With so many mortgage lenders to choose from, finding the right one may seem like a difficult task. Today we will be comparing LendingTree Vs Quicken Loans. In this article, we will learn more about what they are, how they work, what are the rates, and more.

The history of each company

Doug Lebda founded LendingTree in 1996. In 1998 LendingTree.com was officially launched. By 2006 the company reached 20 million customers. Four years later in 2012 LendingTree reached 30 million customers.

Formerly known as Rock Financial, Quicken Loans was founded by Dan Gilbert in 1985. From 2013 to 2017 Quicken Loans closed over $400 billion in loans. The company currently has over 24,000 employees.

What are they?

Quicken Loans is an actual mortgage lender. In fact, Quicken Loans recently surpassed Wells Fargo as the largest mortgage lender in the U.S.

LendingTree acts more as a broker, but it is not mortgage lender such as Quicken Loans. LendingTree helps to connect you with other lenders in your area.

Customer complaint comparison

Let’s find out which company handles customer complaints better using Better Business Bureau. BBB is an organization that helps to improve the trust of consumers and businesses. BBB ratings are based on 13 ratings.

Quicken Loans

Quicken Loans has been recognized as an accredited BBB business since 1986. Quicken Loans received an “A+” rating. Out of 5 stars and almost 3000 customer reviews Quicken Loans received 4.86 stars in the BBB score.

LendingTree

LendingTree, LLC has an “A-” grade in their rating system overview. Out of 5 stars and 200 customer reviews, LendingTree received a composite score of 3.96 stars.

How does Quicken Loans work?

Quicken Loans offers an easy loan approval process. The awesome thing about Quicken Loans is Rocket Mortgage. Rocket Mortgage is a mortgage product of Quicken Loans. It is basically the online experience of Quicken Loans. With Rocket Mortgage the loan verification process is done seamlessly online. No longer will you have to wait to talk to a loan officer. Instead of sending in your banking information, you can digitally submit your documents such as your pay stubs online. Rocket Mortgage increases the accuracy of the mortgage loan process which increases the speed of the process.

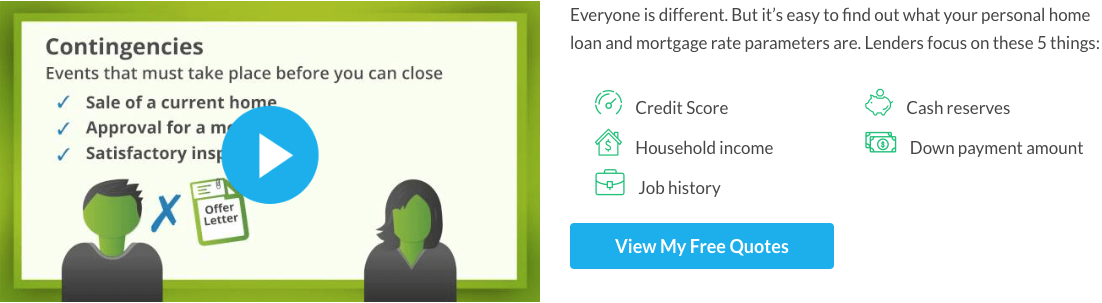

How does LendingTree work?

LendingTree will connect you to mortgage lenders around the nation that fits your needs. LendingTree offers various different loan types, home equity loans, and more. You are free to negotiate directly with the lenders instead of accepting offers. The loan approval process is longer than that of Quicken Loans, but you may be able to get good rates.

