Getting a personal loan used to be a tedious process until the introduction of online lenders. Let’s compare Best Egg Vs SoFi to help you to find out which is the best lender in the industry.

Within this article we will compare several important loan elements such as, the interest rates, funding time, fees, and more.

What is Best Egg?

Best Egg is a fairly young online lending platform that was founded in 2014. The mission of Best Egg is to help you to pay your debt more quickly. Best Egg has funded over $6 billion in loans and has over 300,000 customers. Best Egg offers personal loans for debt consolidation, credit card refinancing, home improvement, moving expenses, major purchases, vacation, adoption, and more.

What is SoFi?

SoFi was founded in 2011. SoFi might be the most popular online lender in the U.S. SoFi is all about helping consumers to reach their next financial goal. SoFi has over $30 billion in loans and over $500,000 customers. SoFi offers large personal loans, but they are also well-known for student loan refinancing, mortgage refinancing, parent PLUS refinancing, and more.

Reputation comparison

Better Business Bureau – A few standards of BBB accreditation include building trust, being transparent, being honest, honoring promises, being responsive, safeguarding privacy, embodying integrity, and more.

Best Egg

Best Egg has been a BBB accredited business since 10/16/2014. Currently, Best Egg has an “A+” rating in the BBB rating system. This means that this online lender exceeds what you need to meet the BBB accreditation standards.

SoFi

Similar to Best Egg, SoFi currently has an “A+” rating in the BBB rating system overview.

Trustpilot

Best Egg

Best Egg has a great Trustpilot rating. In total, Best Egg has over 1700 Trustpilot reviews. Best Egg received 5 out of 5 stars. On a 10-point rating system, Best Egg received 9.5 out of 10 points.

SoFi

SoFi has an exceptional Trustpilot rating as well. SoFi has well over 1900 Trustpilot reviews. Best Egg received 5 out of stars. On a 10-point rating system, SoFi received 9.2 out of 10 points.

Personal loan rate comparison

Best Egg offers competitive APR rates. Best Egg offers low rates that range from 5.99% to 29.99%.

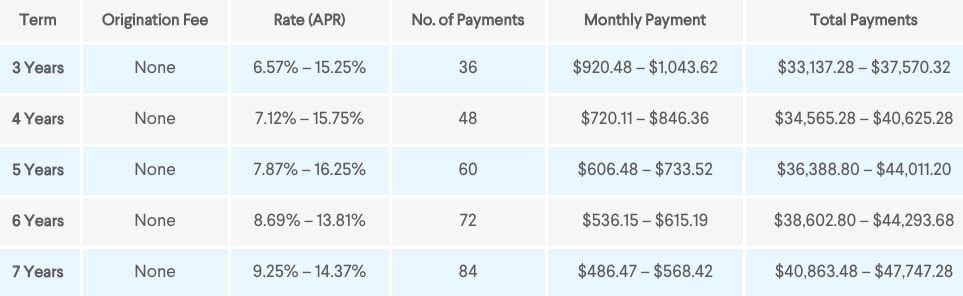

SoFi offers fixed rates that range from 6.57% to 16.25%. You may be able to get a lower rate with Best Egg, but with longer loan terms Best Egg might be more expensive.

Features and benefits comparison

Best Egg features

- Best Egg has extremely fast funding times.

- Soft credit check

- Fast pre-approval and 24 hours approval process.

- Fixed terms

- Competitive rates

- Unsecured loan issued by Cross River Bank.

- Intuitive tools

SoFi features

- If you get additional loans through SoFi you will be able to get them at discounted prices.

- Community benefits – SoFi understands how shaky it may be if you were to lose a job. SoFi will suspend your loan bill and they will help you to find a new job if you were to ever get laid off.

- Accelerator program – With accelerator SoFi will invest seed capital into your company. Accelerator also offers mentorship and resources, community, and access to investors.

- Exclusive career coaching

- SoFi offers low rates compared to other lenders such as Prosper.

