Mortgage loans can get extremely expensive especially if you have bad credit or if you are a first-time buyer. In this article, we will help you to find the best mortgage lenders in Florida.

Whether you live in Jacksonville, Tampa, Palm Beach, Cape Coral-Fort Myers, Port St. Lucie, Miami, or Tallahassee, always remember that rates will vary per person. Make sure that you compare rate quotes today to see how much you will end up paying for your mortgage rates.

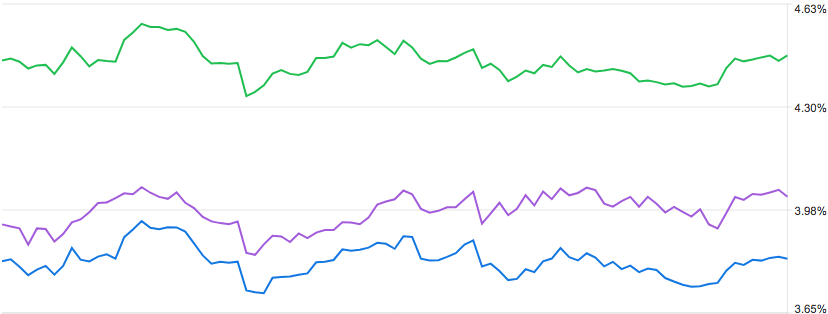

Average mortgage rates in Florida

Mortgage rates are always changing daily and depending on the lender your rate and APR might be more or less than the national average. Rates are not only dependent on the market. Rates are also dependent on a person’s credit score, home loan, home price, and more. The best way to check rates is to compare mortgage rates, which can be done in seconds.

Current mortgage interest rates in Florida

As I said above, mortgage and interest vary per person. With a 30-Year fixed rate you will currently receive an APR of around 4.5%.

With a 15-Year fixed rate you will currently receive an APR of around 3.96 %. This is assuming that you have 20% of down payment and a credit score above 700.

Florida mortgage lenders for bad credit

If you have bad credit, then getting mortgage at decent rates may be a difficult. However, there are several things that you can do such as getting FHA approval, getting adjustable rate mortgage, or finding a private lender. There are many companies in Florida that can help you with purchasing your home such as EquityMax and Third Federal Savings & Loan.

Mortgage Lenders in Miami

Miami is the largest city in Florida with a population of over 5 million people. Miami is known as one of the hardest places to get a mortgage loan. In 2015 it was reported that lenders denied over 15% of all applicants in the Miami-Fort Lauderdale area. Getting in touch with a broker is a good option for many people who desire a home loan. Some well-known names in the area are Alex Doce, Expert Mortgage Group, Luis Moreno, and Homebridge Financial Services.

Most expensive real estate markets in Florida.

- Doral

- Palmetto Bay

- Parkland

- Fort Lauderdale

- Delray Beach

- Weston

- Boca Raton

- Ponte Vedra/Ponte Vedra Beach

- Cooper City

- Naples

Quicken Loans

Quicken Loans is not only one of the most popular Florida mortgage lenders, but it also the largest lender in the United States. There are many things to love about Quicken Loans. One of the things that you will appreciate especially if this is your first-time buying a home is their fast application process.

With Rocket Mortgage your loan can be approved in minutes. Instead of having to talk to someone or send in sensitive information, you can do everything online. You can send in your financial information digitally and they will crunch the numbers for you, which results in more accuracy. Quicken Loans received an “A+” BBB rating and was the highest rated company in the 2018 U.S. Primary Mortgage Servicer Satisfaction Study. Quicken Loans beat out mortgage companies such as Ocwen Loan Servicing, Freedom Mortgage, Wells Fargo Home Mortgage, PNC Mortgage, and more.

SunTrust Bank

SunTrust has had BBB accreditation since 01/01/1967. In the rating system overview SunTrust received an “A+” rating.

SunTrust Bank is good mortgage lender for those who desire low down payments and helpful tools to help the loan process to go smoothly. SunTrust is a trusted company throughout the nation with great mortgage reviews across the board. In the J.D. Power U.S. Home Equity Line of Credit (HELOC) Satisfaction Study SunTrust was the highest rated company receiving 5 out of 5 stars in every category. SunTrust was the only company to receive 5 out of 5 power circles. SunTrust beat out companies such as BB&T, Huntington National Bank, Regions Bank, and more.

Caliber Home Loans, Inc. has been a BBB accredited company since 2004. The company has an “A+” rating, which means that they handle customer complaints well. Although Caliber Home Loans, Inc. is a Texas-based home mortgage provider, they are well-known in Florida and they have offices in Plantation, Boca Raton, Orlando, Miami, and other Florida cities. Caliber rated about average with 3 out of 5 stars in the U.S. Primary Mortgage Servicer Satisfaction Study. Caliber Home Loans offers various conventional loan products such as relief refinance, homestyle renovation, HomeReady, DU Refi Plus, Jumbo Loans, and Jumbo Interest-only ARM.

LoanDepot

LoanDepot offers cheaper rates than some of the largest lenders. There are many benefits of LoanDepot such as you will have over 1700 loan officers available to you. LoanDepot offers an awesome lifetime guarantee to their customers. When you refinance you will not have to pay any lender fees. Another benefit that you will have with LoanDepot is that they partner with 5 of the nation’s top 25 builders. If you live in Florida, you can easily find a branch near you. No matter what state that you live in you will have no problem with using them in your state.

Bank of America

Everyone knows Bank of America. Bank of America Corp. is the second largest bank in America and has over 2 trillion in total assets. Bank of America received 3 out of 5 Power Circles in all three J.D. Power mortgage studies.

With Bank of America you are getting a reputable company that is available everywhere. BOA offers fixed-rate mortgage, FHA loans, VA loans, and more. If you can’t make a large down payment, then one of the best things about BOA is that they offer Affordable Loan Solution. Mortgage insurance is not required with Affordable Loan Solution.

Lenda

Lenda is a great lender if you need refinancing. Lenda is an online mortgage lender that started off as a refinance option. Now the company offers affordable mortgage loans as well. There are many benefits to using Lenda such as an interactive loan dashboard, rate lock guarantees, fast turnaround times, paperless process, and more. For now, Lenda only serves residents in Florida, California, Arizona, Texas, Virginia, Georgia, Illinois, Michigan, Colorado, Oregon, Pennsylvania, and Washington.

LendingHome Funding Corporation

LendingHome Funding Corporation is a lender with a great reputation among Florida residents. Currently the company has over 2+ billion in loans funded and 10,000+ homes financed. The process to get a home mortgage is simple. All that you have to do is get your rate, get pre-approved, and then upload property information. You will then pay for your appraisal and confirm your close date. Lending Home received an “A+” BBB grade.

New American Funding

If you have less than perfect credit or you are worried about making too low of an income, then New American Funding is a great option for you. New American Funding offers various loan types such as fixed rates, VA, FHA, ARM, Jumbo, Home Improvement, Reverse Mortgage, HARP, Interest Only loans. The company has over $20 billion in home loans and an “A+” Better Business Bureau rating. The average closing time for New American Funding loans is under a month.

Home1st Lending

Home1st Lending is a popular lender in Central Florida cities such as Lake Mary, FL. Home1st Lending might not be the easiest lender to apply for, but they do offer several tools to help you and a free consultation. Home1st Lending has had a BBB rating of “A+” since 2007.