Finding the best lender at a good mortgage rate may seem like a difficult task, but we will help you. Today we will be comparing Loan Depot Vs Quicken Loans, which are two large companies.

We will be taking a look at mortgage rates, the loan process, features, and more.

A little history about each company.

Rock Financial was founded by Dan Gilbert, Gary Gilbert, and Lindsay Gross in 1985. Two years later the name was later changed to Rock Financial Corp. In 1999 Rock Financial Corp. was later purchased for $532M by Intuit Inc. In 2002, the company would later receive another name change to Quicken Loans.

LoanDepot was founded in 2010 by Anthony Hsieh. LoanDepot is based in Foothill Ranch, California. Today the company has over 4,000 employees. Since its launch, LoanDepot has received over $100 billion in funding.

Who is the top mortgage lender?

Quicken Loans is the largest mortgage lender in the nation with over a $90 billion total origination volume. Loan depot is the 6th largest mortgage lender in the nation with over a $35 billion total origination volume.

Mortgage rates comparison

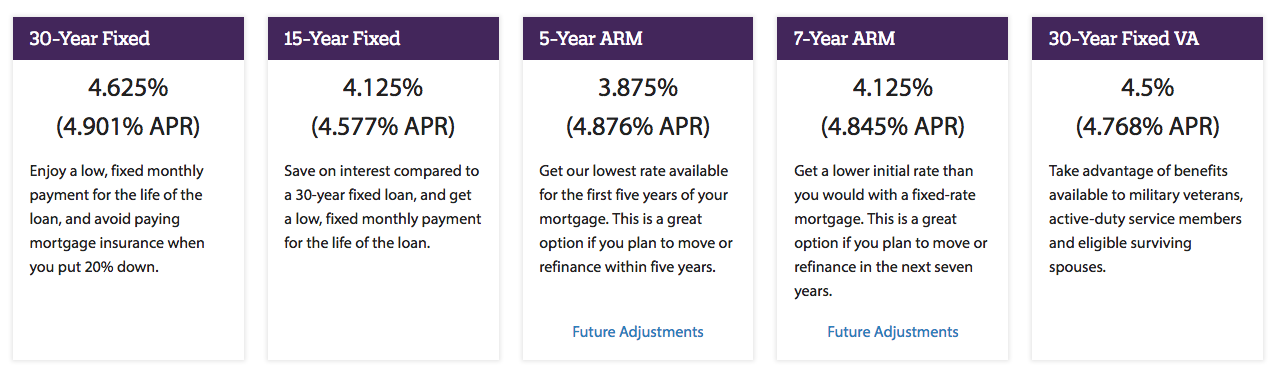

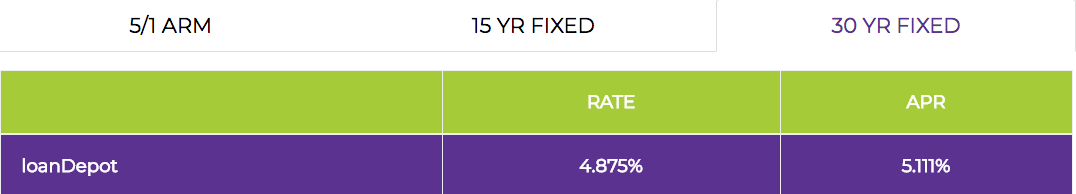

Whether you need 15-year fixed rates or 30-year fixed rates, Quicken is going to be the cheaper mortgage lender with less interest. Here are two screenshots of the APR and rates of both companies.

Quicken Loans mortgage rate

LoanDepot’s mortgage rate

However, we must always remember that mortgages rates are always changing. Today’s current rate is not going to be the rate in the future. There are many factors that go into determining your mortgage rate such as your credit score, which is huge. Mortgage companies also look at the down payment amount, the current state of the economy, home location, and more. The only way to see how much you will pay is to get a quote.

U.S. Primary Mortgage Servicer Satisfaction Study

In the 2017 Mortgage Servicer Satisfaction Study by J.D. Power, Quicken Loans, Inc. was the highest rated mortgage lender on the list with 5 out of 5 Power Circles in Overall Satisfaction. In fact, the company received 5 out of 5 power circles in new customer orientation, billing and payment, mortgage fees, communications, and more. Quicken Loans, USAA Federal Savings Bank, and Navy FCU were the only companies to receive 5 out of 5 power circles in overall satisfaction. LoanDepot was not included in this study.

