If we’re honest, auto insurance can be very expensive if you end up with the wrong insurance provider. Depending on what company that you use will determine if you save or pay more than the average American. Our goal in this article is to help you to find the best cheap car insurance companies near you.

There are many factors that determine your car insurance rates which we will talk more about below. However, I want to emphasize how essential it is that you compare rates today to find the overall cheapest car insurance quotes.

Myths about car insurance

There are many myths out there and maybe you have believed some of them. One myth is that red cars cost more to insure than other cars. This is completely absurd. It doesn’t matter if your car is green, blue, black, white, orange, pink, yellow, silver, etc. Color does not determine the price of auto insurance.

How are car insurance rates determined?

No insurance rate is the same. Each auto insurer has its own quote algorithm. There are various factors that auto insurance companies do take in consideration. Here are a few insurance factors that determine your rates.

Car type – While color might not be a factor, your car type is definitely factored into your auto insurance rate. Which car brand out of a Toyota, Honda, Ford, Subaru, Suzuki, Dodge, Kia, Hyundai, or Porsche do you think will cost more to insure? Most likely it is going to be the Porsche, which is an expensive fast sports car.

Age of driver – There is no denying that age has an effect on your auto insurance rates. Drivers under 25 have to pay more for car insurance than older drivers. Why you ask? Usually younger drivers in high school and college are more high-risk. Average premiums will continue to decrease until around the age of 65, then rates will begin to increase. However, some insurance companies offer a senior discount to accommodate the elderly.

Where you live – Your city and state is factored into your insurance rate. Drivers who live in Maine, Ohio, Idaho, Vermont, North Carolina, Iowa, Indiana, and Virginia pay much less on their average premiums than drivers who live in Michigan, Louisiana, Connecticut, Rhode Island, Florida, Washington, and California. Unfortunately, if your area is highly populated or is a high crime area, you could be paying more.

Driving History – Most people don’t understand how important it is to have a good driving record until it’s too late. Tickets, accidents, DUI/DWI, etc. are all taken into considering when giving rates. I know someone who can’t receive a quote under $500 for an old car because his driving record is bad. If your record is too bad some insurance companies will not have anything to do with you. The safer that you drive the more that you can save on your premium.

Sex/Single/Married – Gender plays a huge role in auto insurance rates. Single males pay more for auto insurance than single females, which is due to crash rates being higher for males.

Credit history – It’s always good to have a good credit history because many insurance companies factor in your credit history.

Average miles driven annually – The less that you drive the less you will pay on your insurance premium. Also, many insurance companies offer a mileage discount for low mileage drivers.

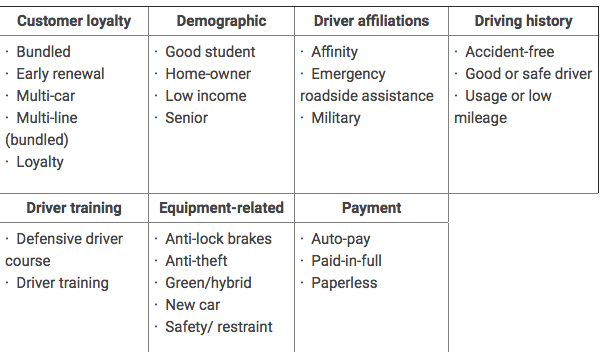

Car insurance discounts

Bundling discount – Most car insurance providers offer a discount when you bundle policies. For example, you might save around 15% when you bundle home and auto insurance. Usually the more that you bundle the more that you can save.

Continuous discount – A few companies offer a discount for those who have had continuous insurance without any gaps for multiple years. When you have had insurance with one company without any gaps this shows loyalty. This shows that you are a person who is in it for the long run.

Organization – Depending on where you work, what school you go to, or what organization that you are a part of you can qualify for a discount for some insurance companies.

Adding multiple vehicles – Every car insurance company offers a multiple car discount. The discount ranges from 5% up to 25%.

Good driver – There are many good driver discounts that you can save on if you have been claim-free or accident-free for three or more years.

Vehicle Equipment – All policyholders should be taking advantage of every safety feature that is installed in their vehicle. Companies give a vehicle equipment discount for things such as air bags, anti-lock brake systems, anti-theft systems, and daytime running lights.

Good students – Honor roll students can save up to 15% on auto insurance.

