More and more people are switching to online lenders to get a personal loan. Let’s review Upstart vs SoFi to help you to make the best choice.

In the comparison, we will be comparing multiple factors between these two lenders such as their credit score requirements, their APR, their loan amounts, and more.

What is Upstart?

Upstart is an online lender that was founded in 2012 by ex-Googlers. Today the company has over 85 employees and has funded over $2 billion in loans. The goal of Upstart is to use data to offer better access to capital on fair and flexible terms. Upstart allows you to refinance student loans, credit cards, and debt consolidation loans. Upstart also allows you to get personal loans for taxes, weddings, home improvement, bills, large purchases, business, and more.

What is SoFi?

SoFi is online personal finance company that was founded in 2011. Today this online lender has funded well over $30 billion and they currently have over 500,000 members. SoFi allows you to get personal loans, mortgage loans, Parent PLUS refinancing, medical resident refinancing, and more.

Comparing the reputation of both lenders

BBB

Having a good Better Business Bureau score means that a company honestly represent products and services, protects the data of their customers well, honors their promises, and they maintained a positive track record.

Upstart has been a BBB accredited company since 11/30/2015. They currently have an “A+” BBB rating.

SoFi has an “A+” Better Business Bureau rating as well.

Trustpilot

Out of 400+ reviews Upstart has a rating score of 9.6 out of 10. This is an excellent 5 out of 5 star score from UpStart.

SoFi has an amazing Trustpilot rating score as well. SoFi has over 1900 reviews and received an excellent Trustpilot score of 9.2 out of 10 and 5 out of 5 stars.

Comparing personal loan rates

Upstart rates

Upstart rates are on the high side compared to other lenders that we have reviewed. Their APR ranges from 7.80% to 29.99%.

Click here to get rates with Upstart.

SoFi rates

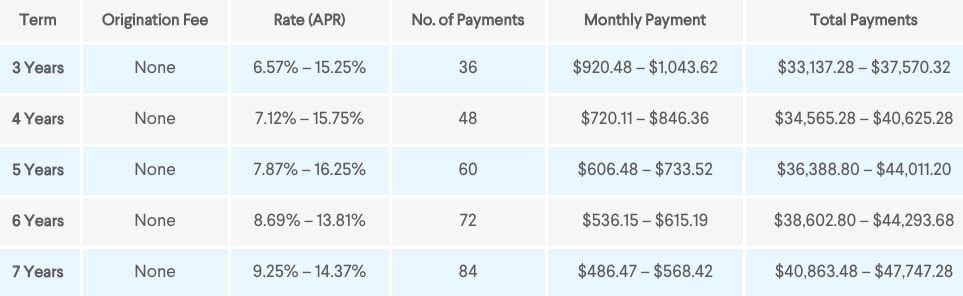

When comparing rates SoFi easily beats out Prosper, Upstart, and many of the top lenders. SoFi has personal rates that range from 6.57% APR to 16.25% APR.

Start SoFi here and get a $100 bonus.

Comparing the loan term options

Loan terms – The loan term is the period of time that your loan will last if you make the required payments. The shorter your loan term the more that you will be able to save on interest rates.

Upstart has loan terms that range from 3 – 5 years.

SoFi has loan terms that range from 3 – 7 years.

How much can I borrow with each lender?

Upstart is for smaller loans. With Upstart you can take out loan amounts from $1,000 – $50,000.

If you need larger loans, then SoFi is a better fit. With SoFi you will be able to take out loans from $5000 to $100,000.

Features and benefits

- Next day funding

- You will be able to borrow a lower minimum amount compared to other lenders. For example, both LightStream and SoFi offer loan amounts for $5000 and up.

- Peer to peer lending for investors.

- No prepayment penalty

- Quick and easy

- Soft credit check

- If you ever lose your job. SoFi will temporary stop your payments and help you to find a job.

- Free SoFi events for all members. Members will be able to bring a guest.

- Complimentary financial advising.

- Get a 0.125% rate discount on any additional loans.

