Let’s compare two of the largest personal loan lenders in the nation. SoFi vs Prosper is a hot debate, but today we will find out which lender is the best.

To see how much you will pay for your personal loan I encourage you to get your rates today.

What is SoFi?

SoFi is an online finance company that was founded in 2011. SoFi is your typical online lender such as LightStream. SoFi provides more than just personal loans. They also provide loans for student loan refinancing and mortgages. In just a short amount of time SoFi accomplished a feat that has never been done before. In 2016, SoFi became the first startup online lender to receive triple A ratings from Moody’s.

What is Prosper?

Prosper is a younger company that was founded in 2005. Prosper is slightly different from SoFi. Prosper is a big name in the peer-to-peer and marketplace lending industry. What Prosper does is connect creditworthy borrowers with individuals and institutions. Prosper has over $7 billion in funded loans and over 450 employees.

Customer complaint comparison

BBB

Prosper.com has had BBB accreditation since 11/30/2012. In the BBB rating system overview Prosper received an “A+” Grade. In the composite section, Prosper received 3.93 out of 5 stars based on an “A+” rating and 50 customer reviews.

SoFi received an “A+” grade as well. An “A+” rating is the highest rating possible. In the letter scale an “A+” rating means that they scored 97 to 100 points.

Better Business Bureau takes a look at 13 elements such as the complaint volume of a business, the unanswered complaints of a business, failure to address complaint pattern, failure to honor mediation/arbitration, government action (per action), and more.

TrustPilot

Currently SoFi has over 1900 TrustPilot reviews. However, the company still received an excellent rating with 5 out of 5 stars. Prosper currently has 50 reviews with an average TrustPilot rating of 3 out of 5 stars.

Personal loan rate comparison

Depending on your credit both lenders can be competitive, but I believe that SoFi offers slightly better rates.

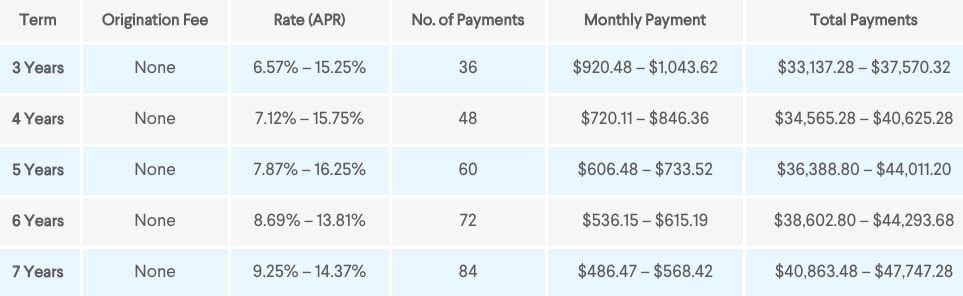

SoFi rates

SoFi offers fixed personal loan rates that can range from 6.57% APR to 16.25% APR.

Prosper rates

Depending on if you have good or excellent credit your Prosper APR will be anywhere from 6.95%

to 35.99%. Borrowers with excellent credit can expect rates between 7% and 15% APR.

Lender fees comparison

Prepayment penalties

It’s awful to be penalized if you pay off your loans early. Unfortunately, some banks dish out prepayment penalties that can end up costing you thousands of dollars. The awesome thing about Prosper and SoFi is that you will not have to worry about any prepayment fess if you pay off your loan faster than expected.

Origination fees

Origination fees are the fees that a lender charges to process the application and agreement.

Prosper

Prosper has origination fees that range from 2.4% – 5%. For example, let’s say that you qualified and took out a $10,000 personal loan with Prosper and there was a 3% origination fee. $300 would be deducted from that $10,000 loan amount. Instead of $10,000 you would receive $9700.

SoFi

Another perk of SoFi is that you will not have to worry about paying any origination fees, which means that you will be getting your loan in full.

Late fees

Prosper

If you don’t have enough money in your bank account to cover your bill, then you will be charged $15. If your payment is late, then you will either be charged 5% of your unpaid installment or $15. The higher amount is the amount that you will pay.

SoFi

SoFi is one of the only lenders that do not charge late fees

How much can you borrow?

Prosper

Prosper will give you a loan amount ranging from $2,000 – $40,000.

If you need a loan amount that is under $5000, then Prosper can better accommodate you. Lenders such as SoFi and Earnest have a minimum loan amount of $5000.

SoFi

SoFi will give you a loan amount that ranges from $5000 to $100,000.

If you need larger loans and don’t want to worry about fees, then you will be glad to know that SoFi offers loans over $40,000 without the headache of fees.

Features and benefits of each lender

Prosper features

- Live loan centers

- Fast funding time

- Soft credit check

- Sign up with Prosper.

SoFi features

- No fees

- Career Coaching

- Community Events

- Member advisory board

- Multiple loan options

- Soft credit check

- Click here to receive $100 from SoFi.

Loan payment options

With Prosper you will only have 3 or 5 year payment options. SoFi allows for more flexibility with your loan payments by having payment options ranging from 3 to 7 years.

Funding time comparison

Prosper funds their borrowers relatively quick compared to other lenders. Prosper has an average funding time of around 1 to 3 business days after approval.

SoFi offers fast average funding times as well. You can expect your loan to be funded within 1 to 7 days after approval.

The loan process comparison

Prosper loan process

Getting a loan with Prosper is fun and easy. All that you have to do is choose your loan amount. Then you are going to select your loan purpose and answer a few questions. The loan process is extremely straightforward. A few loan types that you can choose with Prosper include: debt consolidation loans, home improvement loans, short term & bridge loans, auto & vehicle loans, small business loans, baby & adoption loans, engagement ring financing, special occasion loans

green loans, and military loans.

SoFi

SoFi offers an easy approach to getting a loan as well. All a borrower needs to do is fill out basic requirements that you would expect from a loan form. The application can be completed in a few short minutes. SoFi allows you to borrow for more than just personal loans. They also allow you to borrow for student loan refinancing, medical/dental resident refinancing, mortgages, mortgage refinancing, and parent PLUS refinancing.

Minimum credit score comparison

Both lenders are great for those with good credit. This is the minimum credit score that you should have to apply for each lender.

Minimum Prosper credit score: 640 – Get a loan with Prosper here.

Minimum SoFi credit score: 650 – Start SoFi here today and get a $100 bonus!

Credit history requirement

With SoFi there is no credit history requirement. SoFi is only worried about if the borrower can pay off the loan amount on time.

With Prosper you should have at least some credit history. Prosper likes their borrowers to have at least two years of credit history.

Support comparison

Prosper

Their borrow services department is available from Monday – Friday:

8am – 9pm (ET)

5am – 6pm (PT)

6am – 7pm (MT)

7am – 8pm (CT)

Prosper.com also has a help center with over 60 helpful articles to help their customers.

SoFi

You can contact SoFi customer support from Monday – Thursday 4:00 AM – 9:00 PM PT and Friday – Sunday 4:00 AM – 5:00 PM PT.

SoFi.com gives their customers a resource center, Faq page, and blog articles.

Which lender is better?

Both lenders have perks about them. Prosper has a $2000 loan minimum, which is awesome. However, SoFi might give you better rates without fees, SoFi gives their customer more benefits, you can take out a greater loan amount, and there are less requirements. I strongly recommend that you get rates today, which can be done in a few minutes.