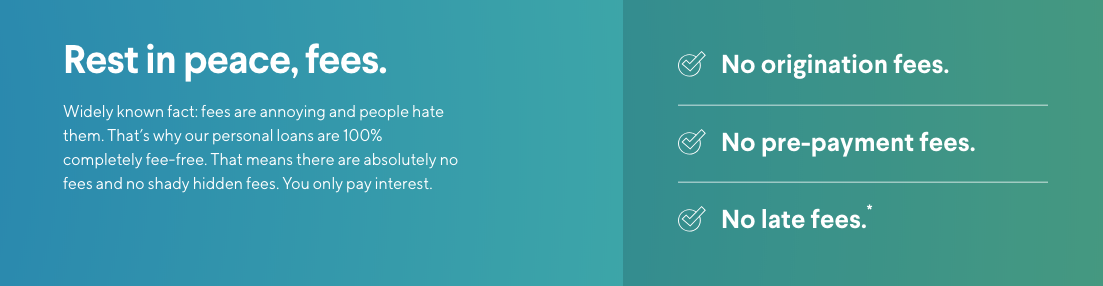

- You will not have to worry about any origination fees.

- Soft credit check

- Personal loan calculator

Loan terms

Best Egg offers 3 or 5-year loan duration lengths.

SoFi offers 3, 4, 5, 6, and 7-year loan terms for you to choose from. The longer the term the lower your monthly rates will be, but you will pay more in interest rates.

Personal loan process

Both lenders remove the long application process that once plagued loan applications. Whether you choose SoFi or Best Egg you will be able to receive a loan in minutes.

Loan amounts

Best Egg might be a better option if you need smaller loans. With Best Egg you can take out loans for as low as $2000 and as high as $35,000.

With SoFi there is a minimum loan amount of $5000. However, you will be able to take out a personal loan of up to 100,000. If you need a larger loan, then SoFi is going to be the best option for you.

Borrow from SoFi here and get a $100 bonus.

Fees

Best Egg

All Best Egg customers have to pay an origination fee that ranges from 0.99% – 5.99%. The origination fee is the amount that you will pay the lender to process the loan application.

SoFi

Unlike Best Egg and some of the top online lenders such as Upstart, SoFi does not have origination fees, pre-penalty fees, or late payment fees.

Minimum credit score comparison

It will be easier to get a loan with Best Egg because of the lower credit score requirements. Best Egg has a personal minimum credit score requirement of 640. However, the average Best Egg borrower has a credit score of 680. There is no minimum credit history with Best Egg.

SoFi personal loans require that you to have a minimum credit score of 680. On average most SoFi borrowers have a credit score that is above 700. One of the best things about SoFi is that there is no minimum credit history. The only thing SoFi is worried about is if you will be able to pay the loan off. The average SoFi borrower makes $100,000 a year.

Funding time comparison

Both personal lenders have a short funding time. Best Egg customers will be able to get their loan deposited in as little as one day after being approved.

SoFi loans will be funded within 1 to 7 days after approval.

Support comparison

Best Egg

The Best Egg Help Center helps you to learn more about how to go about starting a loan application, the information that you will need, information on verification, and more. You will even be able to find helpful information if you need to learn more about an existing loan. Bestegg.com also offers a blog where they publish articles weekly. You can reach a loan specialist or contact customer service from Monday–Thursday 9am–9pm ET, Friday 9am–7pm ET and Saturday 10am–5pm ET.

SoFi

The FAQ page on Sofi.com is well organized and offers more helpful articles for those who are new to SoFi. For example, you will be able to find out how to add a co-applicant to your loan, you will be able to learn more about their programs, membership benefits, and more.

You can call their customer support, mortgage general support, and wealth support from Monday through Thursday from 4AM to 9PM and Friday through Sunday from 4AM to 5PM.

You will also be able to receive support through Twitter by tweeting @SoFiSupport.

Which personal lender is the better choice?

Best Egg and SoFi are unique in a plethora of ways. Best Egg is an option for someone that doesn’t have the best credit. With a minimum credit score requirement of 640 there is a greater chance of you getting approved from them. However, if you meet the 680-credit score requirement and need a $5000+ loan, then SoFi is without a doubt the better company. SoFi offers more perks, you may be able to get lower rates, there are less fees, and the personal loan process is slightly smoother. I strongly recommend that you get rates today.