Finding the right personal lender at the right rate can be overwhelming, but it is also rewarding. Today, we will be learning more about both companies with a SoFi vs LendingTree review.

If you are confused about how to use LendingTree I will make it more clear to you in this article.

What is SoFi?

SoFi is an online lender that offers direct loans for student loan refinancing, personal loans, and mortgages. Some of the lowest APR rates and highest loan amounts are offered through SoFi, along with a customer service experience that feels more like being a member of an exclusive club than being a borrower.

These aren’t the easiest unsecured personal loans to get. SoFi requires a good credit score, and is especially concerned with earning potential. Without a reliable income that exceeds your expenses considerably, you are unlikely to receive a loan from SoFi, and if you do, it is unlikely to be among the best rates they offer.

What is LendingTree?

LendingTree does not offer loans itself, but rather connects prospective borrowers with a huge range of lenders and loans to choose from. Simply fill out a form with information like how much you want to borrow and what it is for, and LendingTree will match you with the loan that is right for you.

The idea is that if banks, independent lenders, and credit partners compete for your business, you are more likely to get the best possible loan. This service is free to use for borrowers, who are matched with five loans to choose from. SoFi is included in the banks that you might be matched to by putting in your application with LendingTree.

Reputation comparison

LendingTree has a A- rating on the better business bureau due to a failure to respond to some complaints. SoFi, on the other hand has an A+ rating on BBB. While SoFi has had plenty of complaints, they responded to them.

On Trustpilot SoFi received a five-star rating, with 85% of borrowers giving them an excellent rating, and another 8% offering a great rating.

LendingTree had a rating of five stars as well, but a slightly lower percent of borrowers, 82%, gave them an excellent rating, while 13% of users gave them a great rating.

SoFi is well known for offering incredible support to their borrowers, including career services, member events, and no fees. They go the extra mile for their borrowers, and most borrowers speak highly of this company.

LendingTree, being only a matchmaking service, doesn’t form the kind of relationships with applicants that SoFi does. This said, they do what they promise, matching borrowers with appropriate loans.

Personal loan rates comparison

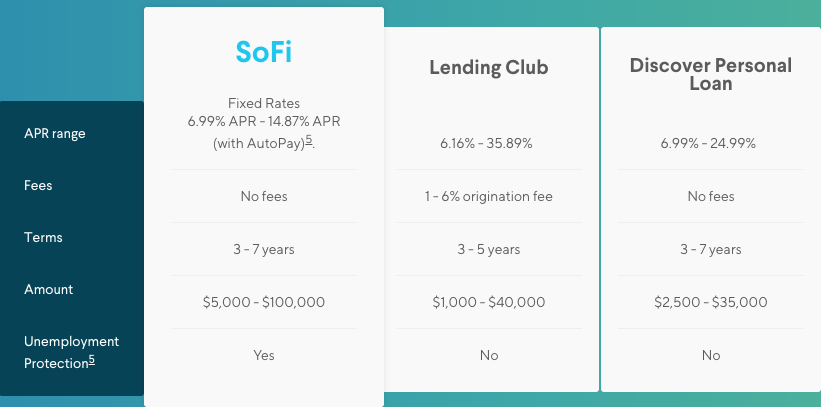

SoFi offers some of the lowest personal loan rates in the business. Even if you are given one of the highest rates they offer, you are still looking at a relatively low rate compared to competition. When we compare the highest SoFi rates and the highest Lending Club rates and rates from other lenders we notice that SoFi usually comes out on top.

LendingTree has starting rates even lower than SoFi for the most highly qualified borrowers. For borrowers who are not so well qualified, rates can go very high.

SoFi rates

You can get a rate as low as 6.99%, but even if you are at the upper scale, at 14.87%, you’ve got a great rate. Rates depend on credit score, of course, but they are also highly dependent on disposable income and job security.

Start SoFi here and receive a $100 bonus.

LendingTree rates

The lowest rates by LendingTree are extremely good, at around 6%. This is one of the best rates you’re going to get in the industry, but your chances of qualifying for that rate are pretty low. Those with the worst credit can get a rate as high as 36% through LendingTree. While this rate isn’t very attractive, if you are having trouble getting an unsecured personal loan, Lending Tree may offer some of the only loans available to you.

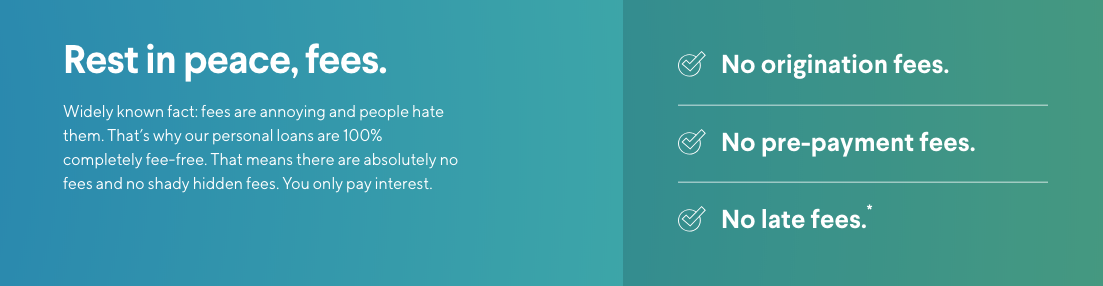

Loan fees comparison

SoFi prides itself on not charging fees to its borrowers, no matter what the loan amount and rate are. There is no origination fee, or prepayment fee. Incredibly, there aren’t even late fees. Neither is there a fee for extending the payment period if you lose your job. You can continue to pay interest without paying on the principle, or even allow interest to accumulate until you can pay it, without suffering fees or penalties.

