Are you looking for the top online lending platform for personal loans? In this Upstart Vs Lending Club battle, we will be showing the differences between two popular and effective options in the lending community.

I recommend that you get rates to take advantage of affordable interest rates.

What is Upstart?

Upstart is an online lending marketplace that was founded in 2012. Today Upstart is one of the most popular online lenders with over 140,000 borrowers and over $2 billion in loan originations.

What is Lending Club?

Lending Club is a P2P lender similar to Prosper. Peer-to-peer lending enables individuals to borrow from investors. Peer lending is growing in popularity for both borrowers and investors. Lending Club is one of the big players in the P2P lending industry. Currently individuals have borrowed well over $38 billion using LendingClub.com

Reputation comparison

Upstart

Upstart Network is a Better Business Bureau accredited business and has had BBB accreditation since 2015. In the BBB rating overview, Upstart received an “A+” grade. This is the highest possible grade that you can receive from BBB. This means that Upstart scored between 97 to 100 points in the letter rating scale, which is excellent.

Upstart has 650+ Trustpilot reviews and received 5 out of 5 stars. The TrustScore is final customer satisfaction rating from Trustpilot. Upstart received a 9.7 out of 10 TrustScore which is one of the best TrustScores that you are able to receive from Trustpilot.

Both companies have a good reputation and you couldn’t go wrong choosing either one.

LendingClub

Since 2008 LendingClub corporation has been a BBB accredited lender. LendingClub currently has an “A-” BBB rating.

LendingClub has been recognized by some of the top brands in the world such as CNN, The New York Times, The Economist, and INC.

Comparing personal loan rates

Interest rates differ per person depending on a number of factors. Upstart looks beyond your credit score to try to give you a fair rate, but once again all rates differ.

Lending Club offers rates that range from 6.16% – 35.89% APR.

Personal loans with Upstart range anywhere from 7.80% to 29.99% APR.

It’s hard to compete with Lending Club or any peer to peer lender. P2P lenders usually offer interest rates that are lower than the competition. However, there is a chance that Upstart might be a more affordable option for you. Upstart rates can go up to 29.99% while Lending Club rates can go up to 35.89%.

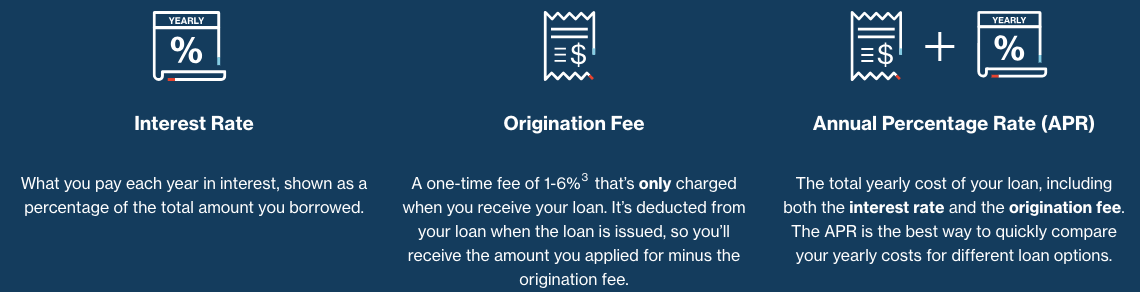

Personal loan fees

Origination fees are fees that cover the cost of entering into a personal loan agreement and processing your personal loan. Most lenders require you to pay an origination fee. You don’t have to worry about paying this fee out of pocket. This fee is going to be taken out of your loan.

Here is an example of an origination fee. Let’s say that you had a $10,000 loan with a 2% origination fee, you would then have $200 taken out of your deposited loan. Instead of $10,000 you would receive $9800.

Upstart has an origination fee that ranges from 0% – 8% of the target amount.

Check rates with Upstart here.

Lending Club has origination fees that range from 1% – 6%.

Check rates with Lending Club here.

Both lenders have a late penalty fee of the greater of 5% of your past due amount or $15.

Another similarity of Upstart and Lending Club is that with both lenders you will not receive a prepayment penalty if you pay your loan off on time.

Features comparison

Upstart benefits

- Your personal loan will be funded in as little as one business day.

- Low credit score requirement

- Soft credit check

- Easy loan process

- State-of-the-art machine learning techniques with thousands of data points.

- No prepayment penalty fee

- Co-signer option

Lending Club benefits

- Low personal loan rates

- Soft credit check

- Co-signer option

- Hardship Plan – If you ever have trouble making payments you will love that Lending Club offers a hardship plan for 3 months. In this time period you will make interest-only payments.

- No prepayment penalty fee

- Low 600 credit score minimum

Credit score requirements

Lending Club

It’s hard to compete with Lending Club when it comes to the minimum credit score required. Lending Club helps those who have fair credit. With Lending Club, you will be eligible for a loan if you have at least a 600-credit score. Most of their borrowers though have a credit score that is around 700. Those who desire to borrow from Lending Club should have at least 3 years of credit history.

