In this article, we will be comparing Credible Vs SoFi to help you to make the right student loan refinancing choice. This is not your average lender comparison.

However, we are still going to compare all the important factors such as interest rates, reputation, features, and more.

What is Credible?

Credible.com was launched in 2012. Credible is not like your average lender nor is it a peer to peer lender. Credible helps you to save money by comparing personal and student loan offers. Credible will give you multiple offers based on the information that you put in. In short, Credible is a comparison website that does the hard work of finding a lender for you.

What is SoFi?

SoFi was founded in 2011. Unlike Credible, SoFi is an actual online lending platform that specializes in student loan refinancing, but also offers personal loans, mortgage refinancing, Parent Plus, and more. SoFi is known for offering low rates and an abundance of features.

Reputation comparison

We will start comparing the reputation by looking at Better Business Bureau. BBB builds trust between companies and consumers. BBB allows us to know how each business handles the complaints of their customers. Better Business looks at complaint history, the age of resolved complaints, the length of time the business has been operating, and more.

Credible

Credible.com has been a BBB accredited business since 2015. Credible received an “A+” rating and close to 5-stars in customer reviews from Better Business Bureau.

Credible has over 1400 customer reviews on Trustpilot.com. Credible currently has an Excellent 5 out of 5 star rating and a 9.5 out of 10 TrustScore.

SoFi

SoFi has an “A+” rating from Better Business Bureau.

SoFi has over 1900 reviews from Trustpilot. SoFi received a great TrustScore of 9.2 out of 10.

Another factor that reveals SoFi’s great reputation was that Moody’s Investors Service awarded SoFi with triple A ratings making Moody’s the first startup online lender to accomplish this feat.

Bottom line

Both Credible and SoFi have a great reputation from some of the top rating platforms.

Student loan refinancing rates

SoFi

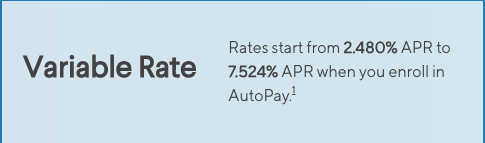

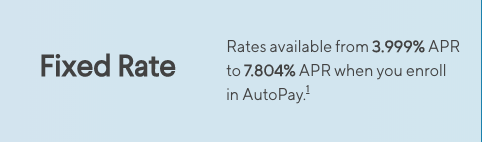

SoFi offers both competitive variable and fixed rates.

Variable rates are always cheaper than fixed rates. However, variable rates may change over time. You might receive a low rate for the time being, but the rate may increase or decrease later on. If you are willing to take the risk, then select the variable option, which might help you to save a lot.

SoFi variable rates range from 2.48% APR to 7.52% APR when you enroll in AutoPay.

SoFi fixed rates range from 3.999% APR to 7.80% APR when you enroll in AutoPay.

Start SoFi here and receive a $100 bonus.

Credible

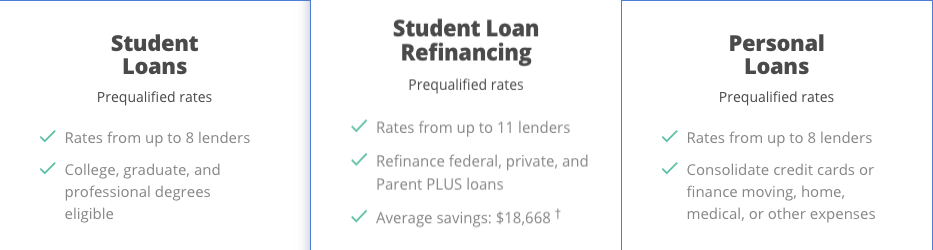

It’s going to be difficult to compare your rates with Credible without finding out the lender that you will be matched with.

Credible has 8 different lenders that they work with when it comes to student loans. When it comes to student loan refinancing Credible has rates from up to 11 lenders. The banks and lenders that Credible works with include Citizens Bank, Earnest, College Ave, Advantage Education Loans, PenFed, RISLA, and Brazos. The most qualified borrowers will receive variable rates for as low as 2.57% and fixed APR rates for as low as 3.25%.

Fees

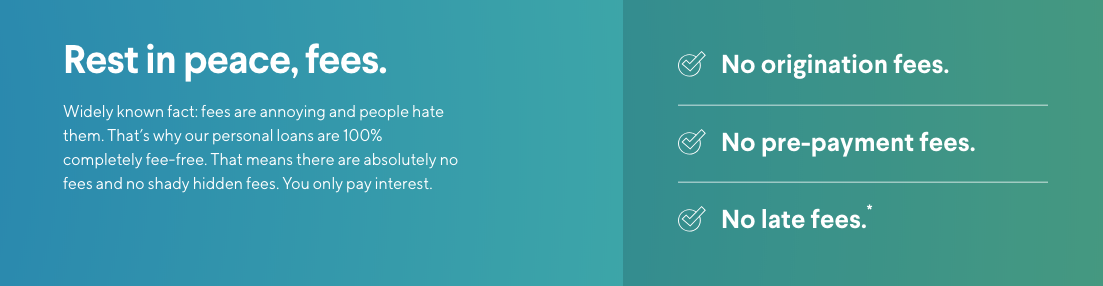

SoFi is one of the rare companies that does not charge you any fees. With SoFi you will not have to worry about prepayment fees, origination fees, or late fees.

