Are you paying too much on your student loans? If so, refinancing is a great option that will lower your monthly bill. Today, we will compare Laurel Road Vs SoFi, which are two big names in the student loan refinancing industry.

In this article, we will help you to learn more about each company and we will differentiate essential factors such as interest rates, features, and credit score requirements.

What is Laurel Road?

Laurel Road has been refinancing student loans since 2006. However, Laurel Road is more than just a student loan refinancing option. Laurel Road Bank is a Connecticut state-chartered bank that also offers personal and mortgage loans. You can also get low rates on in-school MBA loans if you attend schools such as Arizona State University, Carnegie Mellon University, Columbia University, Cornell University, Dartmouth College, Duke University, Emory University, Georgetown University, Georgia Institute of Technology, Harvard University, Indiana University, University of Chicago, University of Michigan, Yale University, University of Southern California, University of Texas, Austin, and more. Over $3 billion in loans have been funded through Laurel Road. Their leadership team has well over 100 years of combined financial services experience.

What is SoFi?

SoFi is one of the top online lending platforms in the nation. SoFi specializes in student loan refinancing. However, they also offer medical/dental resident refinancing, mortgages, mortgage refinancing, personal loans, and parent PLUS refinancing.

Reputation comparison

The company behind Laurel Road which is Darien Rowayton Bank received an “A+” rating in the BBB rating system. Laurel Road has an excellent rating from Trustpilot.com. Out of 160+ reviews the company received a 9.2 out of 10 TrustScore. Across the board Laurel Road has great reviews.

SoFi is one of the go to options for student loan refinancing. They have a fantastic relationship and have been recognized as one of the top lending platforms among financial leaders. Better Business Bureau gave SoFi an “A+” rating. SoFi has over 1000+ customer reviews from Trustpilot and similar to Laurel Road the company received an excellent 9.2 out of 10 TrustScore.

Student loan refinancing rates comparison

It is imperative to note that rates are always fluctuating so it is important that you apply today while rates are low.

SoFi

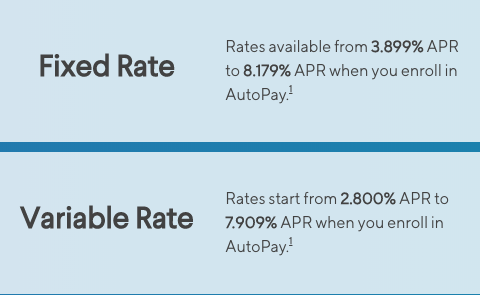

SoFi offers affordable variable and fixed student loan refinancing rates.

Their variable rates range from 2.800% to 7.909%.

Their fixed rates range from 3.899% to 8.179%.

By clicking the link below you will receive $100 with SoFi.

Laurel Road

Laurel Road rates are almost similar to SoFi.

Variable rates: 2.80% – 6.38%

Fixed rates: 3.50% – 7.02%

The rates shown for both lenders is with an AutoPay discount of 0.25%. By clicking the link below you will receive $80 with Laurel Road.

Fees comparison

One of the best things about choosing Laurel Road or SoFi is that you will not have to worry about fees associated with these lenders. Most loan companies will charge you an origination fee that can come up to 8% of your loan. There are some companies who will even charge you a prepayment penalty if you pay your loan off early. With SoFi and Laurel Road you will not have to worry about these. However, both companies will charge you a late fee if you are 15-days late with your loan repayments.

With Laurel Road you will be either be charged a 5% fee of the late payment or $28, whichever is less is the amount that you will have to pay.

With SoFi you will be charged a $5 late fee if you go beyond the 15-day grace period without paying your bill.

Benefits and features comparisons

SoFi benefits

- Click here to receive $100 with SoFi.

- Bundle discount – With SoFi you will receive a discount when take out an additional loan.

- Low affordable interest rates

- Unemployment Protection – If you ever lose your job and you are not at fault, then SoFi will temporarily pause your loan payments. SoFi will also help you to look for a job.

- Student loan refinancing calculator

- Networking events – These events are free for all SoFi members.

- Complimentary financial advising – You will be able to receive guidance from their team of licensed advisors for free.

- AutoPay

- Soft credit check

- Co-signer option

Laurel Road benefits

- Click here to receive $80 with Laurel Road.

- Economic hardship support – Laurel Road offers forbearance if you were to ever experience financial hardship. You may be able to qualify for one or more three-month periods.

- Low variable and fixed rates

- Refinancing for healthcare focused Associate Degree programs

- Employer Partnerships

- Association Partnerships

- Payment calculator

- Autopay discount

- Soft credit check

- Co-signer option

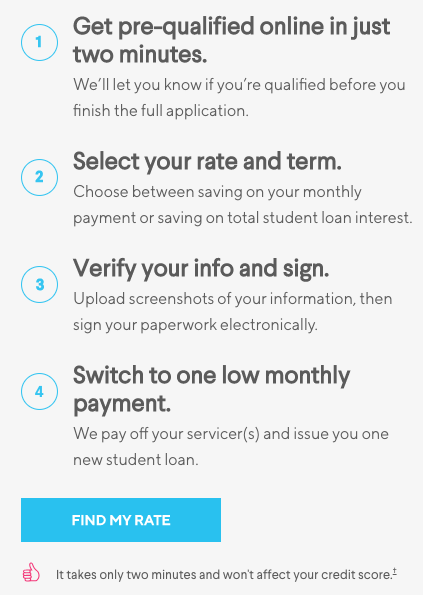

Student loan refinancing application process

Online lenders make the loan application process easier than ever. You will easily be able to get rates in a few minutes by entering in basic information about yourself.

Credit score requirement

SoFi

To be eligible for SoFi student loan refinancing you will need a credit score of at least 650. On average, SoFi borrowers have a credit score that is above 700. There is no minimum income that you have to make. SoFi desires borrowers who are able to pay off their loan and have room to spare.

Laurel Road

To be eligible for refinancing with Laurel Road you will need a minimum credit score of 660. There is no minimum income that you have to make with Laurel Road.

Apply to Laurel Road and get $80.

How much can you borrow?

With both lenders you will be able to get all that you need to pay off the balance. The loan amount has to be at least $5000 for both SoFi and Laurel Road.

Loan terms

Both lenders are rich in loan terms. You will easily be able to find the loan term that best fits what you are trying to do.

Loan terms to choose from: 5, 7, 10, 15 or 20-years.

Estimated funding time comparison

SoFi loans are usually funded faster than Laurel Road. With SoFi you will be able to get your loan within a week.

Support comparison

LaurelRoad.com offers a resource hub page where you will be able to learn more about student loan refinancing. They also have a page for frequently asked Laurel Road questions. On the bottom right corner of the screen you will also notice that Laurel Road offers live chat support. Their Call Center is available from Monday – Thursday 8:30 a.m. – 8:30 p.m. EST and Friday 8:30 a.m. – 5:30 p.m. EST.

SoFi.com offers a Resource Center, Blog, and a FAQ page. You can contact their phone support from:

Monday – Thursday 4:00 AM – 9:00 PM PT

Friday – Sunday 4:00 AM – 5:00 PM PT

Which lender is better?

In all honesty, you can’t go wrong with choosing either company. Both lending platforms give you low rates and no fees. They are identical when it comes to loan terms and the amount that you will be able to borrow. Lastly, they both have great reputations. Although they are similar, I would go with SoFi because SoFi gives you more features and is the more popular option.

I encourage to take advantage of the low rates on the market. Get rates now, which takes 2 minutes. With SoFi you will receive $100. With Laurel Road you will receive $80.