- No fees

- Low rates

- Soft credit check

- Easy Experience

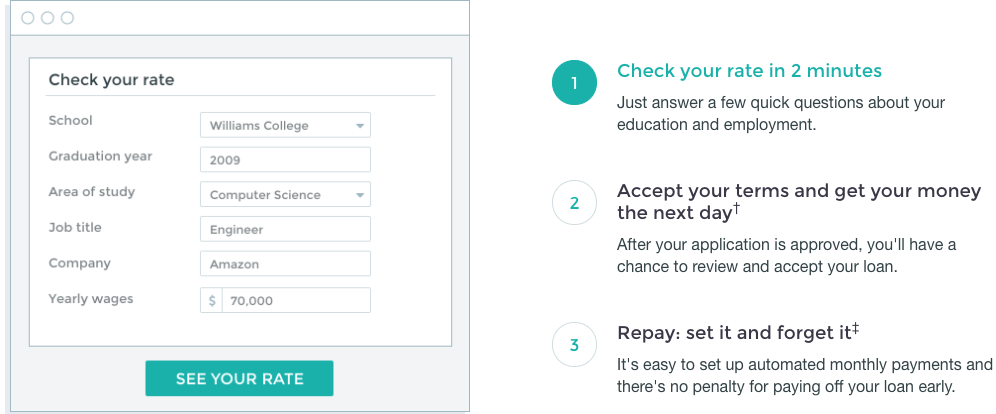

The personal loan process

Both lenders allow you to get a loan in a few steps. All that you have to do is answer a few basic questions, such as your name, education, and employment history. Next you will have to choose your loan options and loan terms. Choose what best fits you. Then, you will sign and wait for approval. One of the main reasons why more people are switching to online lenders is because the application process is easier and quicker. Lenders such as SoFi can verify your information without you having to send in documents like you would with a traditional lender. Both loan applications will take only a few minutes.

Minimum credit score

SoFi wants those who desire a personal loan to have a good credit score of 680. There is no minimum annual income that you have to make with SoFi, but most of their borrowers make over $100,000.

Upstart works with those who don’t have the best credit. Those who desire a personal loan with Upstart must have a credit score of at least 620. With Upstart you must make at least 12,000 a year.

Fees comparison

Upstart

Upstart does not have a prepayment penalty fee if you pay off your loan faster than your loan term. However, they do have an origination fee that ranges from 0% – 8% of the target amount. Upstart also has a late payment fee of 5% of the monthly past due amount or $15. Whichever is greater is the amount that you will have to pay.

SoFi

SoFi is unlike other lenders. With SoFi you will not have to worry about origination fees. SoFi has a 15-day grace period on their payments. After this grace period ends you will have to pay a 4% late fee of the total payment or $5. The amount that is less is the amount that you will have to pay.

When will my loan be funded?

SoFi loans will be funded within 1 to 7 days after the loan is approved. Upstart loans can be funded in in as little as one business day after your personal loan is approved.

Support comparison

Upstart offers a Help Center with various articles to help you maneuver around the Upstart platform. In their Help Center you will learn how to make payments, learn if you are eligible, and more.

Upstart’s phone support is available from Monday through Sunday from 6:00 AM PST to 5:00 PM PST.

SoFi has a larger Resource Center than Upstart. They answers more common questions that might arise for a borrower. SoFi’s phone support is available from Monday to Thursday from 4:00 AM – 9:00 PM PT and Friday to Sunday 4:00 AM – 5:00 PM PT.

Which personal lender is better?

There are many things about both lenders that you will love. They both offer an easy application process and they both have fast funding times. However, each lender uniquely caters to a certain group of people. For those with fair credit, then Upstart might be the better choice because they only have a 620 credit requirement. Upstart will also be the better choice if you need a loan under $5000. Overall, SoFi is the best choice. SoFi will give you more affordable rates and less fees. Also, more benefits and features come with getting a loan with SoFi. I encourage you to get rates today to see how much you will be paying for a loan. This can be done in a few minutes.