Are you searching for a mortgage lender that fits your current situation? Buying a home can be an overwhelming process, but finding an online lender can make the process less stressful for you and your family.

In this article, we will help you to find the best online mortgage lenders.

Online mortgage lenders vs banks

You might be asking yourself, “should I use an online mortgage lender?”

Online lenders don’t have the average expenses that other lenders have. This is great news for those who are trying to save. When the expenses are down that usually means that you will be able to save more. There are many reasons to choose an online lender over a bank.

Receiving lower mortgage rates and having to worry about less fees is one of the main reasons why people are flocking to online lenders. Another reason why you might desire an online lender is because they will help you to save time on the loan approval process. If you have a bad credit score getting a loan online might even be the easier option for you.

Rocket Mortgage

Rocket Mortgage is the top mortgage lender on this list. Quicken loans developed Rocket Mortgage to make getting loans faster. Rocket Mortgage is a great option for first-time home buyers because Rocket Mortgage makes the loan process easier by allowing you to verify personal information online. Traditional lenders make you talk to a loan officer and send in your financial information, but with Rocket mortgage the entire loan process is online. However, if you want there are options to talk to loan experts during the loan process. Rocket Mortgage shortens the approval time. With Rocket Mortgage your loan can be improved in a week.

Rocket Mortgage features

- Quicken Loans received an “A+” rating from BBB.

- Lock your interest rate for up to 90 days.

- Import Your Assets.

- Rocket Mortgage loan preapproval takes just minutes.

- 2018 U.S. Primary Mortgage Servicer Satisfaction Study award recipient.

Minimum credit score:

- Conventional Mortgage: 620

- FHA Mortgage: 580

Minimum down payment:

- 3%

SoFi

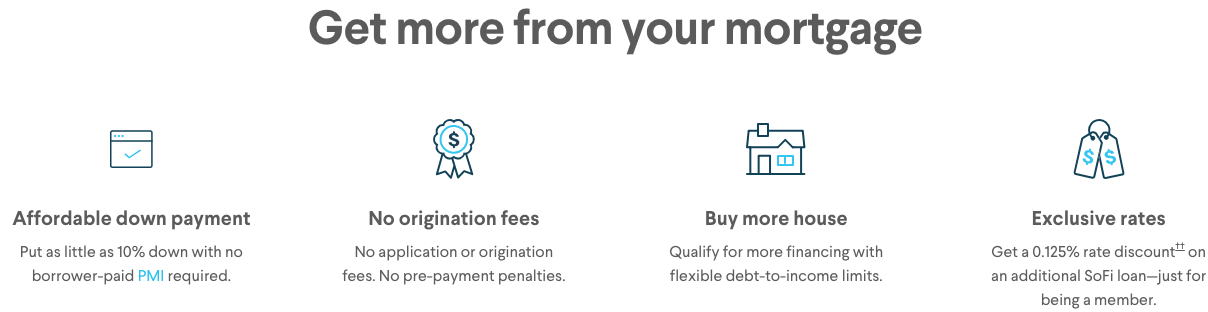

Social Finance, Inc also known as SoFi was founded in 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady. SoFi members will receive a 0.125% rate discount on other services such as mortgage refinancing, personal loans, and student loan refinancing. If you need low affordable rates and a low APR, then SoFi is an affordable option.

With SoFi you are able to get loans of up to 3 million. SoFi has great ratings on Zillow, Trulia, and they also have an “A+” Better Business Bureau rating. One of the best things that I love about SoFi is that they care for you if something were to happen such as a job loss. If you were to ever lose your job, SoFi will pause your payments and coach you through your job payment.

SoFi features

- There are no lender fees

- SoFi doesn’t require PMI (Private Mortgage Insurance)

- Immediate rate lock

- Loan process will be finished in under 30 days.

- Low rates

Minimum down payment:

- 3%

LendingTree

LendingTree is not a traditional mortgage lender. What LendingTree does is connect you to thousands of mortgage lenders. You will be able to choose from several home purchasing and refinance mortgage options. With LendingTree you are able to negotiate your rates to find rates that best fits your budget.

LendingTree features

- LendingTree has a network of 1500+ lenders that you can use.

- LendingTree gives you free credit scores.

- Variety of interest rates.

- Fast online loan process

Minimum credit score:

- Varies

Minimum down payment:

- Varies

Guaranteed Rate

Guaranteed Rate is the world’s first digital mortgage. Guaranteed Rate is the 8th largest mortgage lender in the nation. This lender uses cutting-edge technology to streamline the loan process to make it easy for you and your family. With Guaranteed Rate you can expect a closing rate of under one month. Guaranteed Rate is a great option if you need competitive rates. Since 2000 Guaranteed Rate has given home owners over $200 billion in home purchase loans and refinances. Guaranteed offers several loans for you to choose from such as Interest Only Mortgage, 15-Year Fixed Rate Mortgage, 30-Year Fixed Rate Mortgage, and Jumbo loans. Guaranteed Rate has been a BBB accredited mortgage lender since 11/01/2009. The company received an “A” Better Business Bureau grade.

Guaranteed Rate features

- Free credit scores from all 3 credit bureaus

- Upload and sign your loan documents digitally

- 95% customer satisfaction

- High NPS score

- 170+ branches

Minimum credit score:

- Conventional Mortgage: 620

- FHA, VA Mortgage: 580

Minimum down payment:

- 3%

Quicken Loans

Quicken Loans is dominating the United States mortgage market. Quicken Loans offers more mortgage loans than Wells Fargo Bank, JPMorgan Chase Bank, and Bank of America. Quicken Loans has been a top online lender even before the introduction of Rocket Mortgage in 2016.

