Are you in need of a personal loan? Today we will help you to find the online lender that fits your goals by comparing LightStream Vs SoFi. These are two popular players when it comes to personal loans. Both lenders are geared towards borrowers with good to excellent credit and they both have a great reputation.

In this article, we will find out how well each lender handles customer complaints. We will find out about the different features that they offer. We will learn about their rates and more.

What is LightStream?

LightStream is an online consumer lending division of SunTrust Bank that was founded in 2013. The goal of LightStream is to make your dreams come true. Their motto is “it’s not the loan, it’s what you do with it that matters.”

What is SoFi?

SoFi is an online personal finance company that was founded in 2011. SoFi provides several different types of loan options such as student loan refinancing, mortgages, and personal loans.

What is a personal loan?

Any money that you need to borrow from a lender to handle any personal things such as fixing a home, paying off credit cards, investing, taking a family vacation, paying for your wedding, etc. is considered a personal loan. With a personal loan you will be able to make big financial choices. You will then pay off your loan month to month with a loan rate of your choice.

Better Business Bureau rating

BBB ratings are based on information such as a lender’s complaint history, type of business, licensing and government actions, and more.

SoFi received an “A+” grade in the BBB system overview.

LightStream does not have a BBB rating. However, LightStream is part of SunTrust Bank and SunTrust has been a BBB accredited business since 1967. BBB received an “A+” rating in the BBB rating system overview.

Personal loan rate comparison

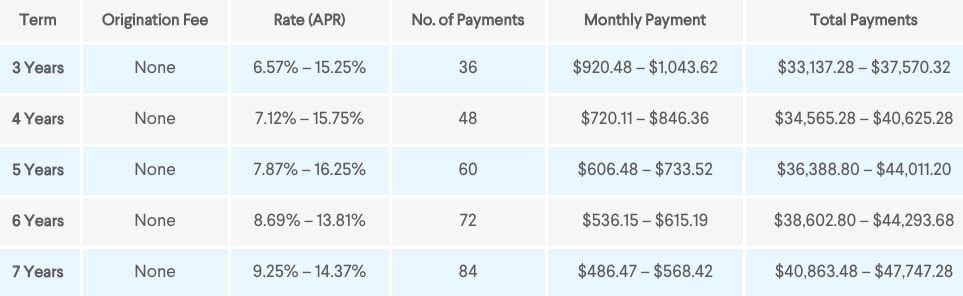

SoFi

SoFi has interest rates that range from 6.57% to 16.25%. To get exact rates make sure to apply today. All rates shown are assuming that you opt for automatic billing. Autopay helps you to receive a 0.25% discount. Loan terms range from 3 – 7 years. Click here to receive $100 with your SoFi loan.

LightStream

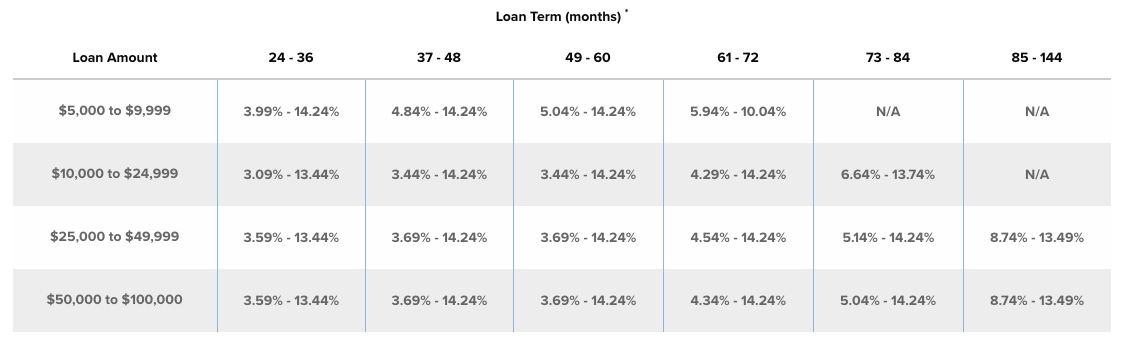

LightStream offers slightly cheaper rates than SoFi. LightStream offers an APR that ranges from 3.09% – 14.24% for fixed rate loans. Loan terms with LightSteam range from 2 – 7 years.

Fees comparison

The great thing about both of these lenders is that they both do not have any fees. You will not have to worry about origination fees, pre-payment fees, or late fees. When you work with an online lender you won’t have to go through the same processes that you would with your local bank. Online lenders save and since there are less expenses you will be able to save as well.

