Let’s compare Personal Capital vs Betterment. It is amazing how quickly your personal finances can get away from you. Even budgeting for normal life expenses with only a few accounts can be challenging, but if you have multiple accounts and are managing investments, retirements savings, and life event savings all at once, it can quickly get confusing.

Personal Capital and Betterment are great robo-advisors. Both platforms allow you to organize your accounts all in one place, and offer tools to help you understand and plan better. Information is continually updated automatically so that you can always see all of your financial accounts accurately at a glance.

Both of these robo-advisors also offer investment opportunities and help you to make good investment decisions using bot technology as well as real live human advisors.

What Is Personal Capital?

Personal Capital works by letting you see and organize all of your financial information in one cloud, so that you can track progress towards financial goals more easily. The founders wanted to blend technology with good, objective financial advice, so as to give individuals power over their own money. A range of tools are offered to help users see and understand their accounts.

Personal Capital was founded by four men including Bill Harris and Rob Foregger, in 2009. Over $1.5 billion is managed under Personal Capital, by investors using free financial tools.

Click here to start Personal Capital.

What is Betterment?

Betterment is one year younger than Personal Capital and was begun in 2008, by a Columbia Business School MBA graduate named Jon Stein, and a lawyer from NYU School of Law named Eli Broverman. A Google software engineer named Sean Owen was Stein’s roommate, and built the first online platform for Betterment.

The idea behind Betterment.com was that Broverman and Stein would offer online financial advice, as well as acting as broker-dealers for customer advice. Now, the company offers investment in retail, an advising platform, and a 401K.

Reputation

Betterment has an A+ rating with the Better Business Bureau while Personal Capital was not rated by them. Personal Capitol received an 8.9 TrustScore out of 10 with over 400 TrustPilot customer reviews. Most users are happy with the services they receive for the price.

Ease of use

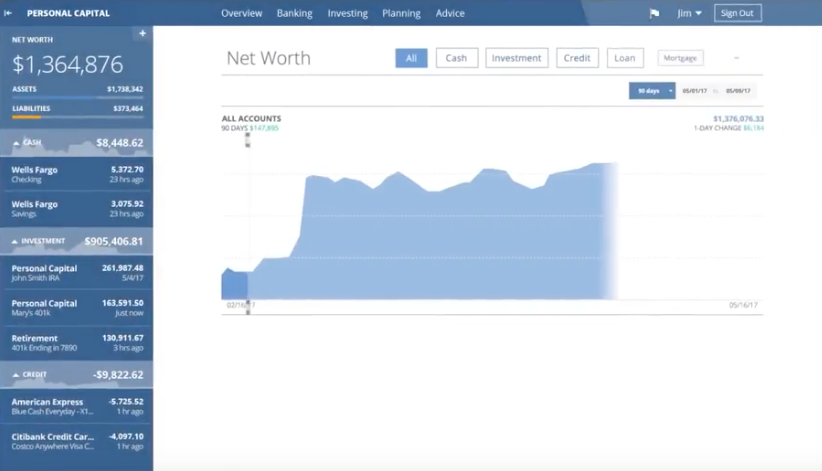

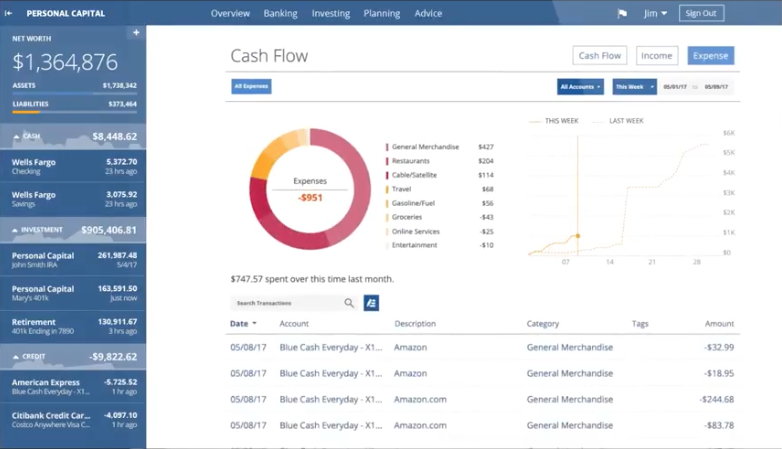

The Personal Capital platform can be used effortlessly by those who are not that tech savvy. All that you would need to do is connect your accounts such as bank account, mortgage or auto loan, credit cards, investment accounts, and any other accounts, and Personal Capital will summarize your financial situation and give you personal guidance at no cost to you at all. Your information will automatically be updated in real time every day, and translated into easy to understand graphs and charts to help you get a real sense of your complete financial situation.

Betterment is simple as well, but the approach they take is slightly different. The Betterment platform provides an intuitive, easy to understand dashboard that makes tracking and tinkering with your own financial investments fun and logical. If you want to invest your savings on your own without worrying about a lot of other stuff, this may be the platform for you.