In the 2017 U.S. Primary Mortgage Origination Satisfaction Study, which was another study done by J.D. Power, Quicken Loans and Guild Mortgage company were both award recipients with 5 out of 5 Power Circles. Quicken Loans received 5 out of 5 Power Circles in loan offerings, approval process, interaction, and loan closing. However, in onboarding and problem resolution Quicken received 4 out of 5 Power Circles.

LoanDepot was included in this review and received 3 out of 5 Power Circles, which puts them in the middle of the pack. LoanDepot received 3 out of 5 Power Circles in every category of this study.

The loan process comparison

The Quicken Loans loan process

Quicken Loans makes getting approved easier with Rocket Loans. Rocket Mortgage is the full online version of Quicken Loans. What Rocket Loans does is allow you to easily share your financial information digitally. They crunch the numbers for you so you don’t have to waste time and send in your information and talk to a loan officer. This significantly reduces the time that it takes to get approved. Closing a loan take longer than a month, but with Rocket Mortgage you will be able to close a loan in under a week. Some people are able to get approved in under 8 minutes. Make sure that you take a few seconds to get a quote today.

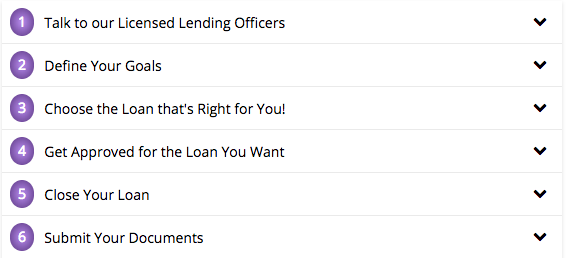

LoanDepot loan process

Purchasing a home with LoanDepot is easy, but it is not as easy as it is with Quicken Loans. With LoanDepot you will be able to talk with 1700+ licensed lending officers. You will then choose a home loan. Once your loan is approved you will submit documents.

Mortgage loan options

LoanDepot

LoanDepot offers fixed-rated mortgage, which is usually easier to qualify for. They also offer Jumbo loans, Va loans, FHA loans, Harp loans, and ARM loans for lower monthly payments.

Quicken Loans

With Quicken Loans you can apply for adjustable rate mortgage. This helps you to receive lower payments and a lower interest rate for your first 5,7, or 10 years. Quicken Loans also offers FHA Loans, 30-Year fixed mortgage, 15-year fixed mortgage, FHA loan, jumbo loans, FHA Streamline, Reverse Mortgage, and YOURgage. With YOURgage you can easily find something that fits your budget by choosing a custom term with a fixed interest rate from 8 to 29 years.

Discounts and features comparison

LoanDepot features

- LoanDepot lifetime guarantee – Never pay lender fees again when you refinance with LoanDepot. You will also receive appraisal reimbursement.

- Find an Expert

- Partners with 5 of the nation’s top 25 builders.

- Diverse product offerings.

- Personal Loans

Quicken Loans features

- Rocket Mortgage – Get approved faster than usual.

- RateShield – With this feature you will be able to lock your interest rate for up to 90 days.

- Verified Approval Letter – Your approval letter will be granted within 24 hours.

- Exclusive rate reduction

- Upload and electronically sign documents

- 24/7 Security Monitoring

- Home Loan Expert

Customer complaints

Better Business Bureau will allow you to know how Quicken Loans and LoanDepot handles the complaints of their customers. BBB looks into factors such as transparent business practices, time in business, failure to honor commitments to BBB, complaint history, and more.

Quicken Loans has had BBB accreditation since 02/20/1986. Currently they have a Better Business Bureau “A+” rating. They have a composite score of 4.85 out of 4 stars based on 2000+ customer reviews and a BBB rating of “A+.”

LoanDepot received BBB accreditation in 2014. LoanDepot has an “A” rating from BBB. In the composite score, LoanDepot received 4.36 out of 5 stars.

Customer Service comparison

LoanDepot

Their phone chat is available from:

Monday – Friday: 5:00am – 7:00pm (PST)

Saturday: 8:00am – 3:00pm (PST)

Quicken Loans

Quicken loans live chat is available from:

- Monday – Friday, 7:00 a.m. – 12:00 midnight ET

- Saturday – Sunday, 9:00 a.m. – 12:00 midnight ET

Phone support is available from:

Monday – Friday, 9:00 a.m. – 10:00 p.m. ET

Saturday, 9:00 a.m. – 8:00 p.m. ET

Sunday, 10:00 a.m. – 7:00 p.m. ET

Which company is better?

Both companies have perks about them. However, Quicken Loans offers lower rates with a faster approval time on average. Also, Quicken Loans was rated higher by J.D. Power. I encourage you to compare mortgage rates today which can be in seconds.