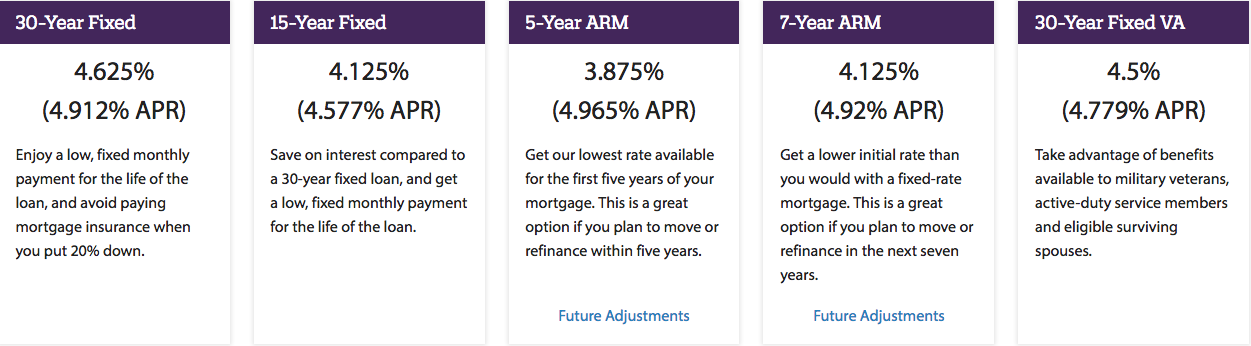

Mortgage Rate comparison

Quicken Loans is an online lender and they don’t have the same expenses as other companies. This is what makes Quicken Loans slightly more affordable than other lenders.

Once again, LendingTree acts as a broker. Rates are not definite, you could end up paying more or less.

Rates are never the same and rates are changing daily. Mortgage rates are dependent on a number of factors. Lenders factor in your credit scores, the amount of the home that you want to purchase, the type of home that you are buying, loan terms, the location of your home, and more. To get the most accurate rates, compare rates today which can be done in seconds.

J.D. Power

In the 2018 J.D. Power Primary Mortgage Servicer Satisfaction Study, Quicken Loans was the award recipient. Quicken Loans was one out of three mortgage lenders to receive 5 out of 5 Power Circles. Quicken Loans was the highest rated mortgage lender for 5 consecutive years. On a 1000-point scale Quicken Loans received 857 points. The next two closest companies were TD Bank and Huntington National Bank. TD Bank received 821 points and Huntington National Bank received 819 points. The Lowest lender on the list was Ocwen Loan Servicing with 667. In the J.D. Power Origination Satisfaction Study there were two award recipients. One of the lenders was Guild Mortgage Company. The other award recipient was Quicken Loans. Quicken Loans received 5 out of 5 stars in every category except for onboarding and problem resolution. In both categories Quicken Loans received 4 out of 5 stars.

LendingTree was not included in any J.D. Power Study because they are not a traditional lender.

Features of each company

LendingTree features that you will love

- LendingTree has a network of over 1500 mortgage lenders.

- Wide variety of interest rates.

- Home Equity Checkup

- Free credit score

- Fast online process

- Simple form

- Alerts on better mortgage deals.

Quicken Loans features that you will love

- Fast online approvals

- YOURgage allows for fixed-rate terms ranging from 8 to 30 years.

- Access to MyQL

- No prepayment penalties.

- Expert online lone support

- You will be able to lock interest rates for up to 3 months.

- Online refinance tools

- Import your assets

Loan options that both companies offer

- Adjustable Rate Mortgage for 5, 7, or 10 years.

- FHA Loan

- 30-Year Fixed Mortgage rates

- 15-Year Fixed Mortgage rates

- VA Loan

- Jumbo Loans

- Reverse Mortgage

Customer support comparison

LendingTree customer care is open from Monday-Thursday 8am – 9pm EST, Friday from 8am – 8pm EST, and Saturday 10am – 7pm EST. To get general information, get answers to technical questions, and more you can submit a ticket on their contact us page.

Quicken Loans allows you to chat with experts through their live chat system and through phone support. Their phone support is available Monday through Friday from:

Monday – Friday, 9:00 a.m. – 10:00 p.m.

Saturday, 9:00 a.m. – 8:00 p.m.

Sunday, 10:00 a.m. – 7:00 p.m.

Another great thing about Quicken Loans is that they offer a Zing Blog which helps you to learn more about mortgage basics, refinancing, home buying/selling tips, and more.

Bottom Line

LendingTree is not a typical mortgage lender. With LendingTree you will have various purchasing and refinancing options from other lenders. Quicken Loans is an actual mortgage lender. With Quicken Loans rates are more straightforward. All lenders have their pros and cons. To get the rates that best fits your budget I encourage to compare rates today.