LendingTree doesn’t charge any fees to match you with loans, or to open loans with a matched company. You won’t be charged anything for rejecting all offered loans either. The lending company you are matched with, however, may charge you origination fees, late fees, prepayment fees, etc.

Comparing the features and benefits of each lender

SoFi benefits

If you can qualify for a loan from SoFi, it is likely to be among the best loans you’ll be offered. With all of the membership benefits, lack of fees, and genuine support offered by this company, combined with some of the lowest rates in the industry and a large range of loan amounts.

- Get $100 by clicking here.

- No fees

- Simple loan process

- Community benefits

- Several loan term benefits

- Unemployment protection

- Discounts

LendingTree benefits

LendingTree benefits are dependent on the lender that you end up choosing. It is difficult to compare the benefits without first knowing the lender.

- Free credit score

- LendingTree works with a truckload of Personal loan lenders.

- Funding time in as little as 24 hours.

- Low borrow amount requirement.

- Soft credit check

Credit score requirements

SoFi requires a high credit score. The minimum score that is acceptable to them is 680, and most borrowers have scores higher than 700.

LendingTree will try to find you a match no matter how low your score is. If your score is exceptionally low or nonexistent, you can also have a cosigner to help you qualify. In general, you need a score of at least 640, but some applicants have scores as high as 750.

Qualifications

To qualify for a SoFi loan, you must be a US citizen or permanent resident. You must be at least 18, or whatever age is the minimum in your state.

If you live in MS, you won’t be able to get a SoFi loan. Minimum loan amounts and terms vary by state.

You must also be employed or have reliable, consistent income from other sources. SoFi will take into account your career experience and financial history, as well as how your monthly income compares to your expenses.

To be considered for a loan from one of LendingTree’s network of lenders, you can have up to 45% debt to income ratio, depending on your income and monthly expenses. LendingTree is offered nationwide, and will offer only loans for which you qualify.

Funding time

SoFi generally gets you your money within a week of being approved, and the approval process rarely takes more than a day.

While you will be matched and prequalified through LendingTree almost instantly, it depends entirely on the individual lender when you will get your funds. If the speed of funding is important to you, make sure to ask lenders what terms are.

Loan terms options

SoFi offers loan term options from three years to seven years. LendingTree’s loan term options vary by lender.

The loan application process comparison

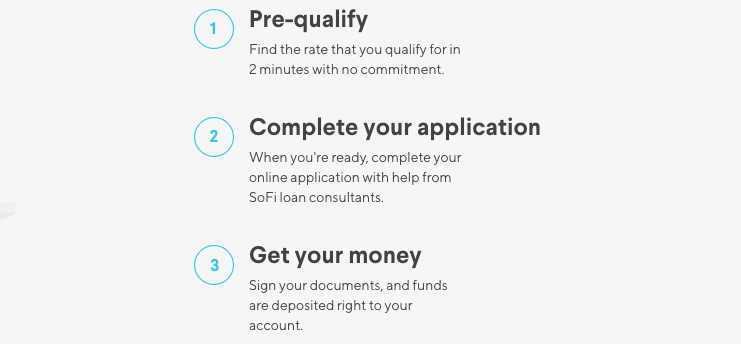

The loan application process offered by SoFi is simple and easy to use. Just fill out your employment and financial history, provide some additional information, and you will usually know within 24 hours whether you are approved.

LendingTree has a very easy and straightforward application process. The more information you provide when you are searching, the better your matches will be. Once you are matched, the continuing application process depends on the individual lender.

How much can you borrow with each lender?

With LendingTree, you can borrow between $1000 and $35,000. SoFi offers higher amounts, from $5000 to $100,000.

Availability

Both companies are available nationwide, with the exception of SoFi, which does not offer loans to residents of MS. Minimum loan amounts and terms vary by state, as does the age required to apply for a loan.

Support comparison

SoFi offers some of the best support in the business. Becoming a member of SoFi’s borrowing club gives you access to a range of career services, member meetups, and other sources of support.

LendingTree makes applying for loans easy, and has a decent customer support team to help with any questions you have along the way. You are unlikely to have questions about the straightforward matchmaking services, and LendingTree will be unable to answer any more specific questions about the loan you are applying for.

Bottom line

SoFi provides top of the line loans to those who qualify. If you have a good credit score, good financial and employment history, and are looking for a higher loan amount, you may decide to skip the matchmaking and go straight to this great lender.

If you are not so sure about your chances of qualifying for a SoFi loan and need money soon, you may be better served by going through LendingTree to quickly find a loan that will work for you.

Click on the link below to receive $100 with SoFi.