Family discount – There are many different family auto insurance discounts which allow your entire household to save.

Coverage types

The amount that you pay on your auto insurance depends on what coverage you get for your vehicles. You can either get full coverage or liability. A few coverage types include liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and personal injury protection (PIP). Coverage options extend beyond these basic options. Additional types of coverage that you can add to your insurance policy are emergency roadside coverage to gives you more confidence in your insurance carrier. Also, you can add rideshare driver coverage if you drive Uber or Lyft, rental car reimbursement when your vehicle is in the shop, accident forgiveness, and small claims forgiveness.

Minimum car insurance requirements by 15 of the largest populated states.

- California

- $15,000 bodily injury liability per person

- $30,000 bodily injury liability per accident

- $5,000 property damage liability per accident

2. Texas

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $25,000 property damage liability per accident

3. Florida

- $10,000 property damage liability per accident

- $10,000 personal injury protection

4. New York

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $50,000 liability for death per person

- $100,000 liability for death per accident

- $10,000 property damage liability per accident

- $50,000 personal injury protection

- $25,000 uninsured motorist coverage per person

- $50,000 uninsured motorist coverage per accident

5. Illinois

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $20,000 property damage liability per accident

- $25,000 uninsured motorist coverage per person

- $50,000 uninsured motorist coverage per accident

6. Pennsylvania

- $15,000 bodily injury liability per person

- $30,000 bodily injury liability per accident

- $5,000 property damage liability per accident

- $5,000 medical benefits

7. Ohio

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

8. Georgia

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

9. North Carolina

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $25,000 property damage liability per accident

- $30,000 uninsured motorist coverage per person

- $60,000 uninsured motorist coverage per accident

- $25,000 uninsured motorist property damage coverage per accident

10. Michigan

- $20,000 bodily injury liability per person

- $40,000 bodily injury liability per accident

- $10,000 property damage liability per accident

11. New Jersey

- $15,000 bodily injury liability per person

- $30,000 bodily injury liability per accident

- $5,000 property damage liability per accident

- $15,000 personal injury protection

12. Virginia

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $20,000 property damage liability per accident

13. Washington

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $10,000 property damage liability per accident

14. Arizona

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

15. Massachusetts

- $20,000 bodily injury liability per person

- $40,000 bodily injury liability per accident

- $5,000 property damage liability per accident

- $20,000 uninsured motorist coverage per person

- $40,000 uninsured motorist coverage per accident

- $8,000 personal injury protection

Benefits of car insurance

There are many benefits of having auto insurance. When you purchase a new car you will not be able to leave the dealership without having auto insurance.

Car insurance is mandatory in the U.S. You can actually go to jail if you get caught driving without car insurance. Lesser punishments for driving without auto insurance include tickets and fees, license suspension, and registration suspension. Besides the legal reasons there are many smart reasons to have insurance.

Insurance will save you a lot of money in the long run. No one ever thinks they will get into a car accident. Although we hope that this never happens, over 5 million accidents happen in the United States each year. Some go unreported! Accidents will happen and a wise man/woman should always be prepared. Car crashes cost thousands of dollars. Even the smallest dent can cost a lot of money to fix. Car insurance removes the burden from your pockets. Not only do accidents affect your vehicle, but they might result in medical expenses for you and your family. Accident related injuries can mean paying over $30,000 for your medical bills. It’s always good to be prepared.

Who has the cheapest auto insurance?

Different companies give out different rates per driver. There are many affordable insurance providers out there. However, you must compare quotes. Some people might get a better deal with Progressive, while others may get a better deal with GEICO. It is up to you to compare rates to find out which provider is going to be the most affordable option for you.

Cheap liability car insurance

Liability is usually the minimum amount of auto insurance that you need in your state. Liability is just barely scratching the surface. Usually people choose liability if they don’t want to pay a lot for insurance. If you want a cheap policy, then liability is an option. However, there are drawbacks such as a greater future cost if you were to ever get into an accident. Always take this into consideration. Sometimes full coverage is a safer option especially if you have teen drivers. Also, if you have a new car, then full coverage would be your only option. Once again, companies differ in how much you will pay for liability insurance.