Using Credible.com is free. You will not have to worry about them charging you to use their service. Nor will you have to worry about getting stuck with a lender that has fees. None of their lenders charge origination or prepayment fees.

Late fees are difficult to assess because depending on the lender you may be charged a late fee.

Features

Credible benefits

- Import your loan easily with the Credible automated tool.

- 100% free to use their platform.

- Personalized rates

- Best Rate Guarantee

- Rates from up to 11 lenders.

- Benefits from the lender that you choose.

- Soft credit check

SoFi benefits

- Unemployment Protection Program – If you ever lose your job, then SoFi will help you out by pausing your payments and by helping you to look for a job.

- Low interest rates

- 0.125% discount when you bundle loans from SoFi.

- Student loan calculator

- Career coaching – As a SoFi member you will be able to get one on one help with experienced career coaches to help you to succeed financial.

- Community – Bring a guest and join SoFi at one of their exclusive networking events.

- Soft credit check.

The online lending process

How does Credible work?

As mentioned in the beginning, Credible is an online marketplace that provides you with competitive real-time interest rates. To use Credible, you will enter in a few pieces of information such as your name, how much that you make, etc. After adding details about yourself, you will then choose your desired option.

How does SoFi work?

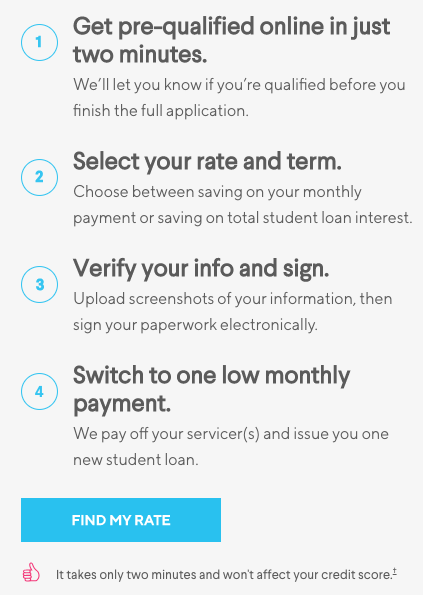

Getting a loan with SoFi is effortless. SoFi is not a middleman so you will be getting rates from them alone. All that you have to do is add basic information and select your rate and term options. Finding a rate that fits your budget can be accomplished in 2 minutes.

Minimum Credit score requirement

Those with a good credit will have no problem with getting loans. Most of the companies that Credible works with such as Earnest have a low minimum credit score requirement. When we compared Earnest and SoFi we noticed that both companies required a 650-credit score, which is not hard to achieve. PenFed, which is another lender that Credible works with requires you to have a 700-credit score without a co-signer and 670 with a co-signer.

A peer to peer lender such as Lending Club or Prosper might accommodate those with a less than desirable credit score, but there are limitations.

In short, you will be able to get a loan with SoFi if you have at least a 650 credit score. The average SoFi borrower has a credit score of 700. With SoFi you will not need a long credit history. Most SoFi borrowers make around $100,000 a year.

With Credible you have a plethora of options, so the credit score and credit history requirement will differ per lender.

Loan term options

A loan term is the length of time that you have to repay your loans. The longer loan term that you choose the more that you will end up paying in interest rates. Longer loan terms help you to pay less on your monthly bill. With Shorter loan terms you will be paying less interest rates overall, but your monthly bill will be higher.

Both SoFi and Credible have a variety of loan term options for you to choose from ranging from 5 to 20 years.

Borrow amount

With SoFi there is a $5000 minimum borrow amount. SoFi refinances your loan up to the full balance of the loan.

Credible varies per lender.

Estimated funding time

With both companies your loan will be funded in one to seven days.

Support comparison

Credible.com has a FAQ page where you can learn more about requesting prequalified rates, co-signers, credit considerations, and more. Their website has a live chat. Their phone support is available from Mon-Thu: 6am – 6pm PT, Fri: 6am – 4pm PT, and Sat–Sun: 7am – 4pm PT.

SoFi.com offers a resource center where you can learn more about debt management, investing, and more. Similar to Credible, SoFi also offers a FAQ page and blog posts. SoFi has phone support that is available from Mon-Thu 4:00 AM – 9:00 PM PT and Fri-Sun 4:00 AM – 5:00 PM PT.

Which is better?

Both platforms have their benefits. SoFi is more straightforward and it’s hard for any lender to top their features and membership benefits. Credible offers tons of loan options because they work with a lot of companies. I encourage you to get rates today.