Are you in need of a personal loan? If so, you will love this Avant vs Lending Club comparison. Unlike home and auto loans, if you’re looking to take out a personal loan, you don’t need any collateral. These “unsecured” personal loans are usually dependent on a mix of customers’ FICO score, debt-to-income history, and employment history. Lending companies such as Avant and LendingClub need only look at these factors to decide an eligible loan and interest rate.

These “unsecured” personal loans are usually dependent on a mix of customers’ FICO score, debt-to-income history, and employment history. Lending companies such as Avant and LendingClub need only look at these factors to decide an eligible loan and interest rate.

What is Avant?

Avant was founded in Chicago of 2012 by Al Goldstein, John Sun, and Paul Zhang. They use WebBank, member FDIC. They are one of the largest lending platforms that cater to borrowers with low credit scores. This makes them more accessible than some other lending companies which require above average credit scores.

What is LendingClub?

LendingClub was founded by Renaud Laplanche in 2007. Headquartered in San Francisco, California, LendingClub has served over 2.5 Million customers. They run as a peer-to-peer marketplace lender, so customers don’t have to borrow from a bank which usually has higher interest rates. LendingClub tends to cater to users with higher credit scores, but they are more accessible in that they lend to and from ordinary people, not big banks.

Reputation Comparison

In order to discern the trustworthiness of lending companies, customers can use consumer-based ratings from Trustpilot and the BBB (Better Business Bureau). Though these ratings are a good gage on how reputable these lenders are, it is important to remember that BBB ratings do not take in to account their actual complaint ratings in deciding whether corporations receive an A+. Trustpilot is a similar review service in that they compile user ratings to give the most accurate display of a corporation’s consumer satisfaction.

Avant has been accredited with the BBB since March 1st, 2015 and received an A+ for their rapid response to resolve complaints. They do, however, have poor consumer complaints there, with many about billing and collection issues.

On the other hand, their Trustpilot reviews are absolutely glowing, with over 91% of users claiming a great or excellent rating. There are only about 5% of reviewers claiming poor service, reporting negativity such as excessive emails, inability to pay off loans early, and high-interest rates (important note: this is dependent on your credit score).

Now, LendingClub has also been accredited by the BBB, since January 1st, 2008, with an A+ rating. Their complaints majority is about billing and collection, like Avant, but they also have many complaints about products and services.

Their Trustpilot score is more mixed, standing at a 44% vs 44% split between excellent and poor ratings. With many complaints about inferior customer service and being careful to avoid default loan settings.

Both lending companies show an equally active response effort in resolving BBB customer complaints, with LendingClub showing a lower rating among Trustpilot reviewers.

Personal Loan Rates Comparison

Avant offers rates from 9.95% to 35.99% APR, with no prepayment fees.

LendingClub offers rates from 6.95% to 35.89% APR, with no prepayment fees.

Loan Fees Comparison

Avant origination fees range from 1.50% to 4.75%.

What is an origination fee? It is a one-time fee that’s only charged when users are approved for a loan. The fee is deducted from the loan when it is issued, therefore, customers receive the amount they applied for minus the origination fee.

Avant has a $25 late fee if customers are delayed on a scheduled payment, with a 10-day grace period. Unsuccessful payments incur a $15 fee.

In comparison, LendingClub origination fees range from 1.00% to 6.00%.

If customers miss a payment with LendingClub, they charge 5.00% of that unpaid payment or $15, whichever is higher. This late fee is an agreed penalty found within their Loan Agreement. Given that LendingClub is a peer-to-peer lender this is a fair way to ensure that investors are still compensated for their investments.

Both lenders have considerably low origination fee rates, starting at 1.00% and 1.50%, but LendingClub has the highest possible rate at 6.00%. These are both reasonable options, especially given that these charges are only applied if the loan is approved. Their late fees are also understandable since peer investors and banks need to make smart financial decisions.

Comparing the Features and Benefits of Each Lender

Avant

- Lower Credit Score requirements: 600-700.

- Simple and quick application process.

- Consolidate debts, emergency funds, etc.