Personal Capital vs Betterment performance

Both companies perform well to make personal financial management easier and more convenient for the average person. For overall investing and a clear view of your financial accounts in clear charts and graphs, Personal Capital offers slightly better services. Personal Capital offers far more helpful tools than Betterment has to offer.

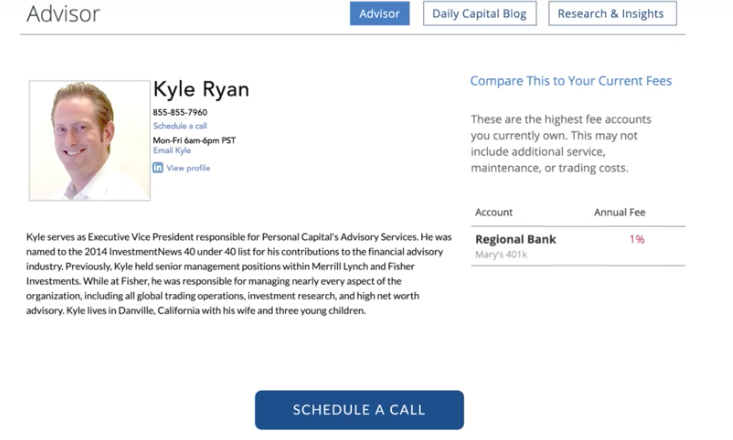

Advisors available / human advice comparison

Personal Capital starts their process by having you talk with a real live personal advisor about your life and upcoming plans that may affect financial decisions, like starting a business or having a baby. Human advisors are available to you throughout your experience with Personal Capital.

Betterment goes further to customize your personal experience, matching you with a vetted advisor that meets your preferences. You will need a minimum account balance to be matched with a Betterment advisor, so be sure you have a significant account to begin the process.

Account minimum comparison

In order to open an account with Personal Capital, you will need a minimum account balance of at least $100,000. Betterment has no minimum account balance.

Pricing and fees comparison

Betterment fees

If you open an account with Betterment with sums below $10,000, you will pay a flat $3 a month fee without auto-deposit, or a .35% annual fee with auto-deposit of at least $100 a month. Fees go down as account balances increase, up to a .15% annual fee with a balance of $100,000 or more.

Personal Capital fees

Personal Capital has straightforward fees. Up to $1,000,000 the fee is .89% of the account balance. Fees go down after that per million.

Types of accounts supported by each company

Betterment allows you to open Roth IRA, traditional IRAs, individual taxable accounts, joint taxable accounts, SEP IRA, and trust accounts.

Personal Capital will manage whatever kind of account you have, for complete account management.

Which platform manages 401(k)s?

Personal Capital manages 401Ks, but Betterment does not.

Tax strategy comparison

Personal Capital offers a variety of options for optimizing taxes, including avoiding mutual funds, carefully locating assets in optimal accounts, and utilizing tax-loss harvesting.

Features and benefits / tools comparison

Personal Capital offers more active benefits for higher account investors seeking to diversify investments and manage large sums. Most people will use Personal Capital to keep track of all their accounts, as well as managing investments. One thing I love about Personal Capital is that they help to spot all hidden fees, which helps to save you money.

Betterment is better for those with lower accounts who are more interested in managing and keeping track of accounts than increasing investment returns. If you want to see all of your accounts clearly so that you can make good spending and saving decisions, but aren’t interested in large sum investing, Betterment may be a better option for you.

Tax Loss-harvesting is offered by both platforms, but only Personal Capital manages 401(k)s.

Mobile App comparison

Both companies offer good mobile apps that let you see and manage accounts from your smart device. Betterment’s app leaves something to be desired in a graceful user experience, but it does offer most of what you may need in an app.

Personal Capital has an award-winning app that lets you do everything that the website can do. If doing your personal banking and investing on the go is important to you, Personal Capital may be a better choice for you.

Security comparison

While there are legitimate fears in the investment community about these online cloud investment and wealth management companies, due to a rise in hacking and identity fraud, both companies have managed to maintain secure clouds thus far.

There is always a risk in giving your financial information to a third party and in letting them access and update information at will, but if you want to maintain management of multiple accounts as easily as possible, some kind of third party platform is unavoidable.

Customer support comparison

Betterment offers live chat support, which is extremely useful as you are already using an online platform. Personal Capital does not have this feature, which may affect the experience of some users.

Both companies offer support through telephone and email.

Bottom line – Personal Capital is the clear winner

If you are trying to get your mind around your finances and be more active in making investments, but don’t want to pay huge percentages in fees, Personal Capital and Betterment both offer good options in investment and in wealth management. Whether you want to save for retirement, plan for a family, or just get a better sense of what your money is doing for you, you can accomplish your goals using an intuitive online platform.

Betterment is a great choice no matter how much money you have, but you should invest at least $100 a month in order to get away from the worst of the fees. Personal Capital is best for those with larger accounts, at least $100,000, with rates going down by the million. Personal Capital is the clear winner because you are given personalized investment strategies, dedicated financial advisors, smart indexing, all your accounts will be in one place, and you will be given more tools to help you to succeed.