With the inclusion of Rocket Mortgage Quicken Loans reached new heights like never before. Quicken Loans received great reviews across the boards. Quicken Loans was the top-rated lender in the Primary Mortgage Origination Study for 8 years in a row. In the Mortgage Servicing study done by J.D. Power, Quicken Loans has been the top-rated lender for 5 years in a row.

Quicken Loans features

- Custom fixed-rates with YOURgage ranging from 8 to 30 years.

- Competitive mortgage rates

- Rocket Mortgage

- Large number of loan options

- Quicken Loans offers email and text updates

Minimum credit score:

- Conventional Mortgage: 620

- FHA Mortgage: 580

Minimum down payment:

- 3%

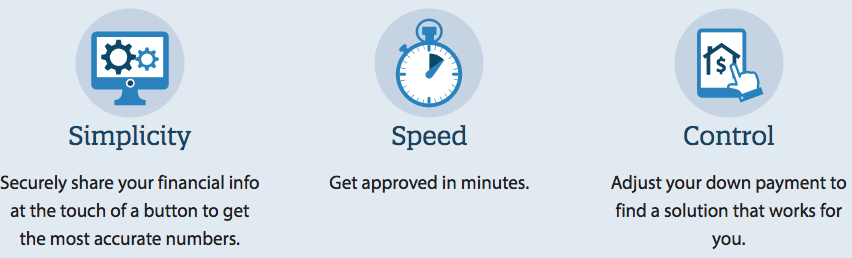

LoanDepot

LoanDepot desires to be the lender of choice for consumers. Finding an expert is easy. All that you have to do is find a loan officer by their first or last name or you can find a branch near you. Currently LoanDepot has over 6500 employees across the nation and over +1800 loan officers. In the J.D. Power Primary Mortgage Origination Satisfaction study on a 1000-point scale, LoanDepot received 831 points.

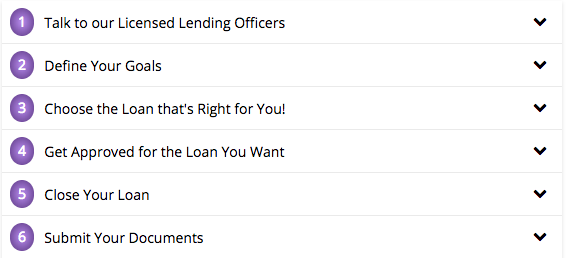

This is an average rating. The LoanDepot loan process is simple. All that you have to do is talk to one of their licensed loan officers, find your budget and find out what you desire in a loan/home. Choose the right loan for what you are trying to do. Then, get approved for your loan, close your loan, and submit your financial documents. With LoanDepot you will be allowed to receive up to $2,000,000 in loans. Loan types include Jumbo, Adjustable Rate, Fixed Rate, Personal Loans, VA, FHA, HARP, and Home Equity.

LoanDepot features

- Mortgage loans are offered in all 50 states.

- 180+ locations across the nation.

- End-to-end proprietary digital lending platform.

Minimum credit score:

- Conventional Mortgage: 600

- FHA Mortgage: 580

Minimum down payment:

- 3%

Lenda

Lenda is a new lender that was founded in 2013. Unlike Quicken Loans that allows for both an online and a home loan process. The goal of Lenda is to give you a fast loan that is completely online. You will not have to drive to a local branch nor will you have to fax anything over to a bank. Lenda is a great option if you need refinancing. The biggest drawback of Lenda is that it is not available everywhere. Lenda is only available in 12 states at the moment. Lenda is available in Arizona, California, Colorado, Florida, Georgia, Illinois, Michigan, Oregon, Pennsylvania, Texas, Virginia, and Washington. Lenda is still a young company so they are still growing and improving.

Lenda features

- Lenda does not charge origination fees, broker fees, or application fees.

- Fast turnaround time

- Paperless process

Minimum credit score:

- Conventional Mortgage: 620

Minimum down payment:

- 5%

New American Funding Mortgage

New American is a family owned mortgage lender that was founded in 2003 by Rick and Patty Arvielo in Orange County, California. New American Funding has been had BBB accreditation since 09/15/2004.

The company has an “A+” BBB rating. New American Funding is an awesome lender that offers low down payments and underwriting flexibility. Currently the company has over 22 billion in home loans. Loan types include fixed rate mortgage, VA (Veteran’s Association), FHA home loan, ARM mortgage, Jumbo, home improvement, reverse mortgage, and interest online.

New American Funding Mortgage features

- Around 130 branches

- Manual underwriting

- Online Mortgage Application

Minimum credit score:

- Conventional Mortgage: 620

- FHA Mortgage: 580

Minimum down payment:

- 3%

Better Mortgage

Better Mortgage was founded in 2014 with a goal in mind to re-engineer the mortgage process. In the same year Better partnered with Avex Funding. Two years the company closed $30 million in Series A funding. Although Better is a young company it is growing rapidly.

Better mortgage features

- With Better Mortgage you will receive loans of up to $3 million.

- Loan officers are available if you need any help.

- Easy revamped mortgage application process.

Minimum credit score

- Conventional Mortgage: 620

Minimum down payment:

- 3%

Which is the best mortgage lender?

There are some awesome mortgage lenders on this list. However, I strongly recommend Quicken Loans because of the easy online process and the fast average closing times.