- Borrow up to $35,000.

- Lending time of 24 to 60 months.

- 9.95% to 35.99% APR rates.

- No prepayment fees.

- 4.0+ billion borrowed.

- Simple UI website and mobile app.

- WebBank lending.

LendingClub

- Higher Credit Score requirements: 640-700.

- Lengthier application process (Due to peer-to-peer investing and documentation).

- Consolidate debt, emergency funds, etc.

- Borrow up to $40,000.

- Lending time of 36 to 60 months.

- 6.95% to 35.89% APR rates.

- No prepayment fees.

- Possible credit score boosts of 19 points

- $42+ billion borrowed.

- Possibility of holding multiple accounts and loans.

- Simple UI website and mobile app.

- Peer-to-peer lending.

Both lenders have similar features and benefits, with varying APR and loan fee rates. LendingClub has experience lending to over 2.5 million customers, at a whopping $42 billion lent. That is an impressive comparison to Avant’s measly $4 billion lent to just 600,000 customers. However, Avant promotes their international exposure and acceptance of customers with lower credit scores.

Credit Score Qualifications

Avant states that most customers who receive loans have credit scores between 600 and 700. Accepting lower credit scores has made Avant a top-rated lending platform because they are accessible to more customers.

LendingClub, similarly, requires a score of at least 640, with 700 being the average amongst users. Their blog recommends a 700 score, so this suggests that LendingClub prefers above average credit histories from their customers.

Funding Time

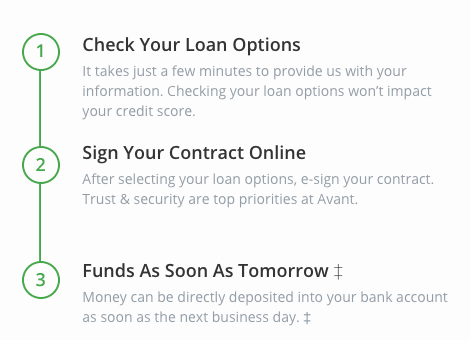

Avant boasts disbursement of funds in as little as one business day, a surprisingly short approval time. If users are in an extreme time crunch than this company may be the quickest route.

Lending Club, on the other hand, fund disbursement usually takes a week, with some reviews stating possibly two weeks, depending on the loan.

Loan Terms Options

Loan lengths for Avant range between 24 and 60 months.

Loan lengths for LendingClub range between 36 and 60 months.

The Loan Application Process Comparison

Avant’s application process is quite fast, they simply need a full name, address, income information, and social security number. There are no application fees at Avant.

LendingClub’s application process is considerably lengthier than Avant, usually a week. This is due to there being more required documentation, such as tax forms, proof of income, proof of identity and address, and proof of employment. There are no application fees at LendingClub, this is a nice comfort as some lenders require a non-refundable payment even if they deny an application.

How much can you borrow with each lender?

Avant offers loans from $2,000 to $35,000, dependent on eligibility from customers’ credit score, income history, etc.

Lending Club offers loans from $1,000 to $40,000, dependent on eligibility from customers’ credit score, income history, etc.

Locations Served

Avant has grown quickly into an international lender, operating in the United States, the United Kingdom, and Canada. They have served over 600,000 customers.

As of September 2016, Lending Club offers lending to all U.S. States apart from Iowa. They claim to have served over 2.5 million customers.

Support Comparison

Avant boasts helpful customer support available 7 days a week via phone, email, and chat.

Lending Club provides a telephone hotline and email address for customer support.

Bottom Line

Both lenders are great options for differing reasons. Avant appeals more to customers with average credit scores who need energy funds quickly. Lending Club provides this as well but caters as a peer-to-peer lender, this means users will have to wait longer for potential loan approval. LendingClub also tends to cater to customers with a better than average credit score, 700 and above. Both companies work well to resolve any customer complaints on the BBB, with LendingClub having the worse ratings on Trustpilot. Though LendingClub may take longer to receive a loan, they do offer somewhat better rates, fees, and loan terms. Using these and the above-outlined factors should help users determine which lender is a better option for their needs.