Let’s compare two well-known mortgage lenders. In this Amerisave Vs Quicken Loans article, we will compare mortgage rates, customer service, the loan process, the features of each lender, and more.

I strongly recommend that you compare rates today to get the best prices.

History of both mortgage lenders

Amerisave Mortgage Corporation was founded in 2002. The company is headquartered in Atlanta Georgia. The mission of Amerisave is to provide their customers with beneficial responsible home lending solutions.

Quicken Loans is the older of the two and was founded in 1985. Their mission is to provide you with an excellent mortgage experience.

BBB rating comparison

BBB factors in things such as the number of complaints filed, the size of business, the length of time the business has been operating, long standing unresolved complaints, and more. Amerisave is currently not rated in the Better Business Bureau rating system. However, Quicken Loans has been a Better Business Bureau accredited business for over 10 years. The company has an “A+” rating, which means on a 100-point scoring scale Quicken Loans received a 97-100 grade. These positive signs reveal that Quicken Loans is a trustworthy company and they will provide a great experience for their customers.

J.D. Power comparison

Quicken Loans was one out of three mortgage lenders to receive 5 out of 5 stars in the 2018 J.D. Power U.S. Primary Mortgage Servicer Satisfaction Study. Quicken Loans rated higher than SunTrust, Regions, Capital One, Bank of America, Wells Fargo, Fifth Third Mortgage, and more.

Quicken loans was the top lender in the J.D. Power Primary Mortgage Origination Satisfaction Study. In the study, Quicken Loans rated higher than LoanDepot, PNC Mortgage, Flagstar Bank, and more. Amerisave was not included in either J.D. Power Study.

Today’s mortgage rate comparison

Amerisave is slightly cheaper than Quicken Loans. However, always remember that rates differ per person. A major factor that affects mortgage rates is the current housing market. The housing market trend can cause mortgage rates to go up and down. Your credit score is another factor that is used to determine how much you will be paying for your mortgage. With bad credit expect to pay a higher interest rate compared to someone with good credit. Another factor that plays a role in how much you will pay is your down payment amount.

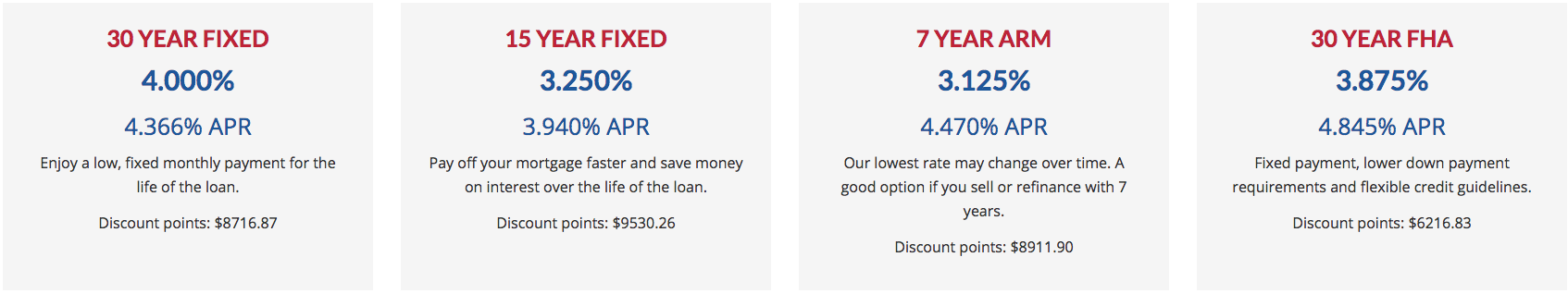

Amerisave mortgage rate

As you can see, Amerisave offers cheaper fixed rates and a lower APR than Quicken Loans.

