It was reported that the average student in 2016 had a student loan debt of over $30,000. Being in debt can seem like a nightmare.

Here is a SoFi student loan refinance review to help you to shed some weight off you debt and receive lower monthly payments.

What is SoFi?

Social Finance Inc. also known as SoFi is currently the most popular and highest rated online lending platform in the U.S. SoFi was founded in 2011 by four students, Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady. In only a few short years SoFi became the leading student loan refinancing provider. The company has over $18 billion in refinanced student loans and over 250,000 members. Although SoFi specializes in student loans, SoFi also offers personal loans, medical resident refinancing, mortgage refinancing, parent PLUS refinancing, and more.

Benefits of refinancing student loans

Refinancing your loan is a great way to reduce your interest rates especially now that you have a better credit score and longer credit history. Do you need breathing room with your finances? Refinancing your loan can result in major monthly savings. You could end up saving $10,000+. Another benefit is that you will be able to release a cosigner from your loan if you have one. Also, if you don’t appreciate your current repayment term, then you will be able to change your loan term to a loan term that best fits your needs.

Is SoFi legit?

BBB

Better Business helps us to know the legitimacy of a business. With BBB we will know if SoFi can be trusted or not.

Sofi currently has an “A+” rating in the BBB rating system overview. BBB allows us to know that SoFi is a trustworthy lender. SoFi has maintained a positive track record, they have advertised honestly, they honestly represent products and service, they honor their promises, and they protect the data of their members.

Trustpilot

SoFi has 1900+ reviews on Trustpilot. SoFi currently has a TrustScore of 9.1 out of 10.

Bottom line

Whether you check BBB, Trustpilot, Reddit, etc. you will see that SoFi has great reviews across the boards. You don’t become the top student refinancing platform by chance. SoFi has a great reputation among their customers with a 98% recommendation rate.

SoFi student loan rates

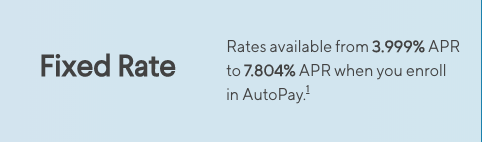

Fixed Rates

A fixed interest rate remains the same. With fixed rates you know what you will be paying every month. If you want your rates to be predicable, then fixed rates are a great option.

SoFi fixed rates range from 3.99% APR to 7.80% APR.

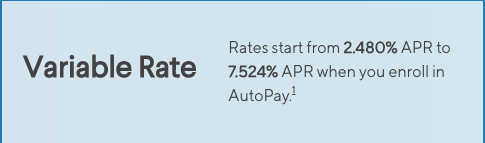

Variable rates

Variable interests rates are lower than fixed rates. However, they are less predictable. Variable rates have the potential to fluctuate. Your rate may change without notice. You might end up paying less or you might end up paying more than your initial rate.

SoFi variable rates range from 2.48% APR to 7.52% APR.

Bottom

With SoFi if you turn on AutoPay, then you can get very low rates. SoFi offers competitive rates compared to other lenders such as Earnest. If you desire to save, then SoFi is a wonderful option. Click the link below to get $100.

No more loan fees

Depending on the company that you choose it may be hard for you to run away from fees. Origination fees can end up costing you hundreds or thousands of dollars. However, one of the benefits of SoFi is that you will not have to worry about any fees. There are no origination fees, pre-payment fees, or late fees. However, if you don’t pay your loan within 15-days of the due date, then you will be charged $5.

SoFi member benefits and features

- Click this link to get $100 with SoFi.

- Unemployment Protection Program – Always make sure that the lender that you refinance with has forbearance. With SoFi’s unemployment program if you were to ever lose your job, then SoFi will pause your loan payments. This is great to assist you in getting back on your feet. Another benefit of their Unemployment Protection Program is that they will help you to find another job.

- Competitive rates

- No hidden fees

- Simple online application

- Additional discount – You will get a 0.125% rate discount when you get additional SoFi loans.

- Borrowers will get access to licensed financial advisors.

- Exclusive community events – You will be able to make new relationships, get financial advice, grow your career, and more.

- Exclusive career coaching

- SoFi Entrepreneur Program

- Wealth Management

- Student loan calculator

- Soft credit check

- co-signer option

- SoFi will consolidate and refinance both federal and private student loans.

SoFi minimum credit score

Borrowers who are applying for student loan refinancing are required to have at least a 650 credit score. An average SoFi borrowers has a credit score of 700. SoFi does well in this category compared to other lenders. For example, in the SoFi vs CommonBond comparison we learned that CommonBond requires you to have at least a 660 credit score.

How much can I borrow from SoFi?

The lowest amount that you can get a loan for with SoFi is $5000. SoFi will refinance your loan up to the full balance.

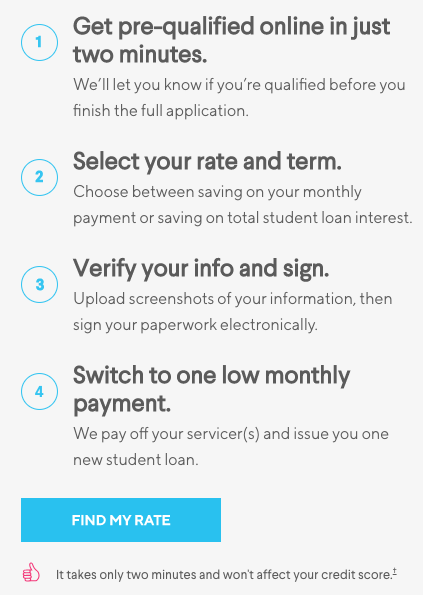

How does SoFi Work?

Getting a loan with SoFi is fast and easy. The entire loan process is online. If you need any help you will be able to chat with a loan expert while you are completing your loan application. You will be able to get rates in 2 minutes.

Apply to SoFi here and receive $100.

Estimated funding time comparison

If we’re honest, once we are approved we always want our loan to be funded immediately. SoFi is not like other lenders where you have to wait a long time to receive your loan. After approval, SoFi loans will be funded within 1 to 7 days.

Loan term options

SoFi has more loan terms than most lending platforms. With SoFi you will be able to get loan terms of 5-years, 7-years, 10-years, 15-years, and 20-years.

How does SoFi compare?

SoFi is our highest rated lender. We compared SoFi to some of the top lenders in the nation such as Upstart, Prosper, Best Egg, Lending Club and more. In each battle SoF had far more benefits and features than the competition.

SoFi mobile app

SoFi has one of the best apps in the online lending industry. The SoFi app allows for Face ID and fingerprint scanning, viewing and making payments, managing your wealth account, connecting with other SoFi members, and more.

Availability

One of the benefits of choosing an online lender is that you will usually be able to use them anywhere. SoFi is available in all states including Washington D.C

Customer support

SoFi offers a FAQ page that has many common questions that you may be asking yourself. On top of a FAQ page you will receive Twitter support and customer support from Monday – Thursday from 4:00 AM – 9:00 PM and Friday to Sunday from 4:00 AM – 5:00 PM.

Is SoFi worth it?

Yes, I believe SoFi is the future of student loan refinancing. If you need a platform that is member-friendly, has multiple repayment options, and offers competitive rates, then SoFi is your best bet. I encourage you to get rates today. Receive a $100 cash bonus by clicking the link below.