List of car insurance companies

GEICO insurance

After comparing rates, I have found GEICO to be the most affordable insurance provider for auto insurance. I have always been able to receive the best quotes for liability and full coverage. I have personally used GEICO to insure both salvaged rebuilt cars and new cars before driving off the lot. In both cases I was on a budget and I sought to find really cheap car insurance to fit my budget.

I insured with GEICO after comparing quotes. I tried all the largest insurance providers in the world and GEICO came out on top and saved me hundreds a month. 30-year-old males with no accidents pay an average of $1,112 yearly with GEICO. 30-year-old married couples with no accidents pay an average of $1,109 on their premium. Not only does GEICO offer cheaper month to month insurance prices than other companies, but GEICO also offers great claims satisfaction to their companies.

I always tell people who cares if you have a cheap company. Do you have a cheap company that will pay your claim when it’s time to pay your claims? GEICO has the financial assets to pay the claims of their customers. Brand Keys gave GEICO top honors for their ability to create loyal customers. Standard and Poor’s (S&P) gave GEICO an AA+ rating in financial strength. A.M. Best gave GEICO an A++ rating in financial strength which is the best rating that you can receive. GEICO is an all one company that backs up customers with a cheap price, billions in assets, and great claims satisfaction.

Progressive insurance

Progressive received a 5 out of 5 in affordability. Progressive is slightly more expensive than GEICO on average. However, they offer a plethora of discounts and tools to help policyholders save money. I love their Name Your Price tool. It basically allows you to jump into the rate that you desire and the plan that fits your budget. Name Your Price allows you to see what coverage that you can afford. If money is tight or if you are new to auto insurance, then the Name Your Price tool is a handy tool to have.

Another thing that you will love with Progressive is that you will be given an opportunity to lower your insurance premium with Snapshot. If you’re a good driver, then Snapshot is for you because it personalizes your rate based on your actual driving. With Snapshot, you pay as you drive by how well you drive. The average driver will save over $100 on their insurance premium. You will even receive a discount for signing up.

The only knock to using Snapshot is that rates can increase at renewal if you have too many high-risk driving habits. Progressive is a great affordable option and they did well in the J.D Power customer claims study. On a 1000-point scale Progressive scored 850 points which was awesome. Progressive received a financial strength rating of “A+” from A.M. Best, “AA” from Fitch, and “Aa2” from Moody’s.

Amica Mutual

Amica is well loved by their policyholders. Not only will you find affordable premiums, but Amica has great reviews online and they have a great customer satisfaction rating. Amica scored higher than any other auto insurance company by 9 points in the J.D. Power Claims Satisfaction study. Amica received 902 points out of a 1000-point scale.

Amica and USAA were the only insurance companies to receive 5 out of 5 Power Circles In Overall Claims Satisfaction. In the Fairness Of Settlement category there were only two companies to receive 2 out of 5 Power Circles. Those two companies were NJM Insurance Co and Amica Mutual. If you want a company that is top-notch in customer support, then Amica might be for you. You might not get as cheap a quote as you would with some other companies on the list but remember, rates vary per driver.

Check to see if you are able to take advantage of their many discounts such as their Loyalty discount, which is great if you have been with an auto insurer for at least 2 years. The longer that you have been insured with one company the more that you will be able to save. If you are a homeowner you can also save with Amica. Do you have more than one auto to insure? If so, with Amica when you insure multiple vehicles you can save up to 25%, unlike some companies that allow up to 15% savings.

State Farm

I know many people who were able to get good rates with State Farm in cities throughout Florida, such as Fort Lauderdale, Miami, and Orlando. There is no other insurance company that insures more cars and homes than State Farm. There are many perks to being the largest insurance company such as you have more tools and resources at your disposal.

Among the 10 top insurance companies, State Farm was above average in their average premiums. Take advantage of State Farm’s Discount Double check. Many people don’t understand the significance of Discount Double Check. Many people don’t know how they could be saving and some auto insurers will withhold information from their policyholders.

With Discount Double Check you will get all of the discounts that you deserve which can help you save 40% on auto insurance. Here are a few discounts that you can look forward to with State Farm. Drivers can look forward to the Good Driver discount which helps drivers save up to 10% on auto insurance. The Accident-Free discount allows drivers to save up to 25%. Steer Clear helps drivers save up to 15% on their auto insurance.

There are many things to like about State Farm. I had the privilege of building great relationships with many well-known State Farm insurance agents and they exude integrity. Their Better Business Bureau rating speaks for itself. BBB awarded this insurance giant with an A+ rating which speaks volumes of how State Farm handles customer complaints.