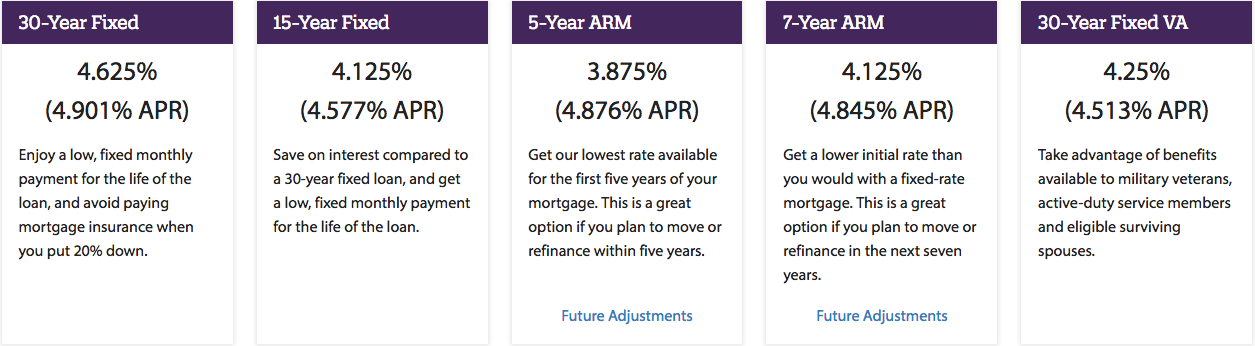

Quicken Loans mortgage rate

Once again, rates differ per person. To get the best rates make sure that you take a few seconds to get mortgage quotes.

Loan options comparison

Amerisave

Amerisave offers various loan options such as fixed rate loans, adjustable rate loans for those who might refinance in a few years, and cash out refinances. Amerisave also offers FHA loans, jumbo loans, HARP loans, VA loans, and USDA loans.

Quicken Loans

Similar to Amerisave Quicken Loans offers Adjustable Rate Mortgage, FHA loans, VA loans, and jumbo loans. Quicken Loans also offers YOURgage. This feature allows you to choose your desired term from 8 to 30 years. YOURgage will help you to find a rate that best fits your budget and your future mortgage plans. Homeowners who are 62 years and older can take advantage of reverse mortgage. Reverse mortgage allows older homeowners to meet their financial goals by using their home equity. You can also choose an FHA Streamline which helps you to receive a lower interest rate.

Mortgage lender feature comparison

Amerisave features that you will love.

- AmeriSave Advantage program – You will be able to earn up to $6500 cash back after closing.

- Low down payment options available.

- Charts – Get mortgage interest rate trends.

Quicken Loans features that you will love.

- RateShield Approval – Even if rates go up your mortgage rates will always remain the same.

- Rocket Mortgage – Customers will be able to get approved faster than ever before.

- 24-hour approval letter.

Loan process comparison

Quicken Loans

Both companies allow for a faster loan process than other lenders. However, Quicken Loans is slightly faster. What differentiates Quicken Loans from other lenders is that with Quicken Loans you have Rocket Mortgage.

Rocket Mortgage makes the online mortgage application process faster. With Rocket Mortgage you can apply for a loan while at home, in line, traveling, without ever having to speak to a loan officer and sending in documents. Rocket Mortgage allows you to digitally send financial paperwork which means more accuracy and faster approval times. With Rocket Mortgage you will be able to get a loan approval in just a few days and sometimes even in minutes. Although Rocket Mortgage is the online experience of Quicken Loans you will have no problem with speaking with loans experts if needed.

Amerisave

With Amerisave you can search their low rates. You can get a custom rate in seconds. After you select from a variety of loan options, you can apply online or call a licensed loan originator. You will then close your loan. After underwriting, Amerisave will schedule for closing.

Customer support comparison

Amerisave

Amerisave has a huge knowledgebase where you can view their frequently asked questions. They have a first-time buyers guide, education articles, refinance videos, mortgage news, and more.

Customer service is available from Monday through Friday from 8:00 AM to 5:00 PM Eastern time.

Quicken Loans

Quicken Loans offers a home buyer’s guide that helps you with preparing to purchase a home, making an offer, working with an agent, getting approved, and more. Quicken Loans also offers refinance guides to help you to better understand the process of refinancing your home. Quicken Loans offer text and email updates to help you to stay up to date with rates, mortgage news, home tips, and more. You will also be able to learn more with their Zing blog.

Chat times:

Monday – Friday, 7:00 a.m. – 12:00 midnight

Saturday – Sunday, 9:00 a.m. – 12:00 midnight

Call times:

Monday – Friday, 9:00 a.m. – 10:00 p.m. ET

Saturday, 9:00 a.m. – 8:00 p.m. ET

Sunday, 10:00 a.m. – 7:00 p.m. ET

Bottom line

This is a close comparison. Amerisave is slightly more affordable on average, but Quicken Loans has better ratings. Both lenders have their advantages and they both have a fast loan process. I encourage you to get rates today which takes seconds to see which company gives you better rates.