Upstart

Upstart is not too far off from Lending Club. With Upstart you will need to have at least a 620-credit score to be eligible for a loan. Also, you should be making at least $12,000 a year.

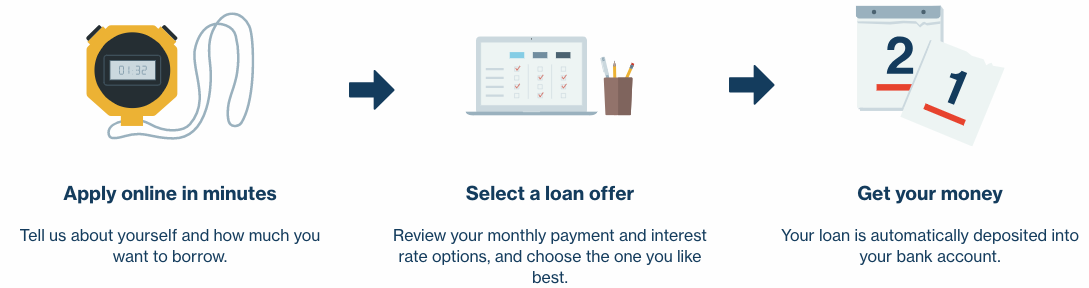

The loan application process

Upstart

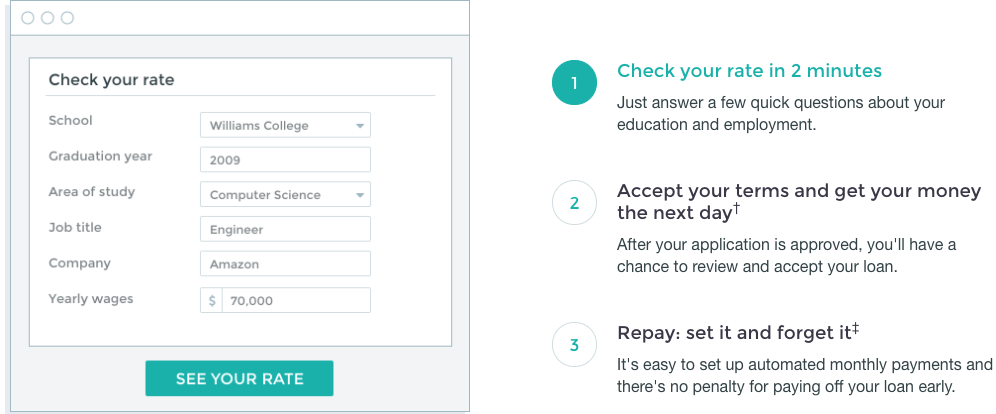

You can check your rate in minutes by adding the amount that you need to borrow, details about who you are, education history, income type, and how much you have saved up. The Upstart application process is one of the most straightforward processes in the loan industry.

Lending Club

With Lending Club, you can easily check your rate by telling them how much you need and what the money will be used for. For example, will it be used for credit card refinancing, home improvement, or business? Similar to Upstart you will add some basic information, then you will create an account and you will be able to see your rates.

Funding time comparison

Funding time is a category that Upstart excels in. Upstart is one of the rare lenders that might fund your loan in as little as one business day after being approved for a loan.

Check rates with Upstart here!

Lending Club offers a quick funding time, but nowhere near as fast as Upstart. Lending Club will fund your loans within 1 to 7 days after being approved for a loan.

Get a loan with Lending Club today!

How much can I borrow for a personal loan?

The great thing about these lenders is that you can borrow a small amount. Most Lenders have a high minimum that you have to borrow. I’ve seen some lenders have a $5000 minimum requirement.

With Upstart and Lending Club there is a minimum borrow amount of $1000 to accommodate you if you want a small personal loan. Upstart allows you to borrow up to $50,000. Lending Club allows you to borrow up to $40,000.

Upstart – $1000 to $50,000

Lending Club – $1000 to $40,000

Loan terms

Both lenders have 3 or 5-year loan term options. The shorter your loan term the more you will be able to save in the long run.

The longer your loan term the more that you will be able to save on your monthly bill, but you will have a higher APR.

Support comparison

Upstart offers a help page to help you to navigate around their platform. You can either enter a question or a topic that you desire to get information for. You can also email the Upstart support team or call them from Monday to Sunday from 6 AM – 5 PM PST.

Lending Club offers a resource center and tons of articles to help borrowers and investors. You can contact their support team from Mon – to Fri from 6am to 5pm PT and Saturday from 8am to 5pm PT.

Which online lender is the better choice?

Upstart and Lending Club have many similarities such as the same loan term options and a fast online application process. Although there are some similarities there are also some differences. Upstart has a faster funding time and Upstart allows you to borrow more.

With Lending Club you may be able to get better rates and there is a lower credit score requirement. Apply and take advantage of affordable rates today. You will be able to get your rates in 2 minutes.