Safeco

Safeco was founded almost 100 years ago in Seattle, Washington in 1923. There is a good chance that you will save hundreds switching to Safeco from another insurance company. In the Safeco vs GEICO auto insurance comparison, both companies were neck and neck, but GEICO had the slight advantage. The only knock that I have on Safeco is they did not rank well in the J.D. Power Claims Study.

Although Safeco did not rank well in the claims study I have heard great things about them from people who use Safeco and had no problems with filing claims and receiving a fair payment. Since Safeco is a member of the Liberty Mutual Group, Safeco is backed by their financial stability. Liberty Mutual received an excellent “A” rating with A.M. Best and a “A-” rating from Standard & Poor’s. Liberty Mutual has over $122 billion dollars in total assets.

In 2016, Liberty Mutual was rank 75th on the Fortune 500 list of largest corporations in the United States. Safeco has the assets to pay out claims in case of an emergency. Low-mileage drivers might want to take advantage with Safeco which allows drivers who drive less than average to say up to 20% on their auto insurance.

MetLife has a history that spans back almost 150 years. MetLife is the largest life insurance company in the United States. However, we forget that MetLife also offers exceptional auto and home insurance policies. On average MetLife offers the cheapest car insurance premiums in Michigan with premiums of around $1150. Although MetLife is affordable and reviewed very well across the boards, MetLife does not offer that many insurance discounts. Although they do offer an insurance discount such as Great Savings, which allows good drivers to save, MetLife does not have discounts that you would expect your insurance provider to have.

In 2016, it was reported that MetLife had almost $900 billion dollars in total assets. MetLife has an Excellent “A” financial strength rating from A.M. Best which shows that the MetLife has the ability to pay your insurance claims.

USAA

USAA is a well-known insurance company that is known for offering cheap insurance rates. Before you get excited, let me allow you to know that USAA is only available for those in the military either retired or active. Another way that you can use USAA is if one of your parents was in the military. My friend recently insured his jeep with USAA and he’s only paying $100 a month, which was far cheaper than some other insurance companies.

USAA offers great coverage options and discounts such as Accident Forgiveness which is perfect for your young driver. If you or your child was ever to get into an accident, your rates would not go up if you have Accident Forgiveness. The longer that you insure with USAA the more that you can save with their Length Of Membership discount. Do you have a new vehicle 3 years old or less? If so, then you can easily qualify for their new car discount.

USAA was awarded an A+ rating by BBB and they have over $137 billion in total assets, which gives policyholders more security and trust in their insurance company. Do you qualify for USAA? If so, then you should compare quote and see how much that you are able to save with them.

Farmers

Farmers Insurance Group is an American insurer group of automobiles, homes, and small businesses. Farmers is the 6th largest auto insurance company in the United States. On average Farmers offers premiums that are far less than the national insurance average by a few hundred dollars. The cheapest states to insure with Farmers are Illinois, Washington, and Arizona. If you have a good driving record, then Farmers is a good insurance provider to capitalize on if you desire good insurance rates. However, Farmers might not be the best company for you if you have a bad driving record.

Farmers offers more coverage options than most companies. Their coverage options include liability, physical damage, uninsured motorist, roadside services, rideshare driver coverage, rental reimbursement, gap insurance, pet damage, locksmith services, personal items coverage, new car protection, custom parts and replacement, rate lock, accident forgiveness, and incident forgiveness.

Farmers handles customers better than most insurance companies according to BBB and the National Association of Insurance Commissioners (NAIC). Overall, with Farmers you get affordability and great customer service.

Erie

Erie is a great company that allows those in eastern states to receive low premiums.

Erie offers great customer service. However, the only drawback of using Erie is that it is only available in a few states. Erie is only available in Wisconsin, Illinois, Tennessee, North Carolina, Tennessee, New York, Pennsylvania, Indiana, Ohio, Maryland, West Virginia, Kentucky, and Washington, D.C. If Erie is available in your state, then it is definitely worth taking a look at.

Bottom line

Whether you live in Florida, Maine, Delaware, Nebraska, Idaho, Arkansas, Colorado, etc. there is always an auto insurance provider that will fit your budget. I encourage you to take a few minutes to compare insurance quotes.