time that the lender has been in business, licensing and government actions, and more.

LendKey Technologies, Inc. has had Better Business Bureau accreditation since September of 2012. LendKey has an “A+” BBB rating.

SoFi has an “A+” BBB grade in the BBB rating system as well. These awesome grades mean that both companies are trusted lending solutions according to BBB.

Trustpilot

With over 1900 reviews SoFi received a 5 out of 5-star excellent Trustpilot rating. SoFi received a TrustScore of 9.2 out of 10. LendKey is not yet rated with Trustpilot.

Student loan refinance rates

LendKey

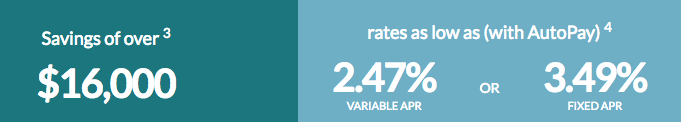

With LendKey you will be able to receive fixed interest rates for as low as 3.49%. Rates can go up to 8.72%. Variable rates can be as low as 2.47% and as high as 7.99%.

- Fixed: 3.49% – 8.72%

- Variable: 2.47% – 7.99%

SoFi

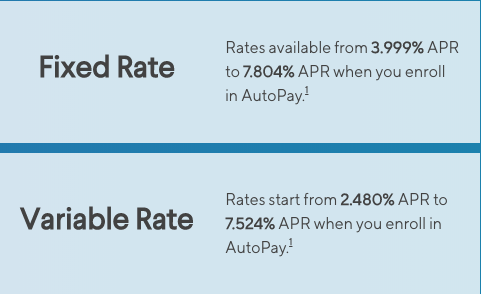

With SoFi you will be able to get fixed rates for as low as 3.99% and as high as 7.80%. If you desire variable rates you will be able to get them for as low as 2.48% and as high as 7.52%.

- Fixed: 3.99% – 7.80% APR

- Variable: 2.48% to 7.52% APR

Differences between fixed and variable rates

Fixed rates are more straightforward compared to variable rates. Many people like fixed rates better because you know your interest rate amount every month. Fixed rates are more predictable.

Variable rates are not as predictable. With variable rates you will be able to get a lower rate. However, depending on the market this could either increase or decrease. You may be able to save a lot if you get variable rates, but there might be a chance that your rates increase.

Bottom line

Both lenders give you low interest rates. LendKey is slightly cheaper, but you may be able to get lower fixed and variable rates with SoFi. LendKey and SoFi both do soft credit checks, so you don’t have to worry about hurting your credit by getting rates.

Fees comparison

One of the ways that LendKey and SoFi differentiate from lending platforms such as Prosper is that you will not have to worry about prepayment fees or application and origination fees.

With LendKey there will be late fees of $5 – $15.

SoFi offers a grace period of 15 days. Their late fee is 4% of the unpaid bill or $5, whichever is lower.

Features and benefits comparison

SoFi benefits

- Fast, easy, and all online

- Additional rate discounts on loans

- Unemployment protection – SoFi understands that life happens, which is why they have unemployment protection for their customers. If you ever lose your job, then SoFi will pause your payments and they will even help you to look for a job.

- No hidden fees

- Exclusive career coaching – Includes career transitions, job search, personal branding, and customized support $1000 value.

- Low rates

- Soft credit check

- cosigner option

- Auto pay rate reduction

LendKey benefits

- Lengthy loan forbearance of up to 18 months.

- Reduce your interest rate

- Network of 300+ credit unions and community banks.

- Refinancing calculator

- No Origination Fees

- Flexible Options

- Soft credit check

- cosigner option

- Auto pay rate reduction

- Student loan calculator

The loan process

LendKey

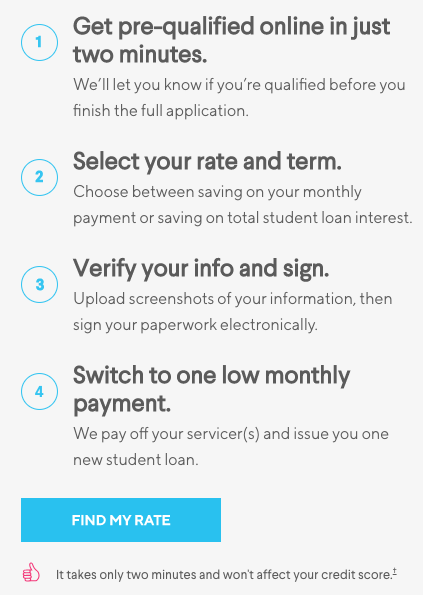

LendKey understands that refinancing and consolidating your federal and private student loans can be an overwhelming process. LendKey helps to get your loan funded by a community lender entirely online. The application process is simple, and you will even have loan specialists to guide you through the entire loan process. You will be able to estimate your rates in 2 steps.

SoFi

SoFi has a desire to help those who are drowning in student loan debts. SoFi refinances your old private and federal loans into a new loan that helps you to save money. All that you have to do is enter basic information such as where you work and you will be able to see how much you can save. The customer care team can be contacted through the chat now button on the lower right-hand side of the screen. You will be able to get rates in two minutes.

Credit score requirement

SoFi

Qualified borrowers with credit scores of at least 650 can be approved for refinancing. The average SoFi borrower has a credit score that exceeds 700. With SoFi you don’t need to have credit history, but you do need to show that you can make payments. The average SoFi borrower makes around $100,000.

LendKey

With LendKey you need a credit score of at least 660. Average LendKey borrowers have a credit score that is around 750. Approved borrowers make around 63K a year on average.

How much can I borrow?

LendKey

The minimum amount that you will be able to borrow from LendKey is $5,000.

You can borrow up to $125,000 for undergraduate degrees. For graduate degrees you will be able to borrow up to $250,000. For medical, dental or veterinary degrees you will be able to borrow up to $300,000.

SoFi

SoFi allows you to borrow anywhere from $5000 up to the full loan balance

Loan term options

There are several loan terms to choose from with both lending platforms.

Both 5, 7, 10, 15 and 20-year loan terms.

Availability comparison

The great thing about SoFi is that it is available in all states. LendKey is available in 46 states and Washington, DC. LendKey is not available in Maine, North Dakota, Nevada, Rhode Island, and West Virginia.

Estimated funding time comparison

On average, both lending platforms will fund your loans within 1 to 7 days of being approved.

Support comparison

LendKey

LendKey offers a blog, a resource center, a FAQ page, and guides to help you to learn more about student loan refinancing. You can contact LendKey by phone from Monday through Friday from 9am to 8pm EST.

SoFi

SoFi is similar to LendKey. They offer blog articles, a FAQ page, and a resource center. SoFi also offers career coaching, community events, and various programs. You can contact their phone support from Monday – Thursday from 4:00 AM – 9:00 PM and Friday – Sunday from 4:00 AM – 5:00 PM PT.

Which lending platform is better?

Both lenders have benefits about them. With LendKey you might be able to get more affordable rates. With SoFi there is a slightly lower credit score requirement, there are more features, and you might be able to get lower rates if you select longer terms. I strongly recommend that you get rates today!