Bundling comparison

This comparison allows us to know which lender is better for bundling different loans. Usually when you have more than one type of loan with one lender you will be able to receive a discount. SoFi allows their customers to receive a 0.125% rate discount when they get multiple loans from them. With multiple loan options to choose from such as personal loans, student loan refinancing, medical resident refinancing, mortgages, mortgage refinancing, parent PLUS refinancing.

LightStream offers many different loan options such as auto loans, home improvement loan options, recreational loans, family loans, debt consolidation, and more. LightStream does not have a discount when you bundle.

Loan amount options

LightStream offers loan amounts from:

- $5,000 to $9,999,

- $10,000 to $24,999

- $25,000 to $49,999

- $50,000 to $100,000

Choose the loan amount that best fits your needs.

SoFi personal loans range from $5K – $100K as well.

Lender features comparison

SoFi features and benefits

- Click here to receive $100 with SoFi.

- Loan discount – 0.125% rate discount when you receive more than one loan from SoFi.

- Community Benefits – If you ever lose your job, LightStream will pause your payments and they will even help you to find a new job.

- Free career coaching

- Great option if you have a short credit history

- Entrepreneur Program

- Fast funding time

LightStream features and benefits

- Rate Beat Program – We’ve all heard of price match. With Price match companies will match the price of another company. LightStream goes a step further. LightStream offers a Rate Beat Program. With this program LightStream ensures that their rates are going to beat out any competition by 0.10 percentage points. If you find more affordable rates elsewhere, then you will be able to call LightStream and they might work with you on the price.

- Several loan options

- $100 Loan Experience Guarantee – If you are not completely satisfied with your loan LightStream will send you $100.

- With every loan LightStream will plant a tree – So far LightStream has planted trees in over 1,500 acres of wilderness.

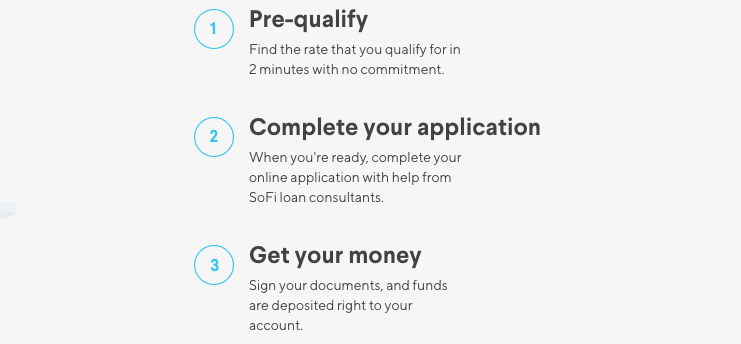

Loan process comparison

Both lenders offer a fast and simple online loan process. All that you have to do is fill out basic requirements that you would expect from any lender, which can be down in just a few minutes. You will then select the rates that best fits your needs and wait for approval.

LightStream

SoFi

Apply to SoFi here in minutes!

Minimum credit score – Both lenders accommodate individuals with good credit.

- The LightStream credit score requirement is high compared to other companies. LightStream recommends having at least a 680-credit score to qualify for a loan.

- SoFi is slightly easier to get a loan with. SoFi requires you to have a credit score of 650.

Funding Time comparison

Both lenders have an average funding time of less than a week. Sometimes LightStream offers same day funding.

Support comparison

SoFi

SoFi gives their customers a convenient resource center filled with career tips and how-to articles. To get answers to common questions you can go to their frequently asked questions. SoFi also offers blog posts to help you to achieve your goals.

You will be able to talk to SoFi members seven days a week via phone, email, or social media.

Phone support is available:

Monday – Thursday 4:00 AM – 9:00 PM PT

Friday – Sunday 4:00 AM – 5:00 PM PT

LightStream

LightStream offers a FAQ page where you can learn more about unsecured and secured loans, loan uses, loan approvals, account services, and more. You may also email them from Monday through Friday, 9:00 a.m. to 8:00 p.m. and Saturday, Noon to 7:00 p.m. Eastern time.

Which is the better lender?

If you are a hard worker and you are financially responsible, then you deserve to be rewarded. Both are great lenders. SoFi offers some unique features such as unemployment protection and a bundling discount. LightStream might offer better rates, but there are some drawbacks. You have a better chance of getting approved with SoFi. SoFi has a lower minimum credit score requirement. Also, LightStream desires that you have several years of credit history with on-time payments. SoFi is willing to work with those who don’t have several years of credit history. Once again, both lenders have unique perks about them. Choose the lender that best fits your goals. By clicking on the SoFi link below you will receive $100.